Blog

Fort Lauderdale condo inventory & price trends plus REO & short sale data with charts and analysis:

After a quick review of the June 2012 Fort Lauderdale, Florida condominium market data, it looks like the temporary condition of rising prices may finally be breaking. Although one month of data does not make a trend, June provided some insight to how the “next leg down” could be in the works. The first chart I am posting shows the gradual drop in condo inventories since foreclosures came to a screeching halt back in late 2010:

In January 2010, there were 8,985 condominium / townhouse units available for sale in the Greater Fort Lauderdale market. Once foreclosures were halted in October 2010 due to the robo-signer issues, you will see a steady decline from 8,696 units in September 2010 to only 3,818 units in June 2012. Next, let’s take a look at the number of distressed sales. The data in the next chart shows the percentage of all condo & townhouse sales that were either a bank-owned REO or a short sale:

In January of 2011, 38% of all condo and townhouse sales in Greater Fort Lauderdale were either a short sale or foreclosure and this percentage peaked at 40% in February of 2011. Keeping in mind that the majority of foreclosures were halted in October 2010, this was the last “push” of banks unloading their inventory from this first wave of distressed properties. As of May 2012, this percentage of sales had dwindled to only 15%, but now June 2012 shows a 5% spike in that rate to 20% of closed sales for the month. Lack of supply created the false bottom in the market, but as the amount of distressed sales begins to increase going forward, prices will continue to be under pressure. The apparent downward turn in prices due to a higher percentage of distressed property sales is illustrated in the next chart:

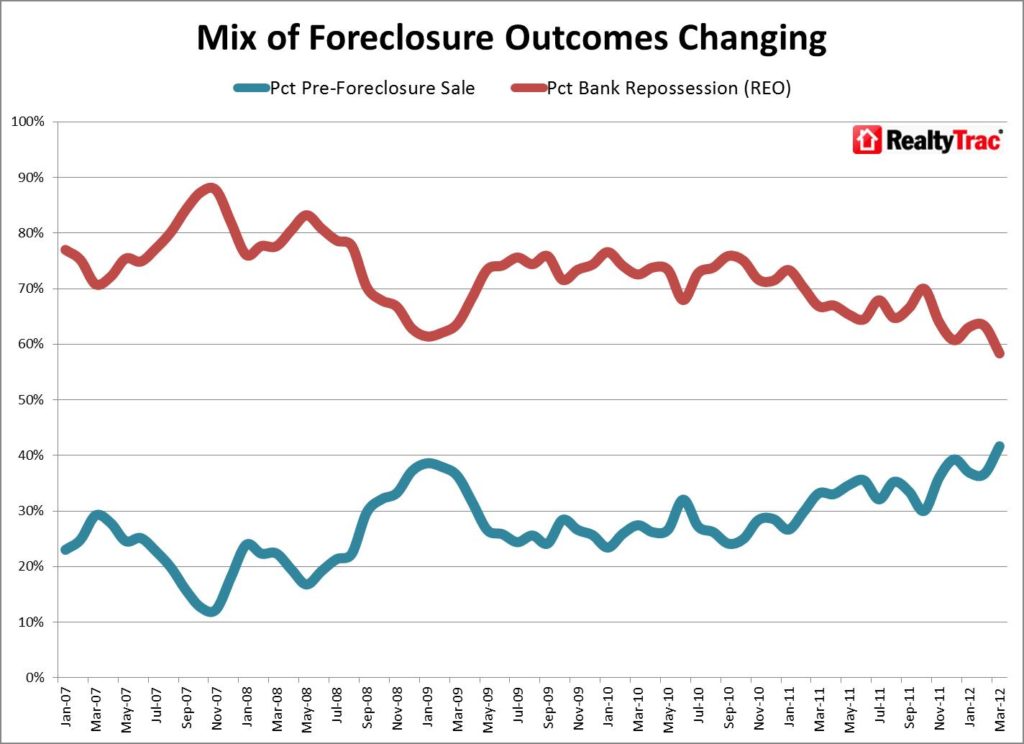

The lack of inventory had a direct impact on prices in the South Florida condo market. Within the next few months, South Florida sellers will start competing with all of the major banks that will be disposing properties. In order for the market to “heal”, this is a necessary and sometimes painful process. The initial flow of distressed properties is most likely from short-sales, which have become easier to complete since the recent robo-signer settlement with the major banks and servicers. In this settlement, short sales and loan modifications were encouraged and foreclosures are supposed to be thee final option if all other remedies fail. Also bear in mind that since Florida is a judicial state, the actual foreclosure process takes over 800 days on average to complete, so the bank-owned will be slower to hit the market and could impact the market for years to come. The attached chart from RealtyTrac shows how short sales now comprise a higher percentage of the distressed sales market.

The Allied Realty Group residential team serves as the exclusive REO broker for a variety of financial institutions in the management and sale of distressed single family and multi-family properties. Our team will inspect, value, repair, market and dispose of REO properties in a manner that mitigates bank losses.

Allied Realty Group’s REO assignment territory is Broward County, Florida and we complete broker price opinions (BPO’s) for banks on a daily basis. All of our residential brokerage clients appreciate our extensive market insight since we are actively visiting properties and preparing comprehensive valuations for asset managers.