Blog

What happens when the training wheels come off?

For the past seven years, abnormally low interest rates have served as “training wheels” for the U.S. economy. They have propelled stocks, bonds and real estate prices higher. Under normal interest rate policy, the markets would not have reached these levels without better fundamentals. Higher interest rates may be just one of the many factors that will lead to a widespread market correction.

Training Wheels for the Weak Economy – Low Interest Rates

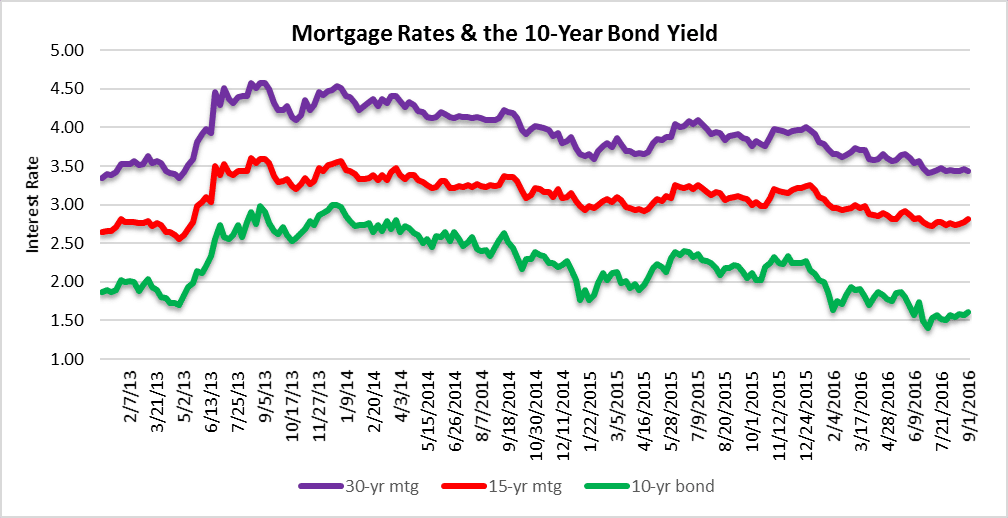

The only time we have seen rate rise since the financial crisis was the “taper tantrum” back in the middle of 2013. The 10-year bond touched 3.00% twice after that, but have been on s steady grind lower since then and basically remain at levels that were needed to rescue the economy after the crisis. People need to ask themselves the following question: If the economy is really in “recovery”, why do we need to keep interest rates at crisis levels? The 10-year bond rose to 1.67% this week and may be on the rise, even if the Fed doesn’t hike soon. If bond yields continue to climb, we may slowly begin to see an impact on mortgage rates and downward pressure on real estate prices.

Real Estate Transaction Volume

We haven’t even seen a rate increase yet and transaction volume is slipping. From June to July condo sales dropped 15% and single-family home sales dropped 16%. One month does not make a trend, but transaction volume is certainly worth watching as we move into the end of the year. Low rates have a tendency to pull consumption forward. People calculate their payment and run out to buy cars, houses and other items they normal wouldn’t buy. Whats happens if that consumption disappears?

South Florida Real Estate Prices

This chart of sale prices goes all the way back to January of 2011. The single-family home prices rose steadily over the 5-year period, thanks to all of the economic stimulus thrown at the market. Condo prices climbed, but not as much. Lately, condo prices have suffered and this may just be the beginning of a prolonged correction in that segment. The average sale price of a South Florida condo has declined 14% since April.

Inverse Relationships of Interest Rates and Prices

We may not be artistically inclined, but the following simple drawings are good enough to show the inverse relationship of rates and prices:

The first drawing shows a normal interest rate environment, where prices are held in check with “normal” rates.

Next, this is a snapshot of our current market , where low rates for seven years have artificially inflated prices.

Next, this is a snapshot of our current market , where low rates for seven years have artificially inflated prices.

Our last drawing shows what happens to prices once rates rise. (The next market)

South Florida Foreclosure Activity

We have added a trend line to this next chart of new foreclosure filings. The chart represents new residential filings in Miami-Dade, Broward and Palm Beach County Florida. The trend rises from the lower left to the upper right of the chart. Yes, the pace of new foreclosure filings has been on the rise. Even though real estate prices have risen due to low borrowing costs, there is clearly a big difference between asset price reflation and a true economic recovery. We will eventually see what happens to the markets once the training wheels come off.