Blog

The banks had a busy November in Broward County, filing plenty of new foreclosure actions

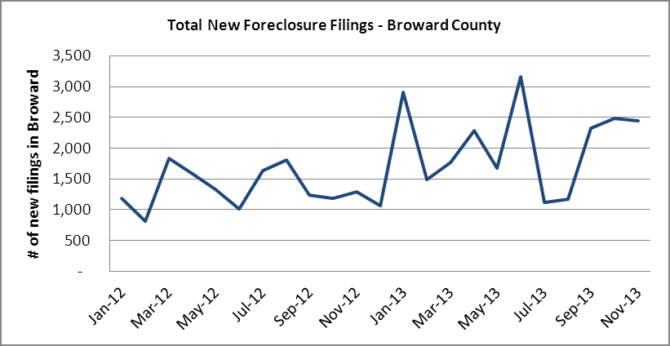

It sure doesn’t seem like the pace of new foreclosure filings will slow anytime soon. In November there were 2,448 new foreclosure filings in Broward County and that makes 22,821 total filings so far in 2013. There were only 15,983 total filings in 2012, so we have already surpassed that. As far as a monthly average in 2013, the 2,075 average is up 56% over 2012 when the monthly average of 1,332. Take a look at this first chart and you can determine if this is a sign of a housing recovery.

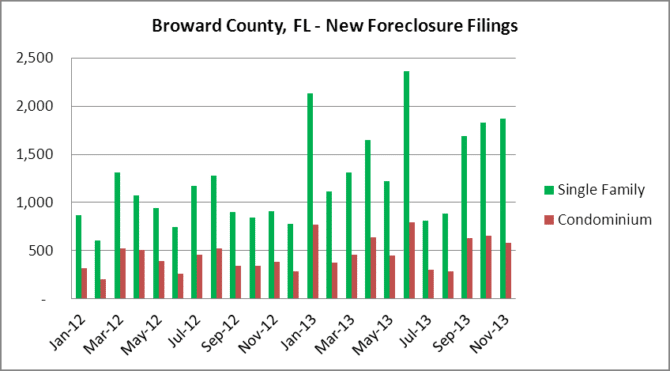

Next, we will breakdown the foreclosure filings by property type. In November, there were 1,869 foreclosure filings in the single family home segment and 579 condo/townhouse filings.

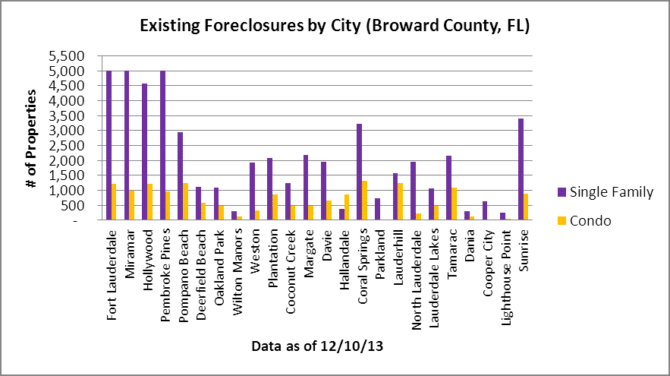

As if the elevated pace of new foreclosure filings isn’t disturbing enough, how about the massive shadow inventory of existing foreclosures in Broward County? Take a look at the next chart and feel free to click on it to see where your city is listed on the chart.

Here are some of the cities with the highest level of foreclosures:

- Fort Lauderdale has over 5,000 houses and 1,226 condo/townhouses in foreclosure

- Miramar has over 5,000 houses and 995 condo/townhouses in foreclosure

- Pembroke Pines has over 5,000 houses and 967 condo/townhouses in foreclosure

- Hollywood has 4,580 houses and 1,216 condo/townhouses in foreclosure

- Coral Springs has 3,212 houses and 1,326 condo/townhouses in foreclosure

- Sunrise has 3,411 houses and 887 condo/townhouses in foreclosure

These are just a few of the chart leaders. Remember that our search results have been limited to 5,000 and several cities have already been maxed-out! Therefore our recent count of 65,898 residential foreclosures throughout Broward on 12/10 is actually a low estimate. The real figure is most likely in excess of 70,000 and growing each month!

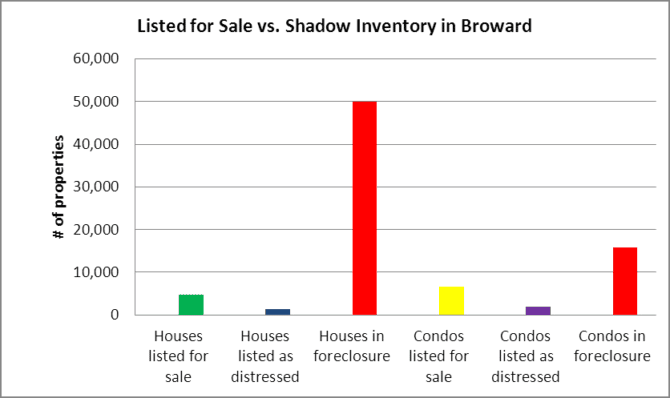

This next chart compares the amount of properties listed for sale, compared to all of the properties in foreclosure. This is further proof that the recent “housing recovery” that people are talking about is a total scam. There will not be a recovery until there is a significant decrease in the inventory of foreclosed properties.

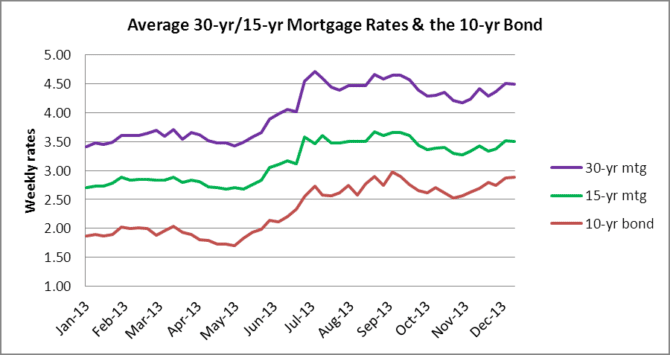

There was a window of opportunity to release these distressed properties onto the market and that window may be closing. Interest rates have been rising and will limit affordability for prospective buyers and dragging prices down. The 10-year bond rate is nearing the critical 3.00% level and when it does: Look out below! Residential real estate prices will be under more pressure and the recent housing bubble will be deflating.

We will be updating Miami-Dade and Palm Beach County foreclosures in the next few days, but will leave you with a snapshot of new foreclosure filings for the tri-county area.