Blog

Studying the charts & trends in South Florida foreclosure filings

We now have the first quarter of 2014 in the bag and it is a good time to see how the monthly foreclosure filings are adding-up in the South Florida residential market. First, let’s take a look at how Miami-Dade, Broward and Palm Beach County look in one chart.

In March there were 6,432 new foreclosure actions filed, up from 5,833 in February. Miami-Dade foreclosure filings were on the upswing in March, while Palm Beach and Broward stabilized. Here’s a look at the South Florida averages:

- In 2012, the monthly average of new foreclosure actions filed was 4,053

- In 2013, the monthly average of new foreclosure actions filed was 6,861

- So far in 2014, the monthly average of new foreclosure actions filed is 6,712

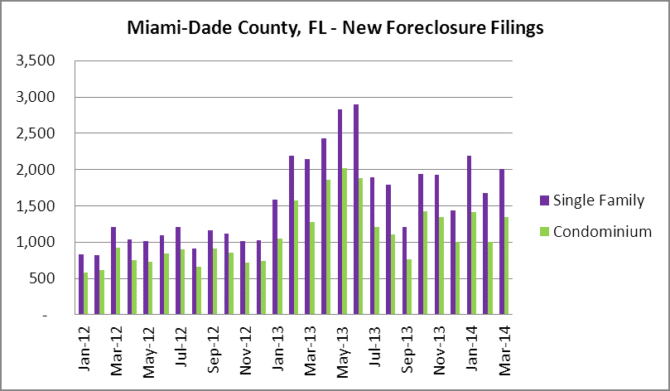

Starting from the South in Miami-Dade, here is a chart of the monthly filings.

In March, there were 3,355 new foreclosure actions filed in Miami-Dade County with 2,004 in the single-family home segment and 1,351 in the condo/townhouse segment. And for now for the averages in Miami-Dade County:

- In 2012, the monthly average of new foreclosure actions filed was 1,807

- In 2013, the monthly average of new foreclosure actions filed was 3,399

- So far in 2014, the monthly average of new foreclosure actions filed is 3,213

Heading up the road to Broward County, here is a snapshot of the monthly filings.

In March, there were 1,727 new filings, with 1,308 new filings in the single-family home market and 419 in the condo/townhouse market. The monthly averages in Broward County over the past few years are as follows:

- In 2012, the monthly average of new foreclosure actions filed was 1,332

- In 2013, the monthly average of new foreclosure actions filed was 2,182

- So far in 2014, the monthly average of new foreclosure actions filed is 2,040

Our final stop on the tri-county foreclosure tour today brings us to Palm Beach County, where there were 1,350 new foreclosure actions filed in March. They are broken-out into 1,098 in the single-family home market and 252 in the condo/townhouse market.

As for the averages in Palm Beach County over the past few years, it is the one South Florida county where the monthly average has increased over 2013. Let’s take a look at the numbers:

- In 2012, the monthly average of new foreclosure actions filed was 914

- In 2013, the monthly average of new foreclosure actions filed was 1,279

- So far in 2014, the monthly average of new foreclosure actions filed is 1,458

So if this is a “housing recovery”, why is South Florida still wrestling with the foreclosure problem that has come and gone in other areas of the country? Here are just a few reasons:

- There is a massive shadow inventory of properties that have lingered in various stages of foreclosure over the past 4-6 years partially due to robo-signing litigation, bank delays or frivolous legal filings on behalf of the property occupant to remain in the property without paying.

- The average foreclosure in Florida takes roughly 933 days (sometimes much longer) because Florida is a judicial state and all foreclosures must be processed through the court system that is overwhelmed by the backlog of cases yet to clear.

- The Mortgage Debt Relief Act of 2007 has finally expired. This means that people no longer have an incentive to short-sell their property and will let it go to foreclosure. If there is no debt-cancellation, people know they can remain in the property for a few more years for free until the bank takes it.

- The recent “market bottom” was merely a head-fake and a true recovery will not take place until the majority of distressed properties are sold. That will provide the necessary foundation for a recovery.

- Borrowing costs are rising and the Qualified Mortgage standards and ability to repay will restrict the amount of potential buyers for properties. Thousands of property owners have just recently emerged from a negative equity position and can barely afford to sell. With fewer qualified buyers, the properties may linger on the market for longer and re-enter default.

- Insurance costs continue to rise in South Florida. The mortgage payment is only a small part of the home ownership cost equation in South Florida where the windstorm, flood and homeowners’s policy premiums continue to escalate. When your lender notifies that you that your mortgage payment has just risen due to a 15-20% insurance premium increase, you don’t really have a voice in the matter. You pay it, or enter default for nonpayment.