Blog

Available inventory of houses grinds higher in the Greater Fort Lauderdale market. Is the Fed-induced rally over?

If you have been getting excited about the value of your house appreciating over the past few years, don’t send your thank-you cards to the federal reserve just yet. By looking at the gradual rise in available inventory for sale, the sugar high may be fading and it may just leave everyone with another headache. In the month of October, the amount of single-family homes listed and available for sale in the Greater Fort Lauderdale area reached 6,574. This is a level we haven’t seen in a few years and represents a 61% increase off the lows that were set back in April 2013.

As for the average selling price, it has dropped 12% after setting a recent high in May. if you remember, we have discussed in previous posts how the May-June period this year was most likely when this last bubble either popped, or started to leak some air.

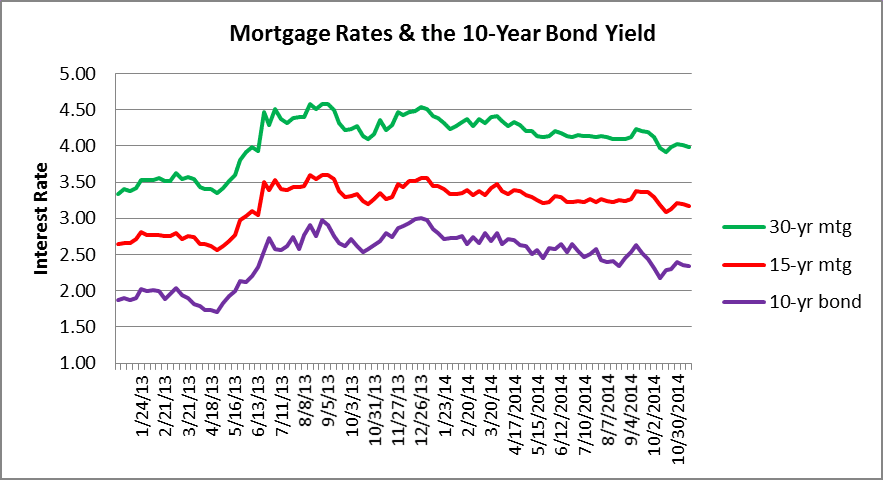

Now, if we were in a rising interest rate environment, the climbing inventory and falling prices would make sense. Take a look at our chart of interest rates and the “gift” that the Federal Reserve has given the housing market over the past few years. The only rationale is that this fed-induced rally has finally run out of steam. If prices are dropping and inventories are rising in this low rate environment, what will happen when rates finally begin to climb again?

How about foreclosure activity? Not only has it remained steady, but here are some averages in Broward County’s single-family home segment worth looking at:

- 2012 monthly average of foreclosure actions filed was 953

- 2013 monthly average of foreclosure actions filed was 1,624

- So far in 2014, the monthly average of foreclosure actions filed is 1,625

As for the level of houses in some stage of foreclosure throughout Broward County, it has been declining as more properties are finally making their way through the court system. As of 11/17/14 we found 26,215 houses in some stage of foreclosure throughout the various cities in Broward County. That does not include the 6,798 condo properties that are currently in foreclosure. Feel free to click on the chart below to see how your city stacks-up.

As for the pace of new filings compared to the distressed sales, the foreclosure actions still remain higher, but luckily a good number of properties are going straight to auction and that will gradually reduce the shadow inventory of foreclosures. You will notice from this next chart that there hasn’t been a single month over the past few years that distressed sales outnumbered foreclosure filings. Do you think that could be a reason that we continue to struggle with foreclosures nearly six years after the housing bust? If you consider all of the failed government programs, delays from the robo-signing litigation and the slick South Florida residents finding ways to remain in their homes for years without paying their mortgage, these are just a few of the reasons that we will continue to have these problems for a few more years.

Finally, let’s look at the median sale prices by transaction type. You will notice in the chart below that the median sale price for foreclosures and short sales have climbed in recent months. Since we have referred to May – June as the most recent high in the market, let’s compare the median sale price numbers:

- Traditional transaction median prices are down 6% from May and were at $295,000 in October

- Foreclosure sale median prices are up 9% and were at $172,724 in October

- Short sale median prices have jumped 31% from May and reached $236,250 in October