Blog

Check out our latest South Florida real estate market outlook

With almost one quarter of 2016 in the books already, we are monitoring the changes in South Florida real estate transaction volume, inventory and sale prices. Asset classes across the board including stocks, bonds, real estate have been propped-up by easy from the Fed and the air pocket beneath them will eventually deflate.

Residential Inventory for South Florida

Our first chart today shows the existing inventory of houses and condo properties throughout the tri-county area. Condo inventory listed for sale surpassed 30,000 units last month and reached 30,232. You will notice from our chart below that you need to look back to July 2011 to see inventory over 30,000. We expect this inventory to continue to swell as we move through 2016. Keep in mind that this is just the existing inventory and doesn’t include the thousands of pre-construction units in the sales pipeline. The inventory of single-family homes reached 20,132 in February and doesn’t appear to be as much of an issue at this point.

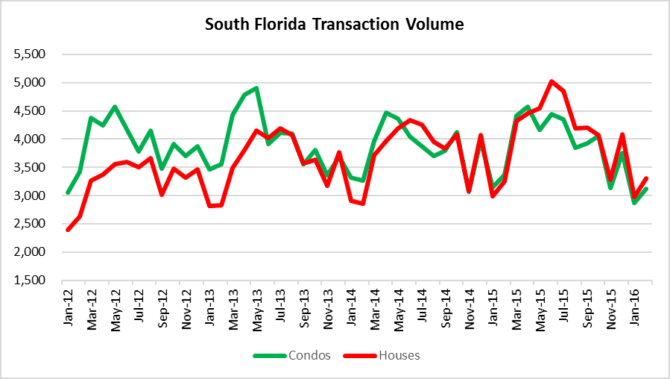

Closed Transactions in South Florida

There were 3,123 condo sales and 3,300 single-family home sales during the month of February in South Florida. We have discussed at length that we believe the South Florida peaked last spring around the May-June period and the chart agrees. The 6,423 closings in February is a 32% decline from the June total of 9,453 transactions. There is a good chance that deal volume won’t see that level again for awhile since artificially low rates have borrowed (or stolen) consumption from the future.

Median Sale Prices for South Florida houses

Take a look at our next chart and you will notice the median sale price of short sales and foreclosures in South Florida single-family homes has been on the rise. Some of these distressed properties have been in and out of the foreclosure pipeline since that last bubble burst and are finally making their way through the long judicial process and reaching the market. Here’s a look at median prices for houses in February:

- Traditional sales -$314,900 up from $305,000 in January

- Foreclosure sales – $220,000 up from $214,000 in January, but up 49% from $147,900 in January 2013

- Short sales – $225,000 (unchanged) in February, but up $50% from $150,000 in January 2013

Median Sale Prices for South Florida condos

How about the condo market prices in February? The rise in distressed property sales hasn’t been as significant, but short sale prices have climbed 46% since January 2013.

- Traditional sales – $173,000 up from $168,000 in January

- Foreclosure sales – $111,035, down from $115,000 in January

- Short sales – $124,000, up from $113,250 in January

South Florida New Foreclosure Filings

While the market is still disposing of distressed assets from the last bubble bursting, the pace of new foreclosure filings is gaining some steam as we move through 2016. With only three weeks of March data, we have already surpassed the February mortgage foreclosure filing numbers. Once we have the data for the full month we will update the chart, but it is obvious from the chart that the overall trend is moving higher.

South Florida New Foreclosure Filings compared to the pace of Distressed Sales

Finally, since there is still a large inventory of distressed properties in South Florida, we think it is important to monitor the pace of new foreclosure filings, compared to the number of short sales and foreclosure sale transaction closings. Through February we appear to be in good shape, but once we enter the foreclosure filings for March we could be in trouble. You obviously want to make sure the number of distressed sales outpaces new foreclosures, otherwise you will see additional inventory builds in the distressed market. Sounds familiar doesn’t it?

Summary

The artificial stimulus of low mortgage rates to reflate asset prices after the last crash may finally be losing its effect. When it comes to South Florida real estate, a continued decline in transaction volume or even the slightest hint of normalization of interest rates will eventually lead to the painful process of true price discovery. The only questions this time around is whether the Fed has any tools left to rescue the real estate market and where prices will end up if they don’t!