Blog

Rising inventories, interest rates, foreclosures and insurance costs should cap South Florida real estate prices for awhile

As an asset class, housing has been artificially supported by low interest rates and the backlog of foreclosures being withheld from the market for the past several years. It now appears that the support legs may be kicked-out from under house and condo prices in South Florida. A combination of new supply being added, rising mortgage rates, a massive shadow inventory of foreclosures and increased insurance costs will bring this party to an end by slowly deflating the recent bubble in South Florida residential real estate. Let’s first look at the gradual increase in residential supply available for sale.

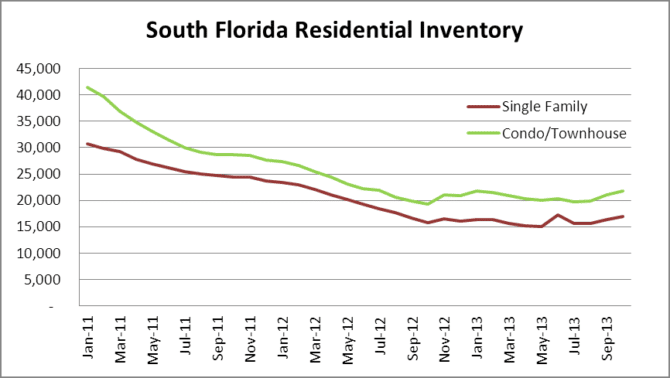

Although it is just a slight increase, the past few months have shown month over month growth in residential inventory for sale since foreclosures were halted by the major banks in late 2010. You will notice from the left side of the chart above that once all of the foreclosures were removed from the market with the robo-signing litigation, the available inventory slowly evaporated. In October, the South Florida single-family home market saw a 3% month over month increase to 16,894 units available for sale and the condo/townhouse segment had a 4% month over month increase to 21,796 for a total of 38,690 residential properties listed for sale. Property owners have finally seen an opportunity to unload real estate now that prices have been propped back up. Also, don’t forget all of the institutional buyers who entered the REO to rental business thinking it would be so easy to generate investment returns by managing single-family homes. Needless to say, they are now becoming sellers as well. The problem is that as new inventory gets piled on the market to take advantage of higher prices, interest rates have been climbing.

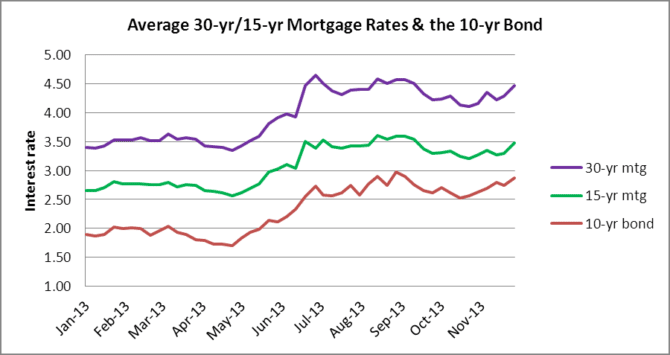

Even with the Fed doing it’s best to keep interest rates down, the 10-year bond (the primary driver of mortgage rates) seems to have a mind of it’s own lately. We have been monitoring the gradual increase and once it climbs over 3.00%, it will really put the brakes on the housing market. The artificially low rates have caused a bubble in all asset classes, ranging from equity markets to housing markets. Now after several years of enjoying the party and causing new bubbles, the punch bowl is finally getting pulled away.

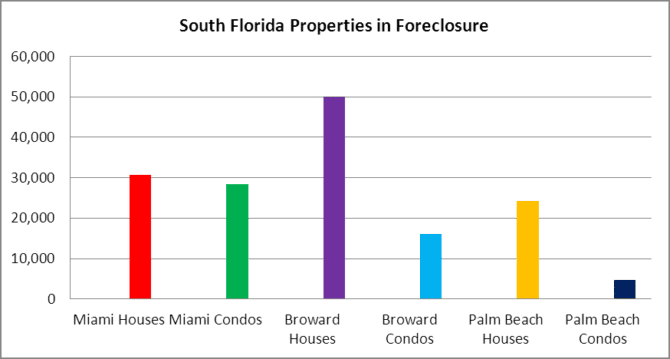

How about foreclosures in South Florida? Yes, we still have plenty of them. Take a look at this next chart of single-family homes and condo/townhouse properties in some stage of foreclosure throughout South Florida. We conduct a monthly city-by-city search in Miami-Dade, Broward and Palm Beach County and have tabulated over 150,000 properties in some stage of foreclosure as of 11/15. Can you imagine if all of these properties were dumped on the market at once? That isn’t likely to happen, but it sure seems as if the banks are finally ready to dispose of some of these properties. By referring back to our first chart showing 38,690 residential properties listed for sale, this next chart shows over 150,000 properties in foreclosure (nearly 4 times the amount of properties currently listed on the market). Basically, the recent supply shortage is more of an illusion than reality. There is plenty of foreclosure inventory and it needs to make it’s way through the court system and eventually be placed on the market for sale. In addition, the actual number of properties in foreclosure in South Florida is well over 150,000 because there are plenty of cities in South Florida that have surpassed the 5,000 property limit for each property type in our search results and we cannot narrow the criteria any further.

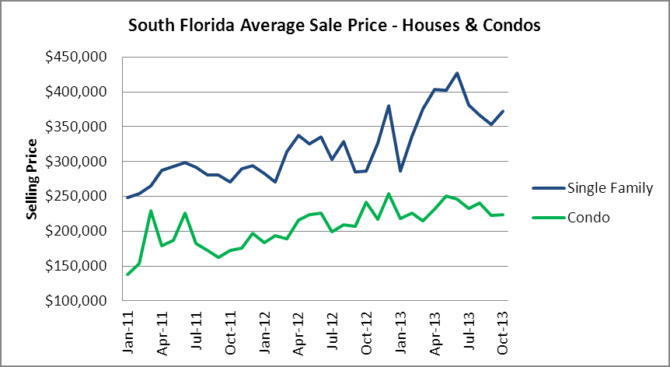

As for prices, you will notice that prices took a hit in the spring when rates started to rise and will be doing the same in the next month once this latest rate increase hits the sale data. There is usually a 1-2 month lag. If you scroll back to the interest rate chart, you will see that that rate increase in April-June dropped the hammer on prices in June and July.

In the next week or so we will have the inventory, price and sales data for November. We already know several factors that will be placing downward pressure on South Florida residential real estate prices as we enter 2014:

- Inventories are finally rising as private sellers, institutions and lenders enter the marketplace

- Interest rates are climbing and this time it will be a sustainable rally in rates

- Foreclosure filings remain strong and the massive shadow inventory of foreclosures has yet to hit the market

- Windstorm and flood insurance costs continue to rise in South Florida and will limit housing affordability

- The Qualified Residential Mortgage Rule becomes effective January 10, 2014 and lenders will need to evaluate a borrower’s ability to repay their loan. What’s with all this crazy talk?