Blog

Pick your poison

When it comes to the current housing and mortgage market, I guess you have to pick your poison. If rates move lower, there is a very good chance that the economy is slowing and the housing market will struggle. If rates move higher, the economy may be stronger, but the higher rates will hurt the housing market. It appears that we are in a no-win situation. Our first chart is a snapshot of mortgage rates and you will notice the correlation to the 10-year bond yield. The 30-year mortgage rate almost reached 5% (net of fees) in early November, but has been on the decline since then. Sometimes those rate shocks do psychological damage to the market and 5% seems to be the “line in the sand” where transaction volume drops sharply once it’s breached. Last week mortgage applications declined, which is not a good sign for real estate market sentiment. The recent decline in rates should stimulate purchase applications, but maybe this is a sign of a shrinking demand for real estate.

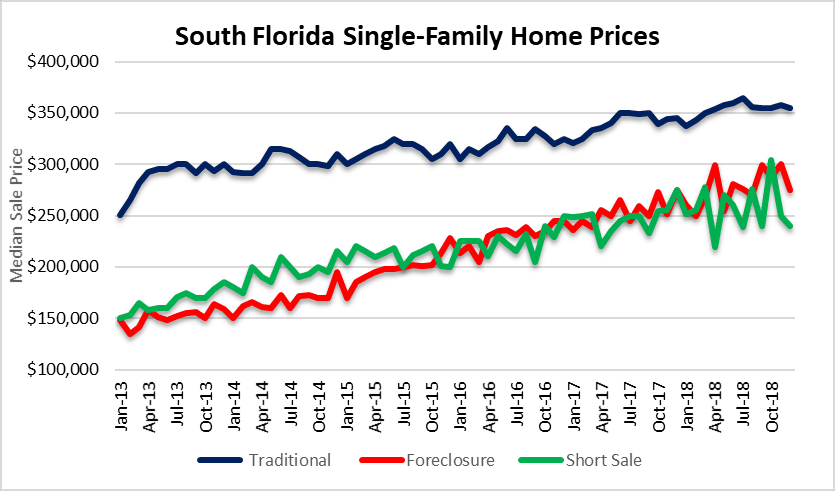

Median Sale Prices – Houses

Do you want higher prices or lower prices? It all depends if you are a buyer or seller. As of December 2018 it sure looks like prices hit a wall. This is typically a slower time of year, but here is a look at the numbers for single-family homes sales in South Florida:

- Traditional sales – $355,000

- Foreclosure sales – $275,000

- Short sales – $240,000

Median Sale Prices – Condos

Traditional sales prices in the South Florida market appear to have peaked in June 2018, when the median price reached $210,000. Here is a look at the numbers for December 2018:

- Traditional sales – $193,500

- Foreclosure sales – $143,250

- Short sales – $160,000

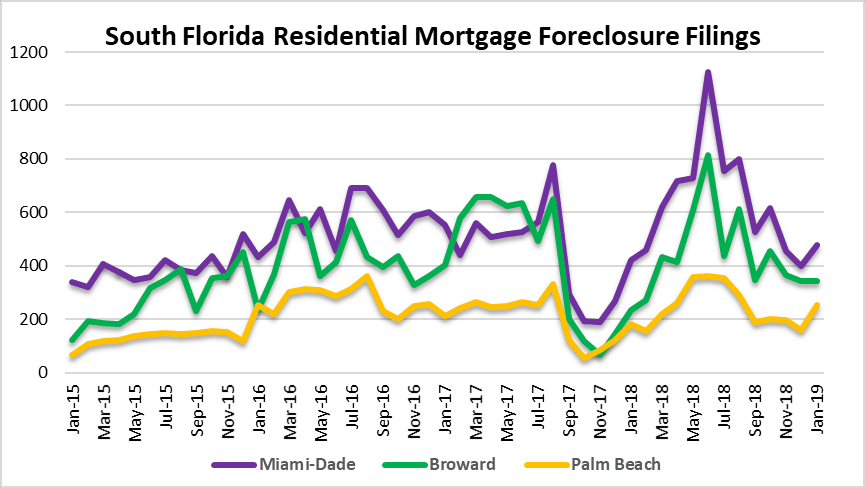

You probably are wondering why we still include foreclosure sales and short sale transactions in our charts. The reason is simple: There was never a full clearing of distressed real estate in South Florida. Years of foreclosure halts and bailouts have allowed this problem to linger throughout Miami, Fort Lauderdale and Palm Beach. This last chart today shows that new foreclosure filings rebounded slightly in January. Auto loan delinquencies climbed into the end of 2018, just another example of how this debt-fueled “recovery” could come back to haunt us.