Blog

Fair warning

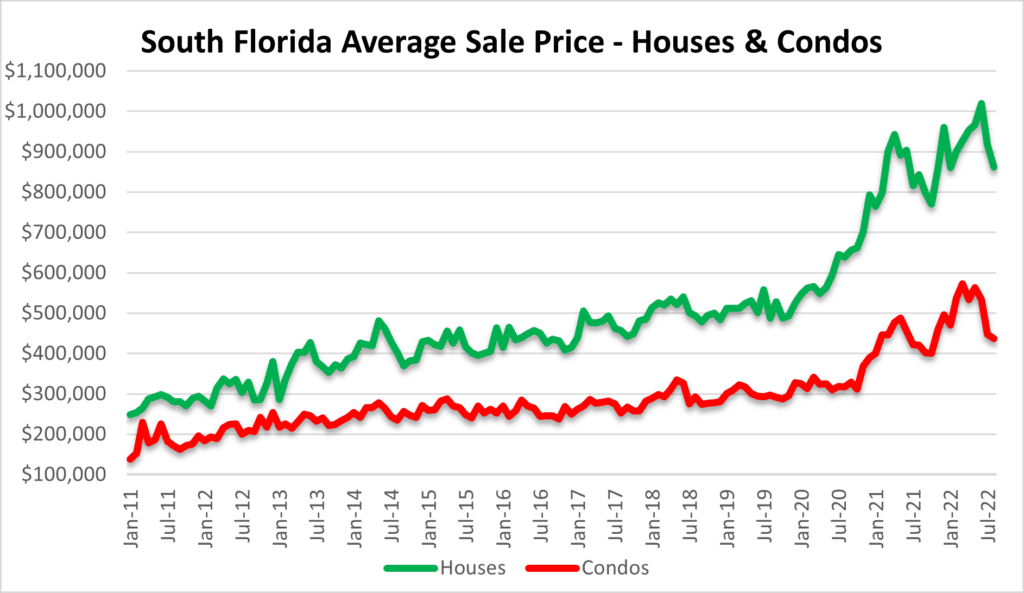

Don’t say we didn’t give you fair warning. Several months ago we said that it’s over and this massive housing bubble was finally showing signs of exhaustion. A combination of sharply higher mortgage rates, ridiculously unaffordable prices and a serious insurance crisis will be putting downward pricing pressure on South Florida real estate for awhile. If you take a look at our first chart of sale prices, you will see that the average sale price of a single-family home peaked at $1,019,037 in June. Condo prices look like they peaked one month earlier at a price of $563,545. How about some easy listening while you check out some charts? Here is a great song off Van Halen’s 1981 “Fair Warning” album.

Here are the numbers for August:

- Single-family home prices have declined 15% from the June peak to $861,550

- Condo prices have declined 22% from their May peak to $437,507

This is just the beginning of what could be a housing price correction that could last a few years.

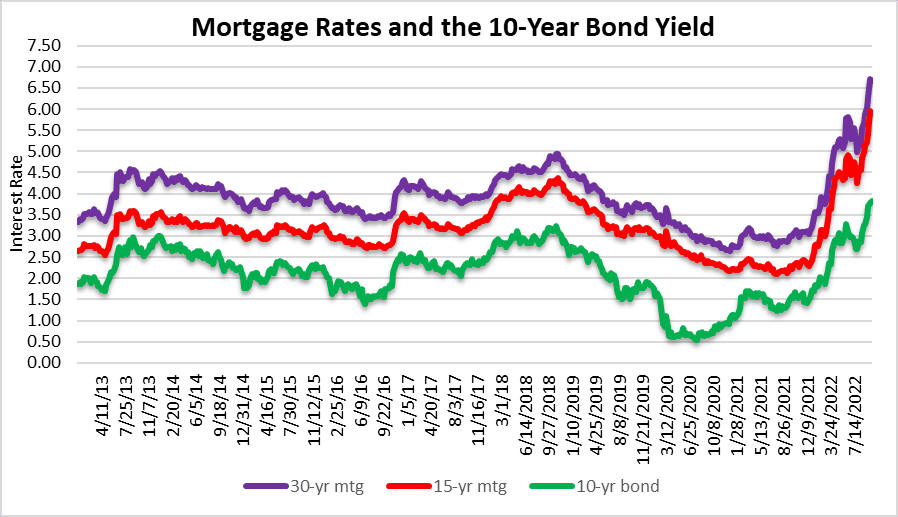

Fair warning on mortgage rates

Artificially suppressed mortgage rates were great for price appreciation since that last housing bubble collapsed. The danger is that at some point the excesses need to be unwound. Take a look at this massive surge in mortgage rates. Think of trying to keep a massive beach ball underwater for over a decade. Guess what? Mortgage rates are that beach ball that slipped out of your grasp and shoots higher. That’s probably the easiest way to describe it. This massive move will put serious pressure on all real estate prices.

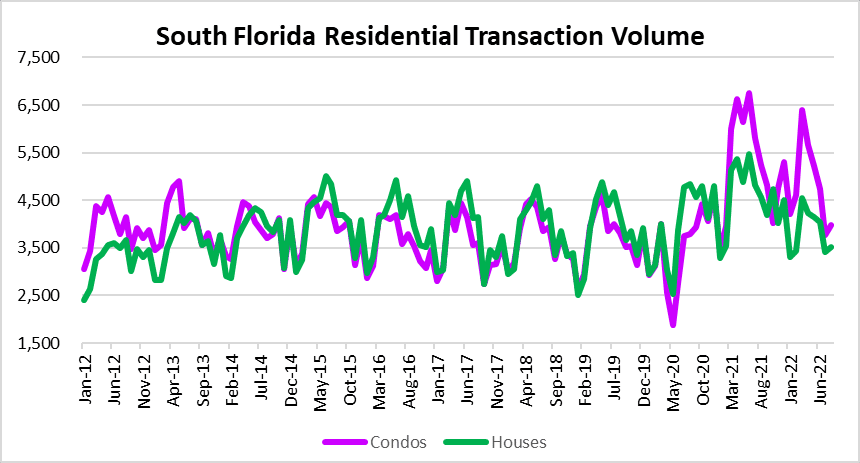

Real estate transaction volume

There were 7,515 residential real estate transactions across Miami, Fort Lauderdale and Palm Beach during the month of August. That number is up from 7,172 from the month of July, but the longer term sales numbers should resume a downward trend for the next several months at least.

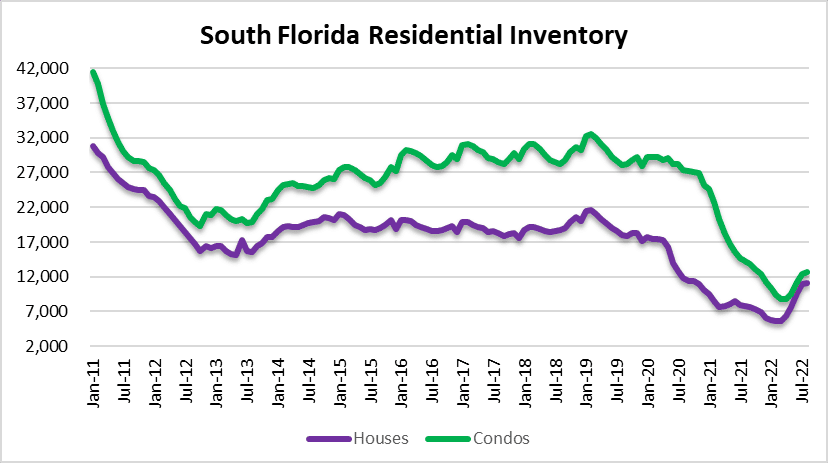

Residential real estate inventory

The one factor that may keep real estate prices from collapsing is the low inventory. The number of houses and condos on the market is slowly increasing, but still remains very low. There were 11,136 houses and 12,645 condo properties on the market in August. At this point the sellers should seriously be considering price reductions if they want to get a deal done, as this market has already turned.

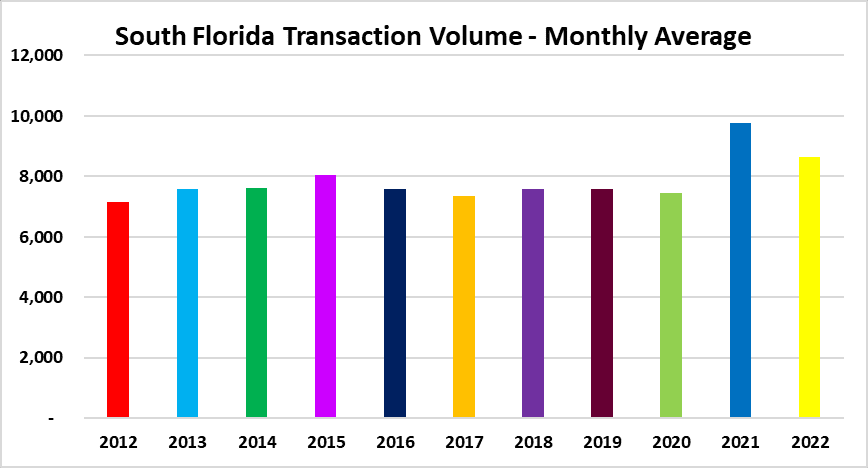

Here is a look at the average monthly sales volume in South Florida since 2012.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.