Blog

The slow leak continues in South Florida residential real estate prices

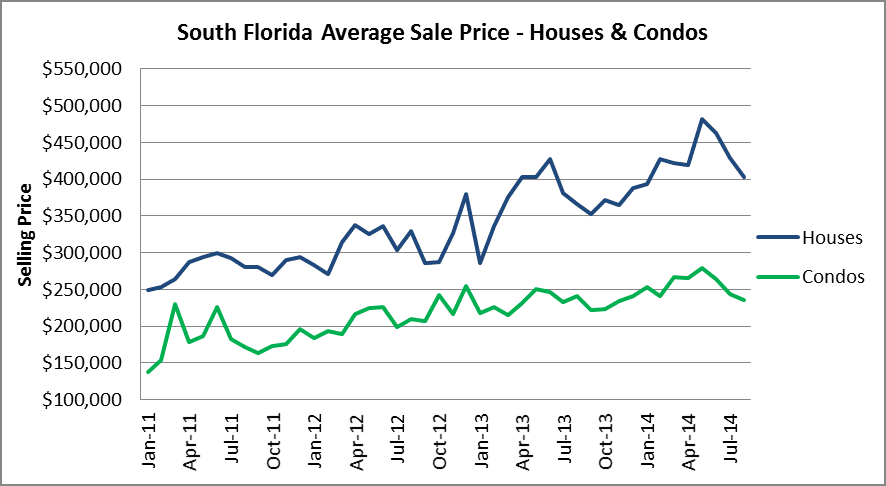

Maybe you didn’t hear the latest housing bubble pop, but we have a few charts that will show how the slow leak continues to deflate prices in South Florida residential real estate. First, let’s take a look at the average selling price of houses and condo properties in the tri-county area of Miami-Dade, Broward and Palm beach County Florida. As we have mentioned in previous posts, South Florida residential real estate prices hit their peak in the month of May. Since then, house and condo prices have retreated 16% from their recent high. With three straight months of declines, this could very well be the beginning of a market correction. Remember that this market “recovery” lacks the necessary foundation and is merely a byproduct of easy money from the Fed and foreclosures being held off the market for several years to create the illusion of a recovery. There is essentially one big air pocket under the market and we will see if it continues to deflate or if we see another bubble “pop”.

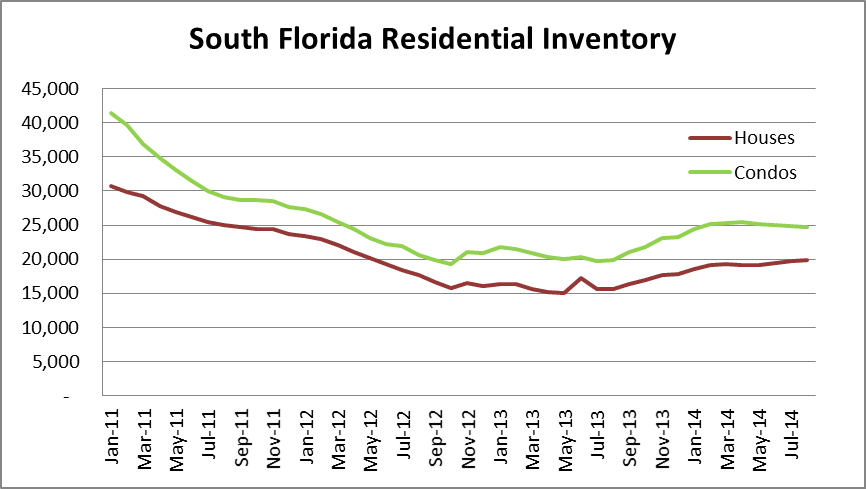

How about the inventory of residential properties available for sale throughout South Florida? Existing inventory is off the lows set after all of the foreclosures were pulled from the market during the robo-signing litigation in late 2010. The number of houses and condos rose slightly in August to 44,615 properties available for sale.

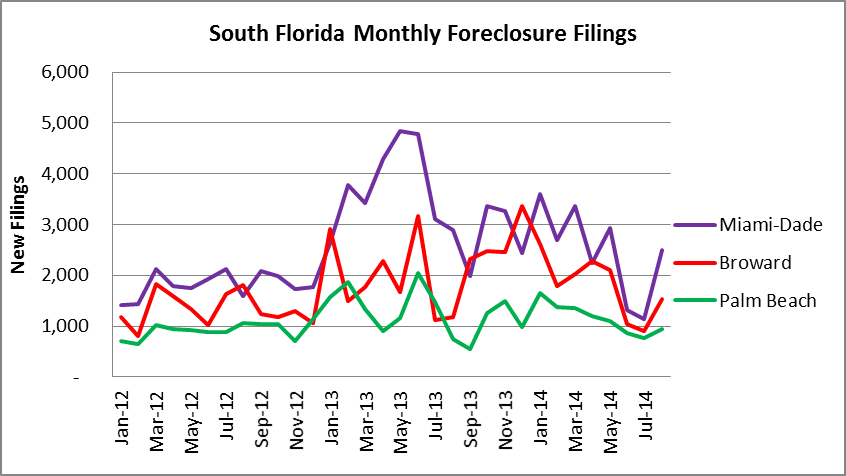

How about foreclosure filings? Well, they appear to be rebounding again. As a judicial state, Florida is still wresting with a massive inventory of properties that have been in and out of foreclosures since the housing bust nearly six years ago and these properties will be lingering for a few more years.

We will continue to provide market updates and shed light on the South Florida real estate market data. When the local papers report the housing data, they tend to use year over year comparisons that put a positive “spin” on the actual market data. Remember that no alarm goes off when the market hits a peak, just as no alarm goes off when the market hits the bottom. We encourage you to sift through the data-masking banter in the headlines to see what is actually happening in the markets today. Stay tuned!