Blog

Fishing for a bottom

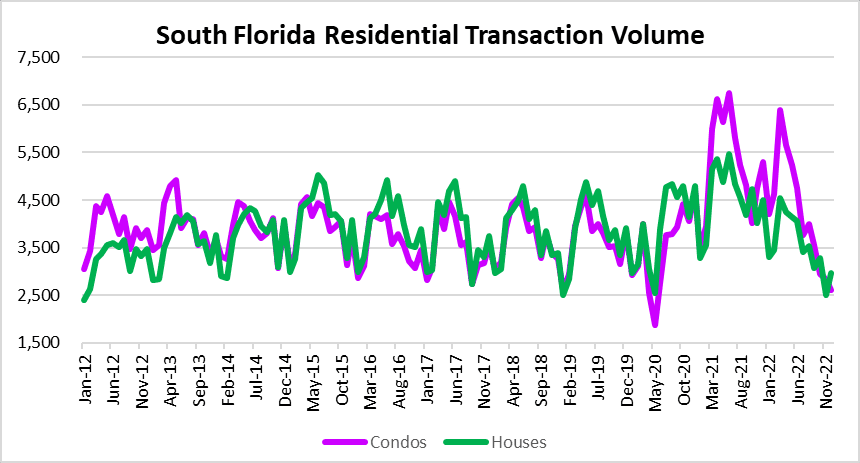

We are currently fishing for a bottom in residential real estate sales across Florida. There were a total of 5,579 closed sales in the single-family and condo market during the month of December. This number is up slightly from 5,357 sales during the the month of November. To put these transaction volumes in perspective, there were 12,208 closed sales in June of 2021. That was the peak of the COVID craziness when everyone was flocking to South Florida. The next few months should will be interesting. One factor limiting sales volume is the low inventory across South Florida. Maybe the airbnbust will add much needed inventory to the market and help deflate the current housing bubble. Let’s look at the prices, transaction volume and inventory numbers through December 2022.

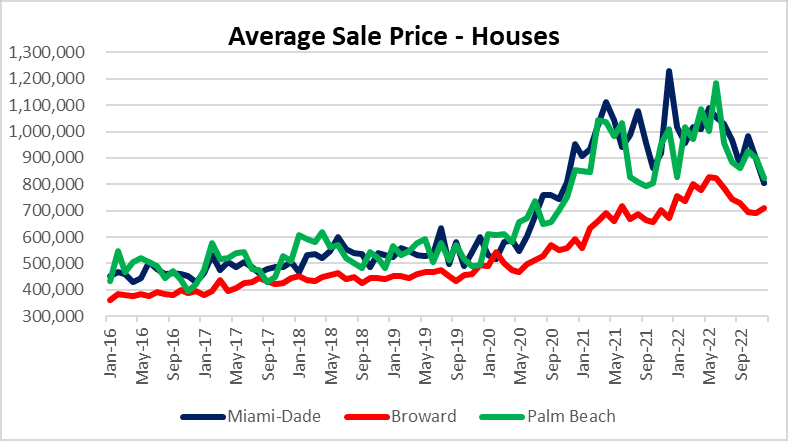

The average sale price of single-family homes has been declining for several months. Miami and Palm Beach continue to drop in price, but Broward / Fort Lauderdale prices may be stabilizing for now.

- Miami-Dade – $804,082

- Broward – $709,412

- Palm Beach – $825,243

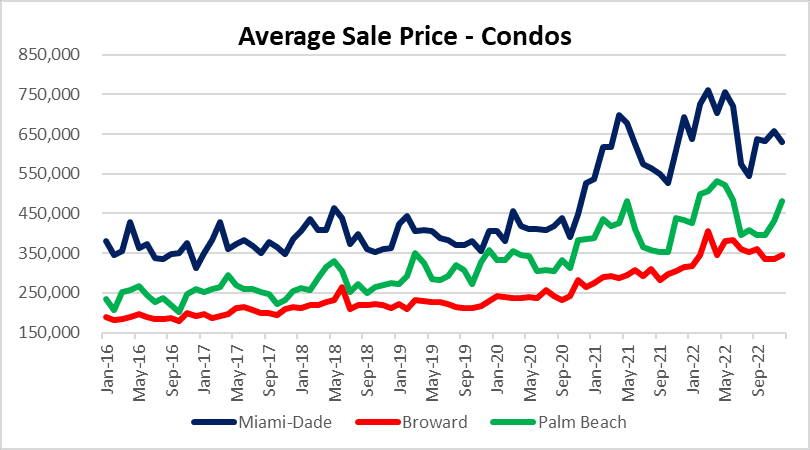

The average sale price of condo properties dropped in Miami, rose in Palm Beach and remained flat-ish in Fort Lauderdale.

- Miami-Dade – $628,907

- Broward – $346,154

- Palm Beach – $480,375

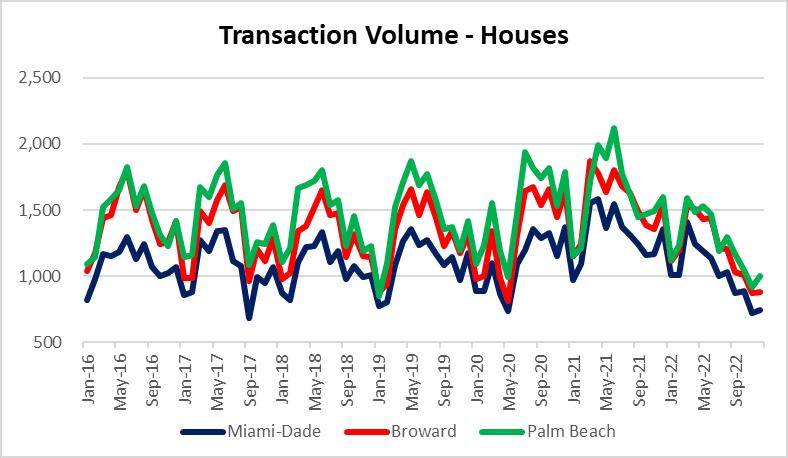

Transaction volume for single-family homes has been in a downtrend across all three markets. After fishing for a bottom, do you think we find it at these levels?

- Miami-Dade – 744

- Broward – 876

- Palm Beach – 999

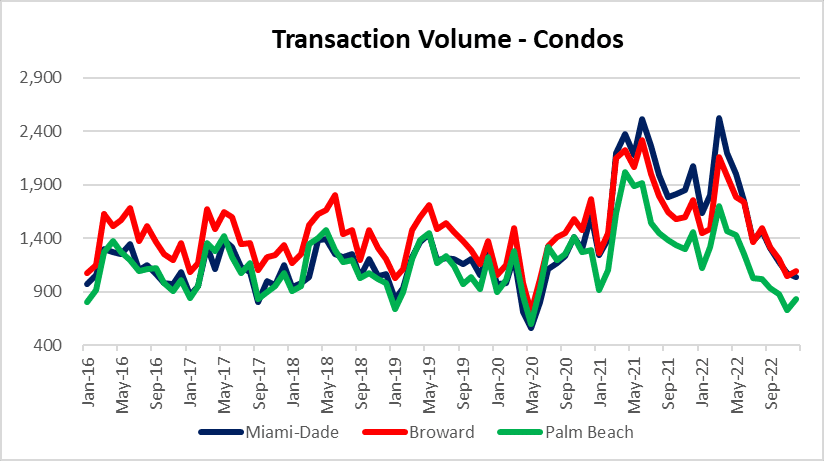

Transaction volume for condo properties was in a steep decline and fishing for a bottom, but could be leveling off as we move into 2023.

- Miami-Dade – 1,035

- Broward – 1,094

- Palm Beach – 931

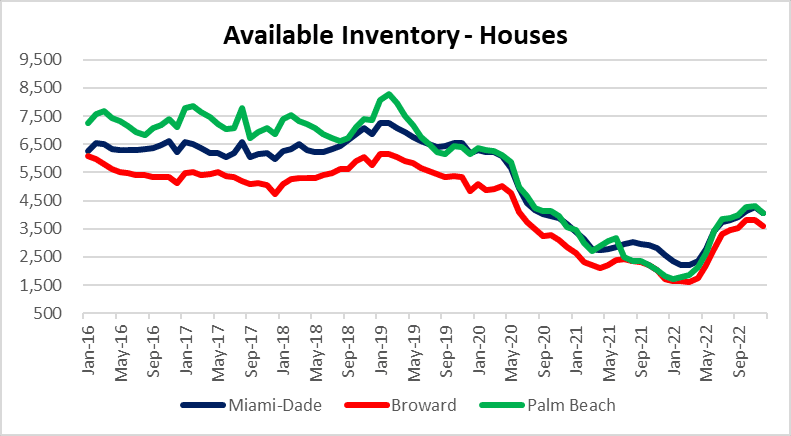

The inventory of single-family homes was climbing for several months, but tapered off in December. There is some seasonality to the inventory as property owners typically relist after the holidays. Let’s see if that’s the case this year.

- Miami-Dade – 4,043

- Broward – 3,582

- Palm Beach – 4,042

The inventory of condo properties across South Florida was starting too climb into the end of 2022. Let’s see if the number of condos on the market starts to increase as we move through 2023.

- Miami-Dade – 6,663

- Broward – 4,190

- Palm Beach – 3,503

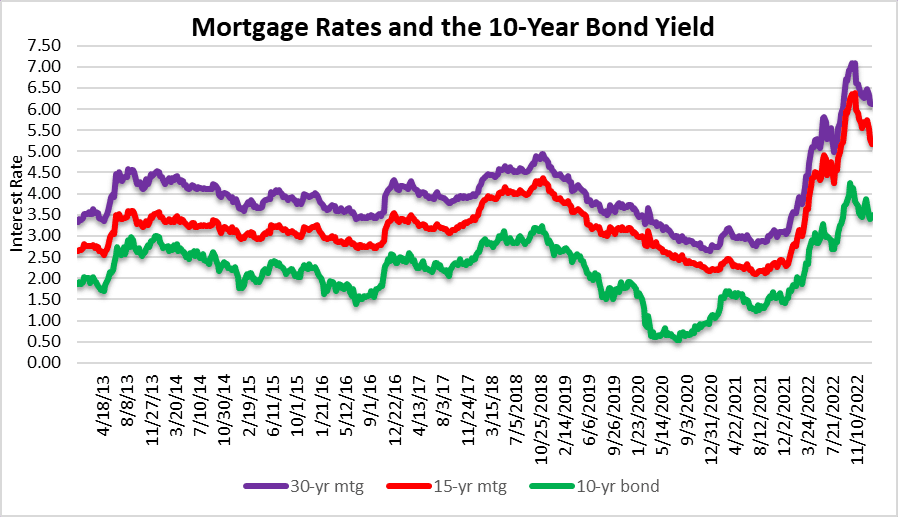

Mortgage rates have moderated after spiking into the end of the year. As rates settle-down and find their footing, real estate sales started to increase again. After several years of ridiculously low rates, any moves higher will hit the market. Although the pace of sales has slowed and may be finding it’s footing, don’t be too quick to call a bottom in real estate prices. This is a process that may take awhile.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.