Blog

Greater Fort Lauderdale area market observations

After some storm-related data volatility, it is a good time to discuss a few of our market observations for the Greater Fort Lauderdale residential real estate market. Today we will discuss trends in transaction volume, sale prices, existing inventory and foreclosure activity. At first glance, it appears that storm activity impacted sales volume, foreclosure filings and possibly the inventory of properties on the market.

Observations in transaction volume

Storm activity obviously crushed transaction volume during the month of September in South Florida and our chart below illustrates the drop in Broward County. There was a 28% decline in deal volume from August to September in the single-family home and condo markets combined.

- The August residential transaction total for Broward County was 2,844

- The September residential transaction total for Broward County was 2,066

Observations in Average Sale Prices

Residential sale prices in the Greater Fort Lauderdale have been holding-up for now. Here are the numbers for September:

- Single-family homes sold for an average price of $433,148 in September, a 3% decline from the August price of $444,424

- Condos sold at an average price of $200,294 September, essentially unchanged from $199,640 in August

Residential inventory observations

Broward County saw a 1% decline in residential inventory during the month of September. Some of this may be attributed to sellers removing their properties from the market to evaluate any wind or flood related damages from Hurricane Irma. We will have to see the October numbers to see if supply increases again. There were 5,085 houses and 7,644 condos available for sale in September, for a total of 12,729 properties on the market.

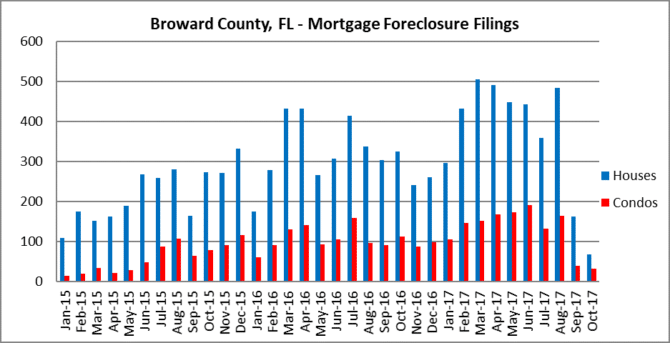

Observations in the foreclosure data

Well, it appears that delinquent borrowers were given another reprieve due to the hurricane. FEMA apparently put a hold on new foreclosure filings in South Florida which explains the sharp decline in September and October foreclosure filings. You will notice from the chart below that the pace of new foreclosure filings was gaining momentum until they were halted yet again. Don’t expect them to resume until the first quarter of 2018 because they will most-likely be suspended over the holiday season as well.