Blog

Greater Fort Lauderdale real estate market: Meet the new foreclosures, same as the old foreclosures.

After taking a break from charting the existing foreclosure inventory in South Florida, we put on our optimist hat and figured that maybe there would be a significant decline in foreclosure inventory. Once we conducted our city by city tabulation, we were shocked to see that the number of residential properties in the foreclosure process in the Greater Fort Lauderdale area has only seen a minimal decline. Feel free to click to enlarge the chart below and see how your city compares to other neighboring cities. We counted 20,457 houses and 4,922 condo/townhouse properties in the foreclosure process, for a total of 25,379 residential properties in foreclosure throughout Broward County. The initial foreclosure actions for most of these properties were filed back in the 2008-2010 time frame, and here they sit as we enter 2016:

Some of the cities topping the chart as of January 1, 2016 are as follows:

- Fort Lauderdale has 2,313 houses and 373 condo/townhouse properties in foreclosure

- Miramar has 2,710 and houses and 308 condo/townhouse properties in foreclosure

- Pembroke Pines has 2,067 houses and 265 condo/townhouse properties in foreclosure

- Hollywood has 1,951 houses and 380 condo/townhouse properties in foreclosure

- Pompano Beach has 1,309 houses and 433 condo/townhouse properties in foreclosure

- Sunrise has 1,267 houses and 280 condo/townhouse properties in foreclosure

By looking at our next chart, you will notice that the pace of new foreclosure filings continued to climb through the month of December, finishing the year on a high note. Maybe that is what all the real estate agents interviewed in the media are talking about when they refer to a “strong” market.

As for the combined data for houses and condo properties, this chart further illustrates the “strong” market. There were a total of 3,198 new mortgage foreclosures filed in 2015 in Broward County, for a monthly average of 267. December saw 405 new filings, so that is well above the monthly average.

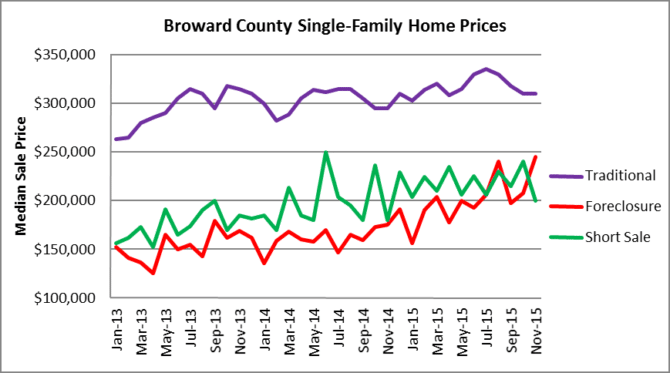

There has been an interesting development in the median sale prices of single-family home transactions. The median sale prices of foreclosures have been climbing. Is it possible that all of the people that have been paying foreclosure defense firms to stall the process are finally running out of time? After the market crashed, the word spread quickly that you could pay an attorney a fraction of what your monthly mortgage, taxes and insurance would cost to stay in your house for years thanks to the backlog in the judicial system. By eliminating your largest monthly expense (housing), you magically have plenty of money for fancy new cars, boats and vacations. In most places this type of activity is considered theft or even fraud, but in South Florida it has become standard operating procedure. In fact, this type of activity has become so prevalent that we even have elected officials in South Florida doing it! Now let’s get back to the numbers: While the median sale price for traditional sales in the single-family home segment have dropped 6% from the month of June and short sale prices have declined 11% for the same period, foreclosure sale prices have actually climbed 27%!

We have recognized a similar situation developing when we look at the sale prices of condo and townhouse properties. The median sale price in traditional sales of condos has declined 11% since the month of June, while short sales and foreclosure sales are spiking. Short sale median prices are still down 17% from June levels, but foreclosure sale prices are up 12% for the same period.

We will continue to monitor the distressed property market in South Florida throughout 2016. In our next few market updates we will provide an update on the Miami-Dade distressed property market as well as an update for Palm Beach County. What’s funny is that most real estate agents and the local media have somehow convinced South Floridians that this problem is long gone. The rally off the lows in South Florida real estate was merely asset price inflation fueled by crisis level interest rates, coupled with a failure to purge distressed assets from the system. A true market recovery will need to built on a strong foundation, not an air pocket. I guess that the best advice to all the misinformed: Don’t get fooled again!

The Allied Realty Group residential team serves as the exclusive broker for a variety of financial institutions in the valuation, management and sale of distressed single family and multi-family properties. Our team will inspect, repair, market and dispose of REO properties in a manner that mitigates bank losses. Allied Realty Group’s REO assignment territory is Broward County, Florida and we complete asset valuations for lenders on a daily basis. All of our residential brokerage clients appreciate our extensive market insight since we are actively visiting properties and preparing comprehensive valuations for asset managers.