Blog

Climbing the wall of worry

Party on! It looks like prices keep climbing in the South Florida residential real estate market, at least through the month of June. Historically that month has been strong for sales volume and prices, so once we get into the next few months, we should have a better indication if this freight train plans to slow down.

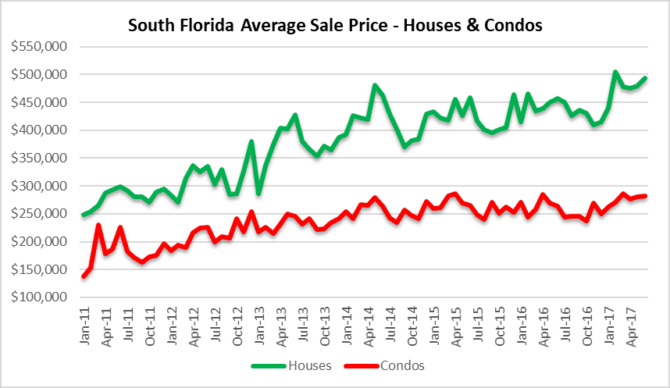

Climbing sale prices

During the month of June, the average sale price of a single-family home in South Florida was $493,648. Although it is down slightly from the recent peak of $505,236 set back in February, this is still an impressive number. As for condos, the average selling price in June was $282,117. It appears that the condo sales have cooled already (see the next chart) and should continue to do so as we move through the remainder of 2017.

Residential transaction volume

During the month of June there were 9,048 residential transactions recorded in South Florida, which is a slight drop from 9,141 in May. The condo market had 4,155 sales, representing a 7% decline month over month. Single-family home sales volume increased 4% from 4,691 in May to 4,893 in June. If you look at the April – June period for the past few years, it is usually a good one for sales volume.

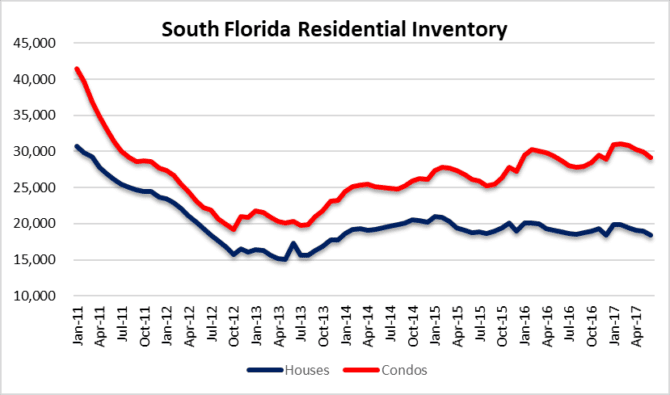

Residential Inventory

As long as you exclude the massive new construction condo product overhang, residential inventory has been declining. There were 18,439 houses and 29,134 condos listed for sale. The decline in condo prices is now becoming clear and this trend should continue for awhile. With the amount of new construction condos not in the MLS and the proposed projects in the pipeline, it could take years to absorb all of the product.

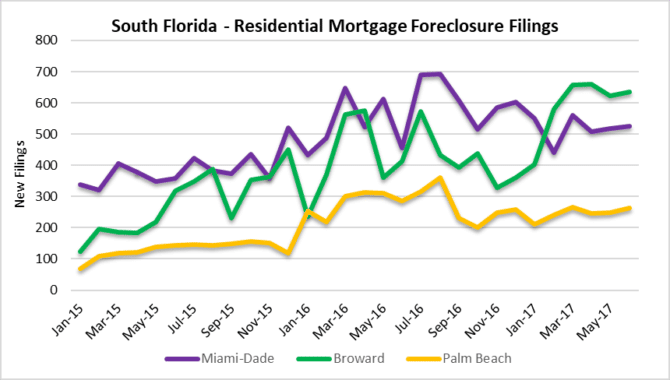

Climbing foreclosure filings

Why isn’t this being discussed? It seems as if everyone thinks that distressed properties are no longer an issue in South Florida, but we will continue to highlight the elevated level of new foreclosure filings in the tri-county area. In 2016 the monthly average of new filings was 1,266 and so far in 2017 the monthly average has climbed 7% to a monthly average of 1,356. As speculators are back in full-force and people continue to stretch their budgets to afford housing, the South Florida market will continue to wrestle with distressed properties. It sure seems as if people have a very short memory!

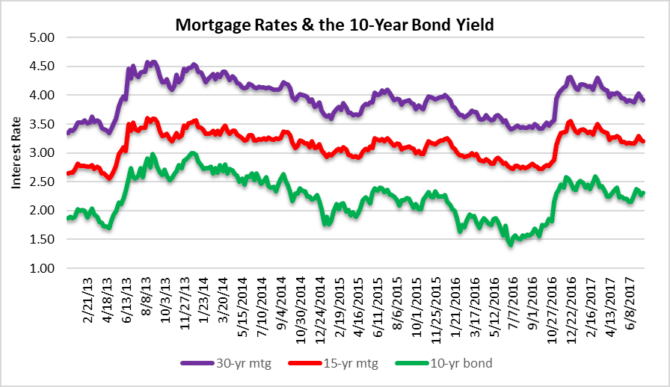

Mortgage Rates – Not Climbing!

As long as rates remain low, the housing party will continue. Low borrowing costs have fueled this latest bubble in the residential markets and we may not see normalization of rates anytime soon. We have always stressed the correlation between low rates and higher asset prices, along with the danger of bubbly markets. If and when rates climb we will see a direct impact on housing demand and prices, so until then, party on!