Blog

Stall speed

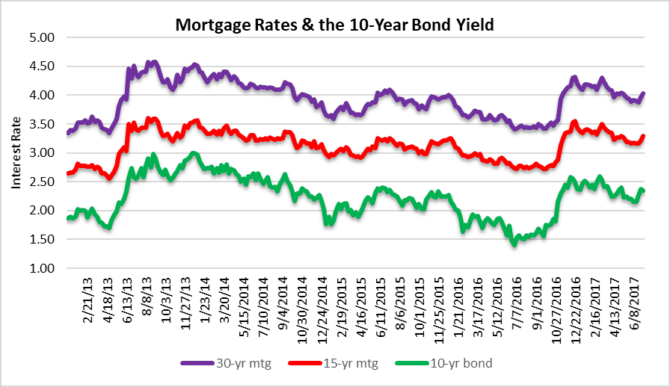

Stall speed is the slowest speed a plane can fly to maintain level flight. That sounds a lot like the state of our economy and the bond market is well aware. After the November election we saw a noticeable jump in 10-year bond yields and mortgage rates, but halfway through 2017, they simply don’t believe the hype any longer. The prospects for economic growth appear slim and the economy has stalled (or has simply remained stalled). Ironically enough, the slight move upward in yields over the last few weeks was a reflex to European bond yields increasing and certainly not a result of economic growth prospects.

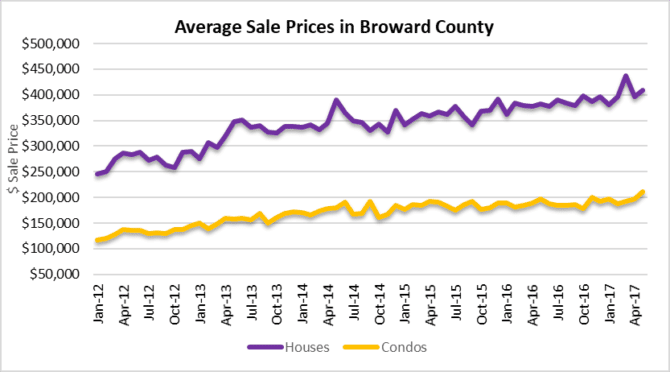

Will sales prices finally stall?

For now, it looks like the average sale prices in the Fort Lauderdale area have remained elevated. During the month of May, the average sale price of a single-family home was at $408,639 and the average sale price of a condo was $211,018. Mortgage rates have remained at crisis levels for over eight years and have continued to fuel higher prices. The summer months will show if the pace of sales and prices will slow.

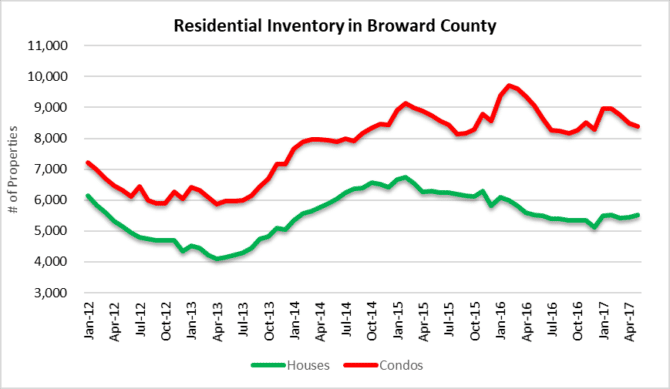

Residential Inventory

Residential inventory around the Greater Fort Lauderdale looks good for sellers. There were a total of 13,909 houses and condos listed for sale throughout Broward County in the month of May. Low rates have allowed buyers to pile on plenty of debt and the fear of missing out (FOMO) is still in full-effect.

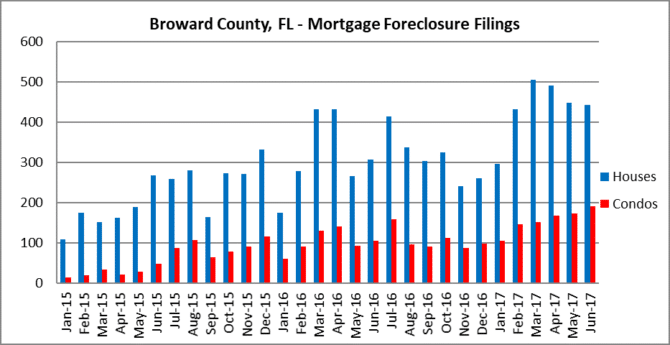

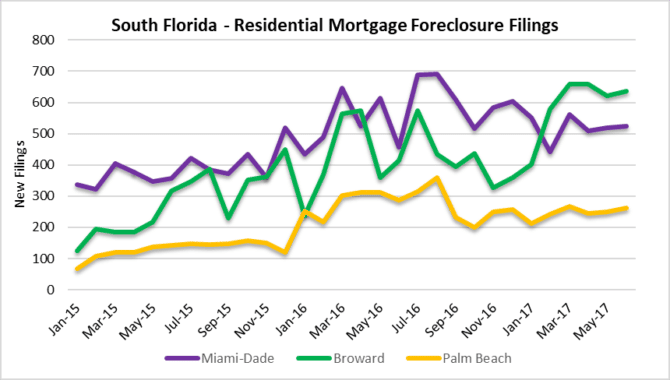

Foreclosure filings – not at stall speed

For some reason nobody cares to report about all of the new foreclosure filings in the Fort Lauderdale area. You will notice from the next chart that they have been climbing in 2017 and remain at high levels that we haven’t seen in years. This is all happening during the eighth year of the “economic recovery” nonetheless! The condo property filings (in red) have been climbing steadily month after month throughout 2017. Here is a quick snapshot of the past three years of residential mortgage foreclosure filings in Broward County, Florida:

- 2015 monthly average was 280

- 2016 monthly average rose 50% to 420

- 2017 monthly average has climbed another 41% to 593

Our next chart is a snapshot of the tri-county area including Miami-Dade, Broward and Palm beach County Florida. Through the month of June there have been 8,138 new mortgage foreclosure filings in the area.

At some point the lack of growth in the economy will come back to haunt the South Florida real estate market. The pace of mortgage defaults remains elevated and new debt will magnify the problem. The fact that the ten year bond yield cannot reach 3% just shows that markets don’t believe we will see any economic growth in the near term. In addition, the Fed currently holds nearly 25% of all the first mortgage loans in the country with a total of $2.5 trillion and they keep talking about winding-down their balance sheet. What will happen to the mortgage market if it relies on other participants to buy all of these loans? Anemic growth and record debt will not allow us to maintain stall speed forever.