Blog

Trick or Treat?

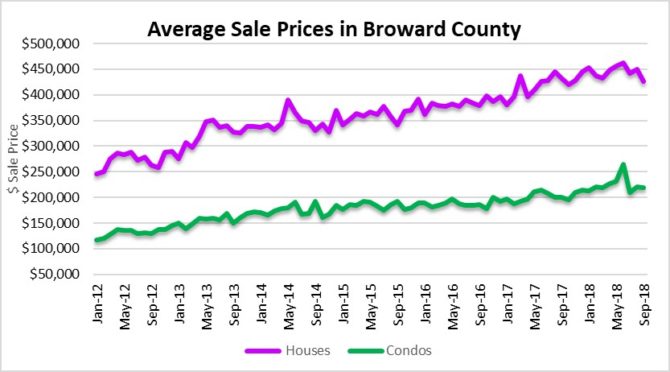

It’s trick or treat time in the South Florida real estate market. Not just because we are at the end of October, but we may finally see changes in the market,. Higher mortgage rates may finally be doing some damage and could impact selling prices going forward. Our first chart shows the average selling price in the Greater Fort Lauderdale / Broward County area. We have been using the month of June as the recent peak in residential prices here in South Florida. Since then, the average sale price of a house declined 8% and condo prices have declined 17%.

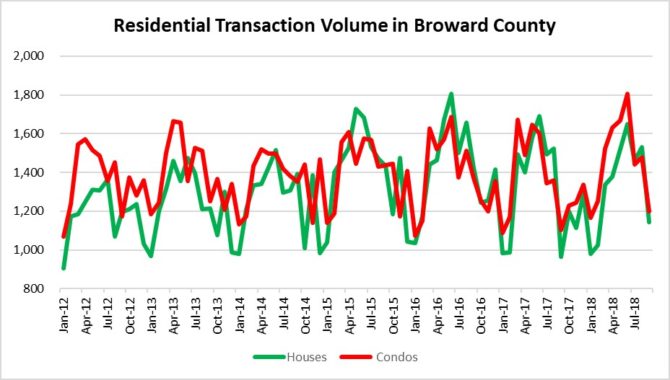

How about transaction volume? It looks like we got a trick in that area. Deal volume dropped 32% from the June highs. In September there were 2,341 residential closings, down from 3,454 in June. Take a look at the chart. You will see that we have seen transaction volume drop during this time of year historically. One month does not make a trend, so it is worth monitoring as we close out the year.

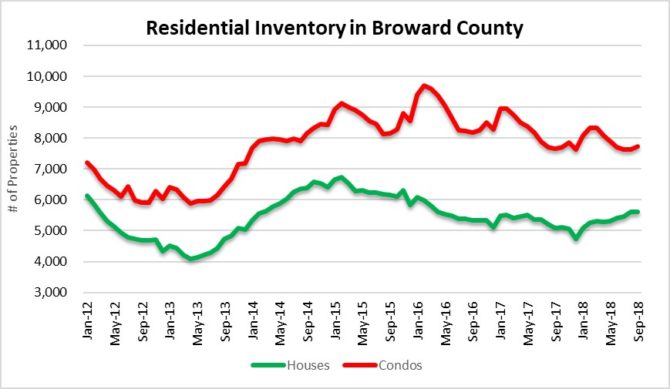

Residential inventory in the Greater Fort Lauderdale market was at 13,324 in the month of September. There has only been a slight increase over the last few months. There were 5,603 houses and 7,721 condos listed for sale during the month of September. If deal volume remains low, inventory will gradually build. Nothing to worry about right now.

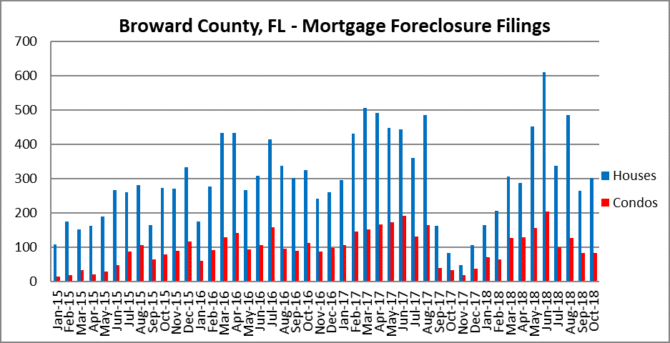

Mortgage foreclosure filings have slowed down after the burst of new filings around May-June. Here is a snapshot of the number and monthly average of filings along with a chart:

| Annual | Monthly | Change | |

| 2015 | 3,356 | 280 | |

| 2016 | 5,044 | 420 | 50% |

| 2017 | 5,228 | 436 | 4% |

| 2018 | 4,563 | 456 | 5% |