Blog

Brace for impact

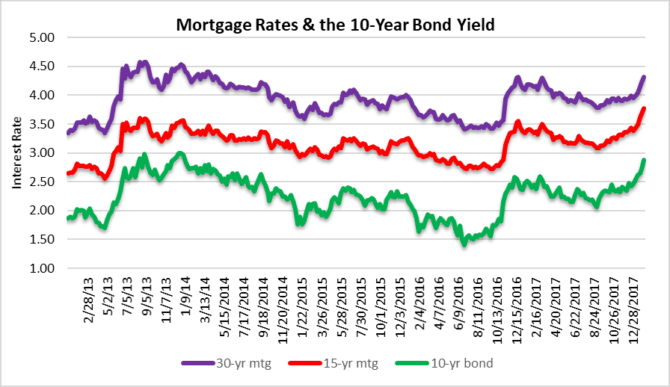

Now is a good time to brace yourself for the impact of higher rates. We have been discussing the artificially low rates for quite sometime and it looks like the path to normalization has begun. Take a look at this chart of rates, with a clear path for the 10-year bond to move closer to 3% sooner than later. That move will edge the 30-year mortgage closer to 5.00% and will effectively slam the brakes on residential real estate activity.

Brace yourself for a rebound in foreclosure activity

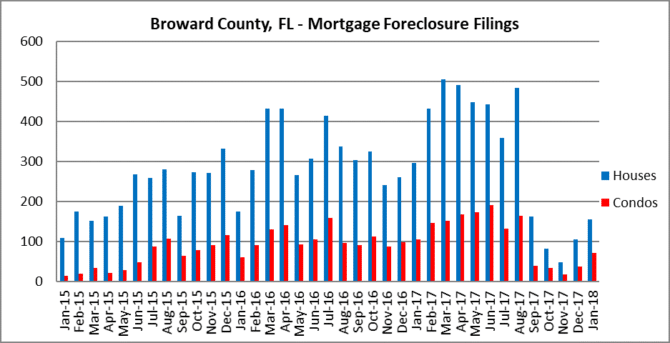

After taking another break, it looks like mortgage foreclosure filings are bouncing back. They just came off of a 90-day FEMA hold from Hurricane Irma and the banks are getting their filings in slowly but surely. This cloud has lingered over the South Florida residential real estate market for nearly a decade and won’t be clearing anytime soon.

Brace yourself for more inventory

Be prepared for average days on market and residential inventory to start increasing. Sellers and their real estate professionals won’t know why their properties are lingering on the market. Here is a clue: Drop the price, the market has changed! During the month of December there were 4,740 houses and 7,620 condo properties listed for sale in Broward County. Seasonality contributes to the decline in listings because many sellers take their properties off the market during the holidays. There should be a rebound in inventory which will grow throughout 2018 as properties sit on the market for extended periods.

And how about price declines?

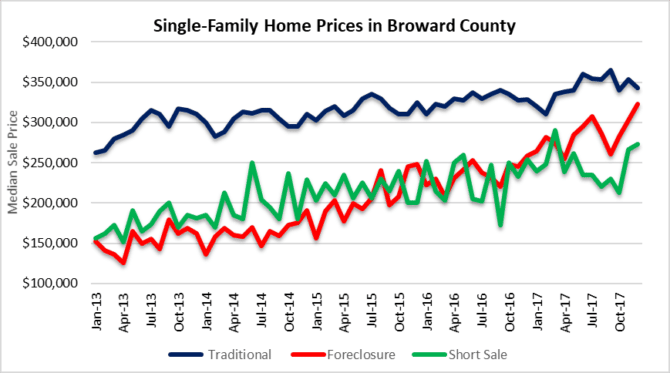

Yes, maybe it’s a good time to be prepared for price drops. Most sellers are currently in denial and behind the market already. By the time they make their next price drop, they will be chasing the market downward. Look at the upward trend in foreclosure prices. It looks like the people that had money to fight their case literally bought some time. Here is a look at the latest numbers for single-family homes in Broward County:

- Median traditional sale was $343,000 in December, down from $353,500 in November

- The median short sale was $273,000 in December, up from $266,000 in November

- Foreclosure sale median price was $322,600 in December, up from $302,500 in November

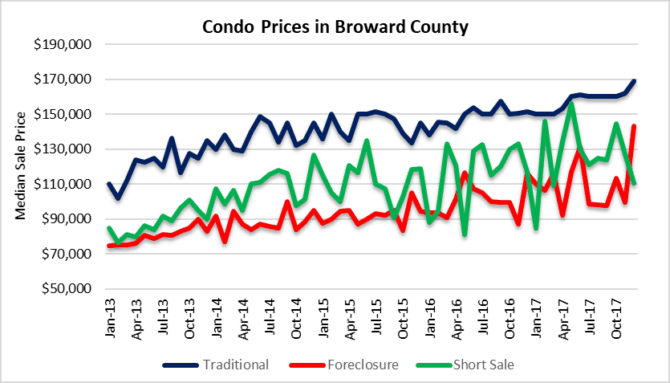

And here is a look at the condo sale prices for December:

- Median traditional sale was $169,000 in December, up from $162,000 in November

- The median short sale was $110,750 in December, down from $127,050 in November

- Foreclosure sale median price was $143,249 in December, up bigly from $99,625 in November

If you plan to buy or sell residential real estate in South Florida, you will need to monitor this trend in borrowing costs. The market is finally changing after a decade of manipulated interest rates and bailouts. A great resource is the Freddie Mac website with weekly rate updates, you should keep an eye on this one: Freddie mac weekly rates

Just a few points to summarize:

- The bond market is changing

- The mortgage market is changing

- The real estate market is changing, so brace yourself!