Blog

Real estate market disruption

Last month the South Florida real estate market showed notable disruption in a variety of metrics. Today we will review and discuss a few areas that were impacted from the weather and if this accelerates a downturn in the South Florida property market.

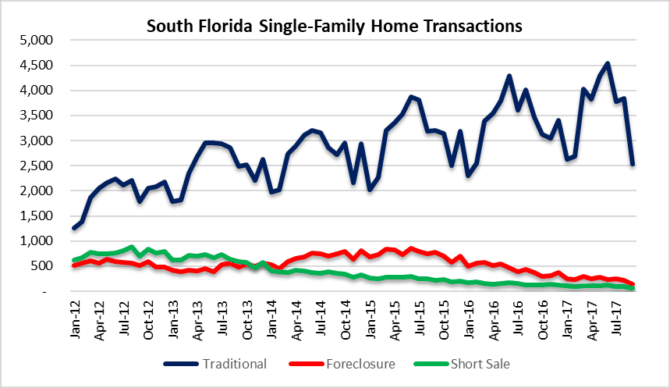

Disruption in transaction volume for single-family homes

The total number of single-family home transactions declined 34% from 4,147 deals in August to 2,735 in the month of September. The sharpest decline was in the traditional sales, which dropped from 3,844 in August to 2,536 in the month of September.

Disruption in transaction volume for condominiums

The number of South Florida condo transactions dropped 24% from 3,610 in the month of August to 2,738 in September. Short-sale and foreclosure transactions have been on the decline for the past few years, but the additional supply being delivered will keep prices in check for several years.

Total transactions for South Florida houses and condos

Overall, there was a 29% decline in residential transactions in the Miami, Fort Lauderdale and Palm Beach area from August to September. There were 7,757 total sales in the month of August and 5,473 closed sales in September. There is a good chance that some of these deals will show up in the October numbers, so we will have to see what happens.

Average Sale Prices – Condos and Houses

The average sale price for a single-family home in South Florida peaked during the month of June at $493,648 and has declined 10% since then. In September, the average sale price of a house in South Florida was $442,867. As for condominiums, the average sale price in South Florida was $282,117 in June and has only dropped 5% to $267,437 in the month of September.

Distressed Sales and New Foreclosure Filings

Distressed property sales in South Florida (purple line) have been in steady decline for the past few years, while new foreclosure filings (red line) were beginning to gather momentum until they were halted in September. This is most likely due to a hold from FEMA for areas impacted by hurricane Irma. Depending on the length of that moratorium on foreclosure filings, we may not see them restart until the beginning of 2018. Remember there is another hold on foreclosures during the holidays. This is actually pretty amazing since the court system is still dealing with foreclosures from the last crisis. Most people don’t realize that there is a massive overhang of distressed properties in the South Florida area that began the foreclosure process back in 2008 and remain in the system. This problem won’t be going away anytime soon!

Market Observations

There are a variety of underlying factors that will continue to impact the South Florida residential real estate market for the remainder of 2017, throughout 2018 and possibly beyond. Here are just a few observations:

- Interest rates have been at crisis-level lows since 2009 and will not stay there forever

- Low rates have pulled consumption forward and real estate demand may finally be evaporating

- Consumers are now burdened with record debt while incomes have not increased

- Low rates have distorted all asset classes and a reduction in easy money policy could pop the “everything bubble”

- Transaction volume was declining prior to Hurricane Irma and the correction may have already started

- Investment buyers may now rethink a South Florida real estate purchase after an active storm season

- Insurance costs will continue to climb for the coastal areas and negatively impact residential transaction volume and prices

- The massive shadow inventory of distressed properties will continue to impact the South Florida market into the next correction