Blog

Palm Beach and Miami-Dade County rejoined the South Florida foreclosure party in January

After taking a break in December, the banks got busy again filing foreclosure actions in Palm Beach and Miami-Dade courts in the month of January.

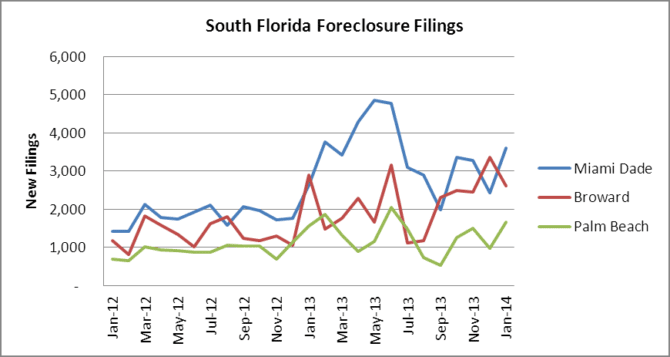

There were 7,870 new foreclosure actions filed in January 2014, up from 6,771 in December. While Broward County had a strong December, it appears that they took their break in January. Here are a few stats on South Florida foreclosure activity that I guess should be filed in the “housing recovery” folder:

- In 2012, there were 48,633 new foreclosure actions filed in the tri-county area

- In 2012, the monthly average of new filings was 4,053

- In 2013, there were 82,327 new foreclosure actions filed in the tri-county area

- In 2013, the monthly average of new filings was 6,861 which represents a 69% increase over 2012

- The January 2014 number of 7,870 new foreclosure filings represents a 15% increase over the 2013 monthly average

Now, let’s take a quick tour through the tri-county area and breakdown the data.

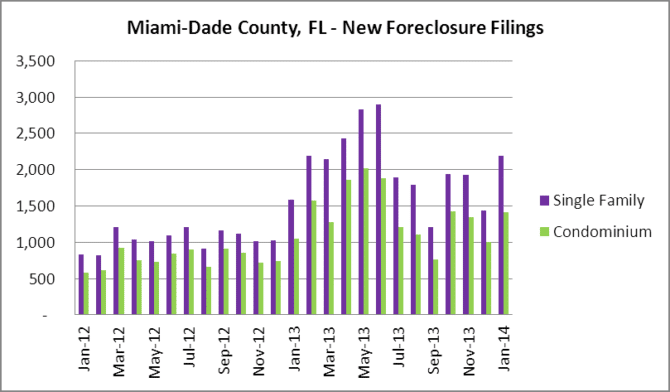

In Miami-Dade County, 2,187 houses and 1,413 condo/townhouse properties received a foreclosure notice in January, up from 1,437 houses and 999 condo/townhouses in December. In 2013, the monthly average of new foreclosure filings was 3,399, so to start 2014 with 3,600 new filings is already a 6% increase over last year’s monthly average.

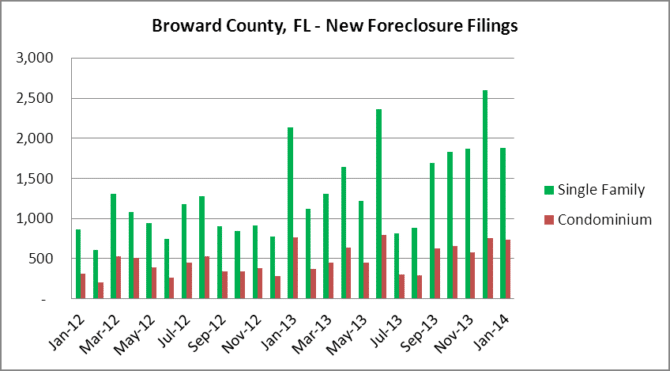

As for Broward County, there were 2,614 new foreclosure filings in January, with 1,877 houses and 737 condo/townhouse properties receiving a foreclosure notice. This is a slight drop from the 3,362 new filings in December.

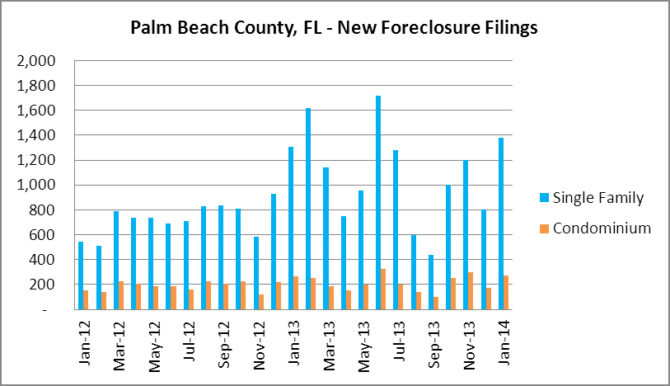

As for Palm Beach County, they took a break in December with 973 filings, but picked-up the pace in January with 1,656 new filings. There were 1,382 filings for the single-family home segment and 274 condo/townhouse properties on the receiving end of a foreclosure action.

The lack of residential inventory certainly played a role in the “housing bubble 2.0” that we have witnessed over the past few years, but as banks get more aggressive in foreclosing on delinquent borrowers, this trend will begin to reverse. Most of these delinquent borrowers have milked the system since 2008 and may actually have to vacate the properties they have been squatting in mortgage-free. To put this lopsided inventory into perspective, take a look at this snapshot below of the listed inventory for sale in South Florida vs the shadow inventory of foreclosures. Most of the recent buyers were rushing to purchase a house or condo thinking they would be “left out”. Wow, does that sound familiar? Its sure does, people certainly have a short memory and something tells me that their real estate agents didn’t inform them of the massive shadow inventory of foreclosures that looms and continues to grow. Our figures on the foreclosure front are actually conservative, as our search results are limited to 5,000 properties in each segment and city.