Blog

Bubble trouble in the South Florida real estate market

There’s bubble trouble in the South Florida residential real estate market. This isn’t the first time, as we were ground zero for the last housing bubble and collapse. Today we will look at some charts of the single-family home and condo markets for the Miami, Fort Lauderdale and Palm Beach area.

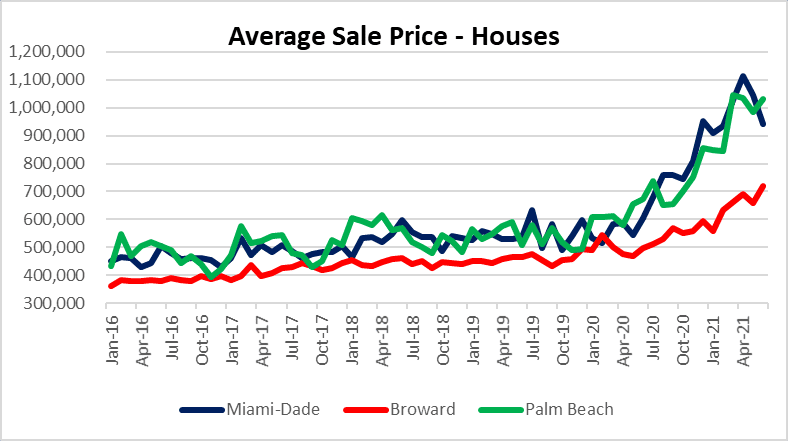

By looking at the chart above, it looks like the average sale prices in the single-family home market are starting to roll over in the Miami area. Here is a snapshot of the tri-county market:

- Miami-Dade prices dropped 10% month over month, from $1,043,932 in May to $942,484 in June. Going back to April, prices have declined 15%, so the Miami housing bubble is either leaking or getting ready to pop!

- Broward / Greater Fort Lauderdale prices actually rose from $660,338 in May to $719,293 in June

- Palm Beach prices climbed 5% from $983,654 in May to $1,031,919 in June. Prices are basically flat since march though.

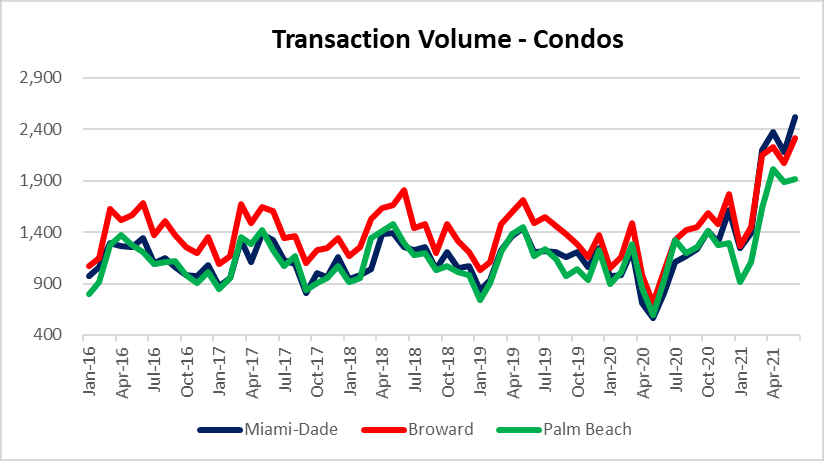

Is there some bubble trouble brewing in the condo market? Prices for the tri-county area were mixed in June, here is a look:

- Miami-Dade condo prices dropped 8% from $676,675 in May, to $624,884 in June

- Broward / Greater Fort Lauderdale condo prices were up 4% from $296,156 in May to $307,951 in June

- Palm Beach condo prices declined 15% from $481,771 in May to $409,595 in June

There was a rebound in sales volume in June for both houses and condos, here are the charts:

- Sales of houses in Miami climbed from 1,360 in May to 1,542 in June

- Sales of houses in Broward / Greater Fort Lauderdale climbed from 1,634 in May to 1,803 in June

- Palm Beach sales rose from 1,890 in May to 2,117 in June

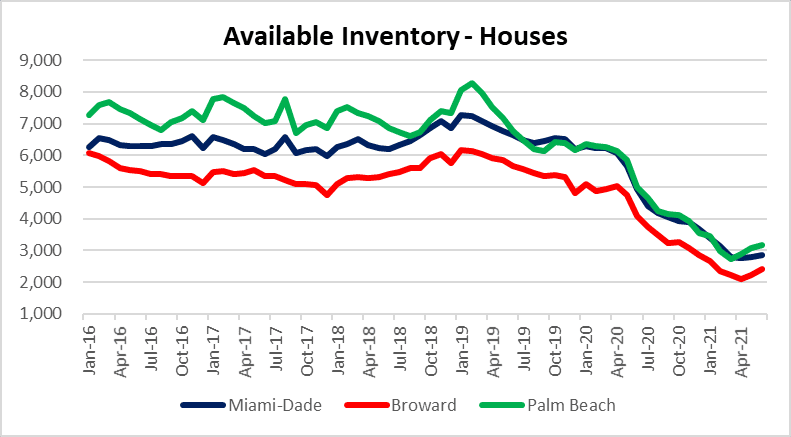

Inventory may have finally stabilized, take a look at the single-family and condo market charts.

As we move into the summer, the dynamics of this market could be shifting. It hasn’t been easy predicting a slowdown, but there are a number of factors signaling that it may finally be upon us. It also seems as the problems in the insurance market are finally getting some attention and may keep buyers on the sidelines. Finally, reflating prices after the last housing market crash (over a decade ago) has put home ownership out of reach for so many. At some point this needs to stop, because it’s not healthy for the real estate (or any other) market.