Blog

Was the January decline in deal volume seasonal or the sign of a new trend?

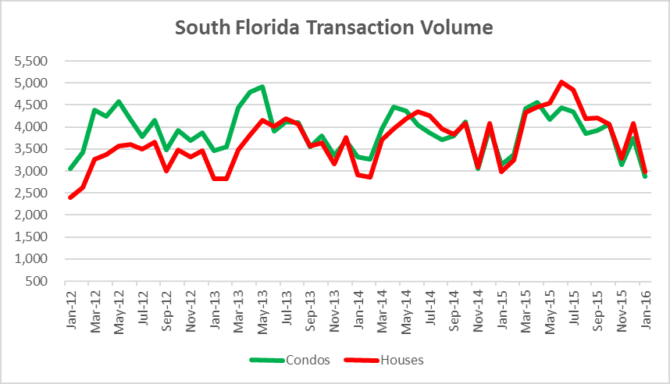

The South Florida residential real estate market saw a noticeable decline in deal volume in the month of January. There was a 25% drop in closed transactions from December and a 5% drop from January 2015. Before we breakdown the data by property type, here is a snapshot of the closed transactions in Miami-Dade, Broward and Palm Beach County, Florida.

You will notice that each January for the past several years has seen a decline in transaction volume. The questions is whether this year may be signaling something new, because the total number of transactions has declined to just above 2012 levels. From January 2012 until January 2016, the transaction totals were as follows:

- January 2012 – 5,453 closed sales

- January 2013 – 6,280 closed sales

- January 2014 – 6,227 closed sales

- January 2015 – 6,125 closed sales

- January 2016 – 5,849 closed sales

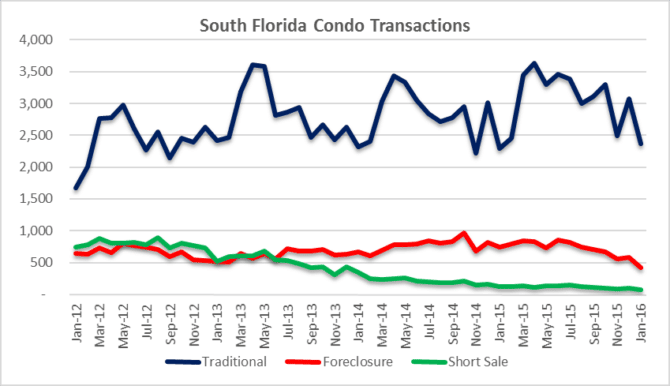

To gain perspective on the decline in sales, we will take a look at the condo sales volume which totaled 2,870 in the month of Jnauary. Traditional sales were 82% of all condo transactions, foreclosures made up 15% of sales and short sales were approximately 3% of all South Florida condo closings.

Next we will look at the breakdown of the 2,979 closed sales in the single-family home segment during the month of January. Traditional sales were 77% of all transactions, foreclosures made up 17% of sales and short sales were approximately 6% of all South Florida closings.

The average sale prices for single family homes dropped from $464,123 in December to $414,831 in the month of January, while condo prices climbed from $252,454 in December to $270,132 in January.

As for the supply of residential properties on the market, in January there were 49,592 residential properties available for sale in South Florida. There were 20,128 houses and 29,464 condo properties listed for sale. To put this inventory into perspective, we have to go back to February of 2012 to see a number this high. During that month there were 49,635 residential properties on the market, as we were still working off the supply of distressed properties from the last crisis. Most foreclosures were halted after October 2010 due to the robo-signing litigation and available inventory magically declined.

Take a look at the far left of the chart above and you will see that the inventory of 72,241 listings in January of 2011 was cut in half by October 2012. Halting foreclosures was not a solution to the problem, but simply kicking the can down the road. Many of the distressed properties from the last crisis are still lingering and will eventually be listed for sale (again), this time it’s eight years after the crisis, or six years into the “recovery”, however you choose to view it.