Blog

Holding Pattern

It looks like the South Florida residential real estate market is stuck in a holding pattern for now. It will be interesting to see what breaks first. Will it be selling prices? How about inventory? It will probably take a combination of the two to unlock the market. Let’s take a look at some charts and numbers. Here is the data for June:

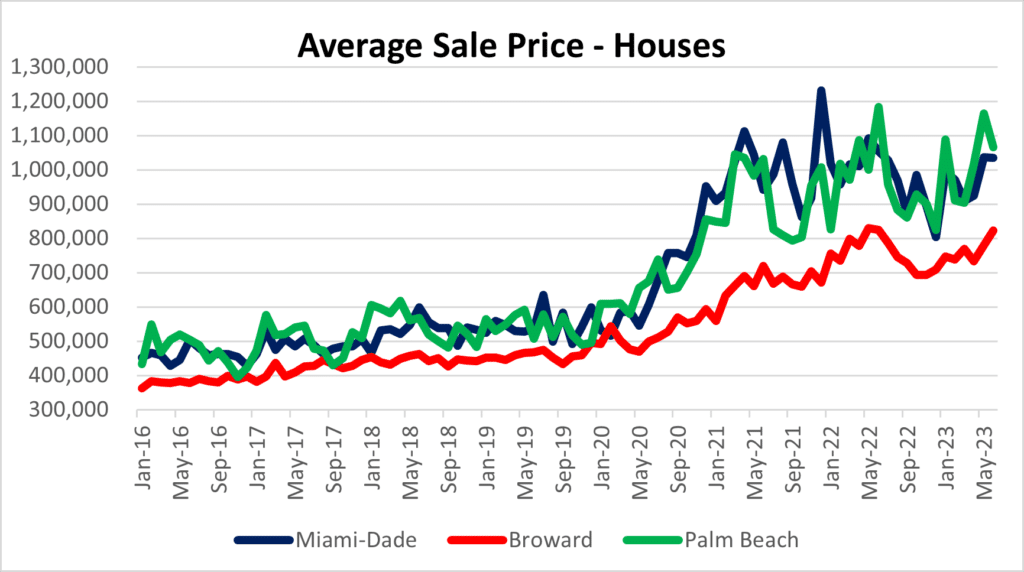

Average sale price of Single-Family Homes

- Miami-Dade – $1,034,110

- Broward – $823,005

- Palm Beach – $1,066,235

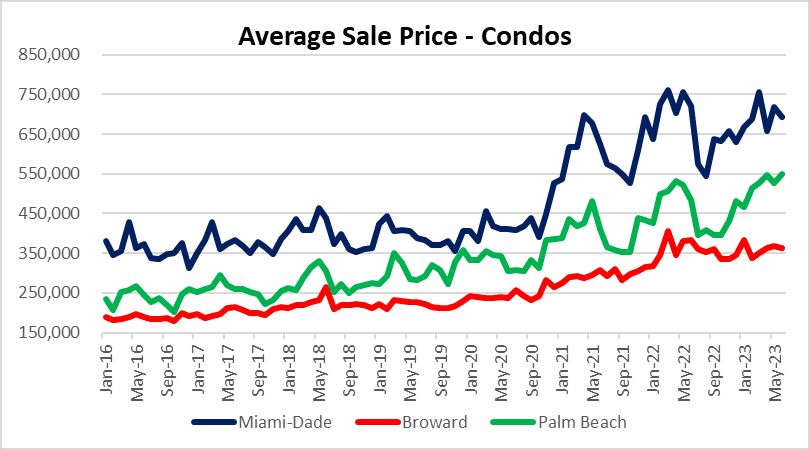

Average sale price of Condo Properties

- Miami-Dade – $692,430

- Broward – $361,747

- Palm Beach – $550,437

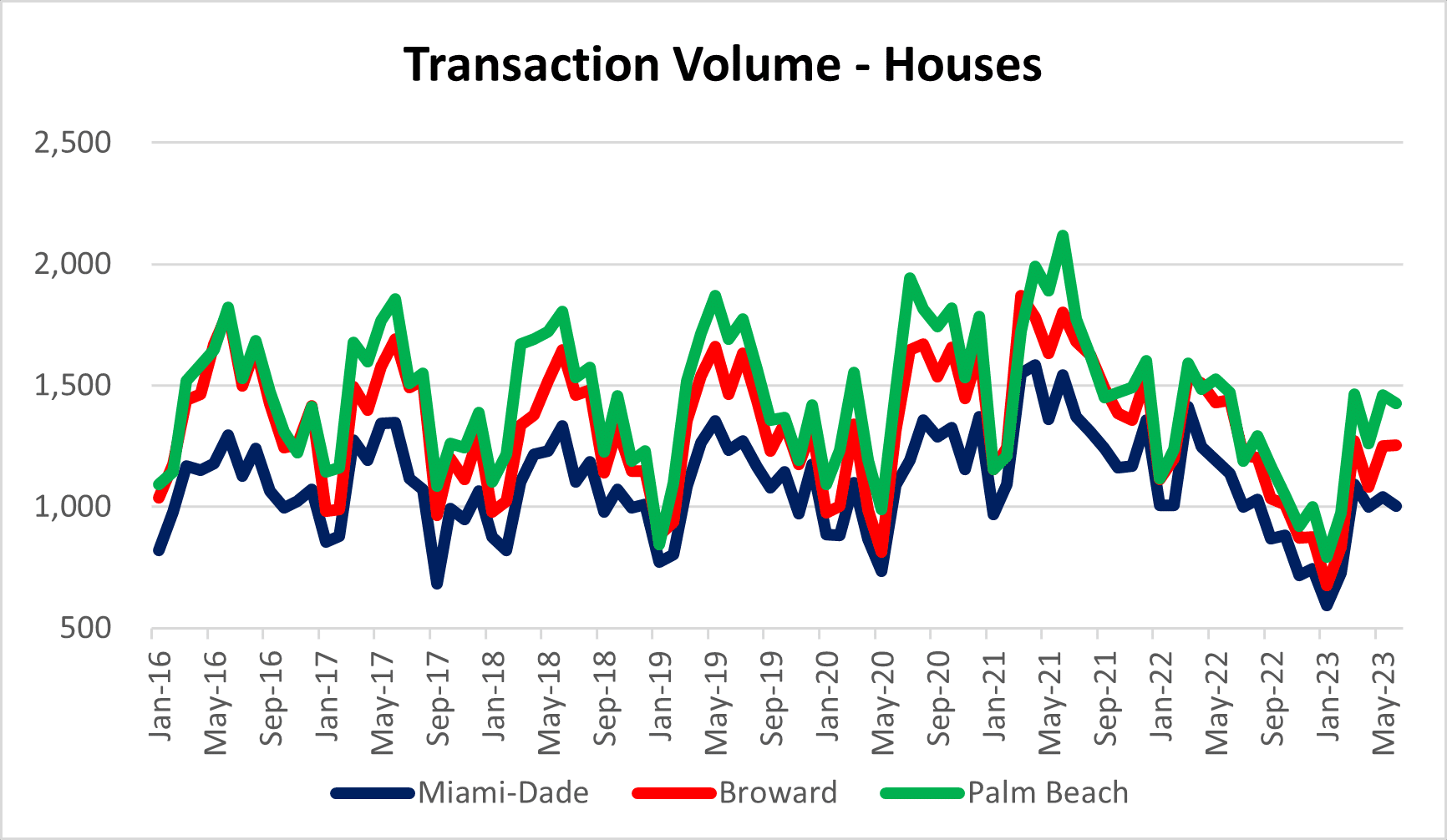

Transaction Volume for Single-Family Homes

- Miami-Dade – 1,004

- Broward – 1,256

- Palm Beach – 1,428

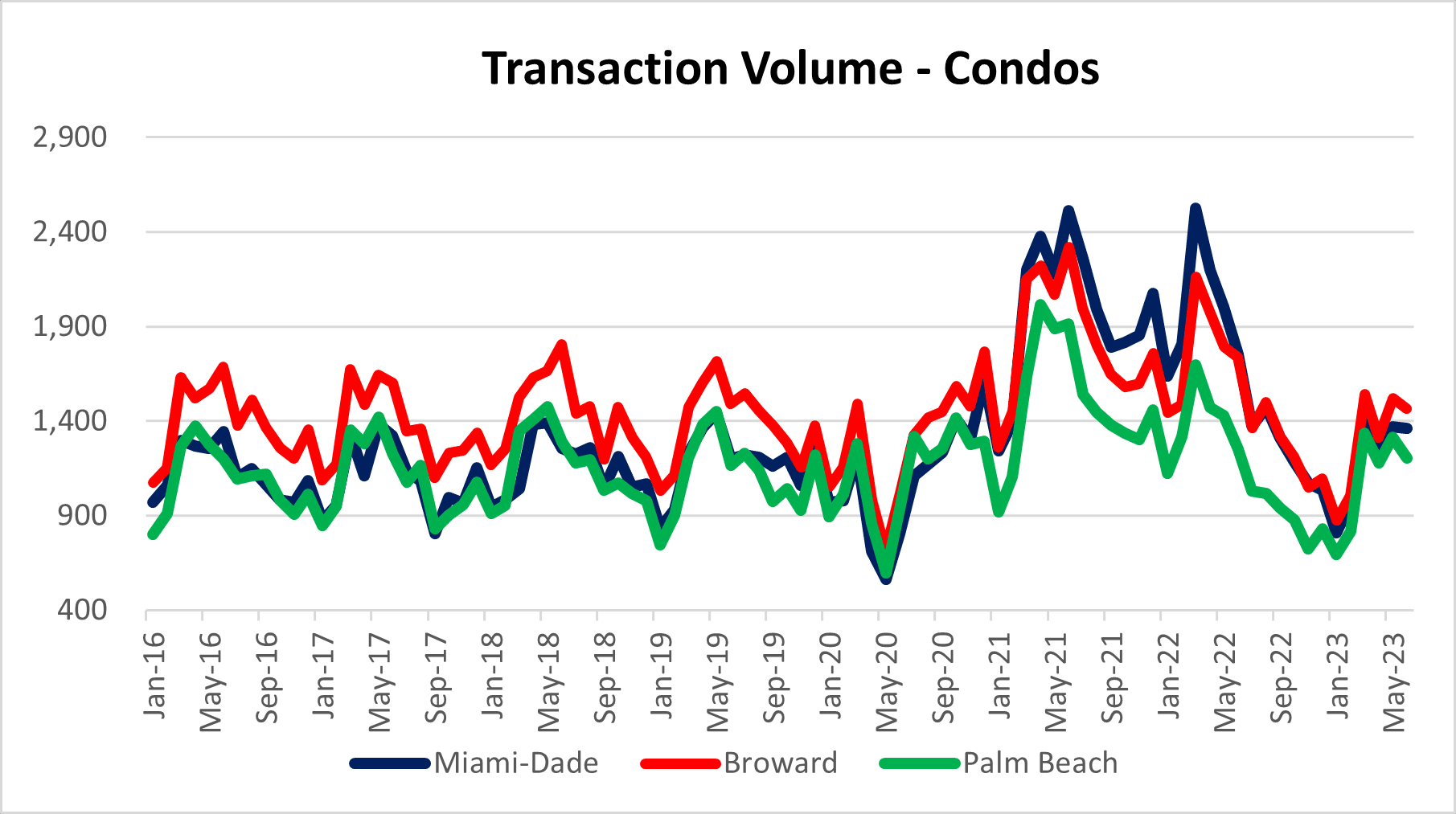

Transaction Volume for Condo Properties

- Miami-Dade – 1,360

- Broward – 1,466

- Palm Beach – 1,204

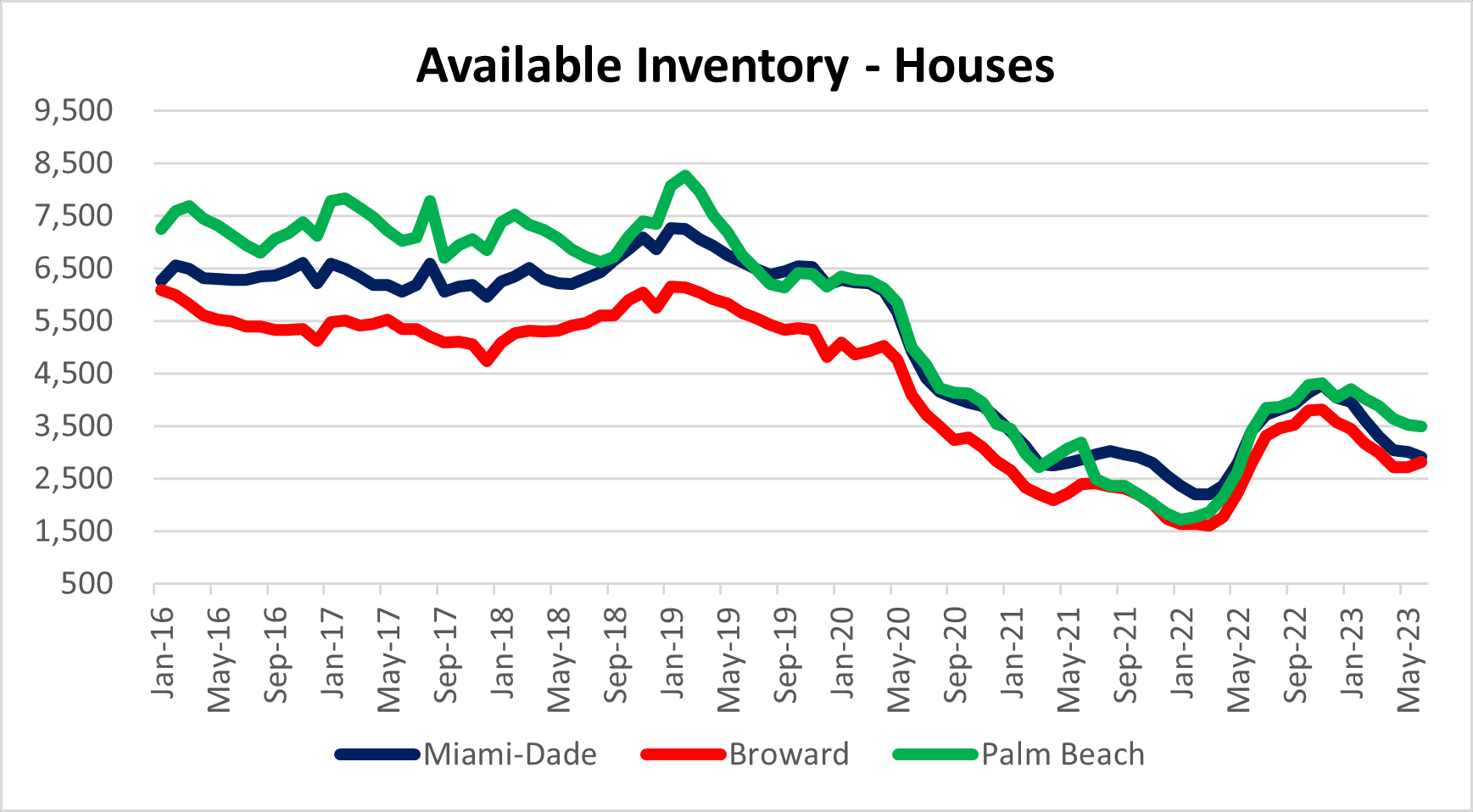

Inventory of Single-Family Homes – This is an area where we definitely see the holding pattern. What will it take for inventory to start hitting the market?

- Miami-Dade – 2,911

- Broward – 2,826

- Palm Beach – 3,497

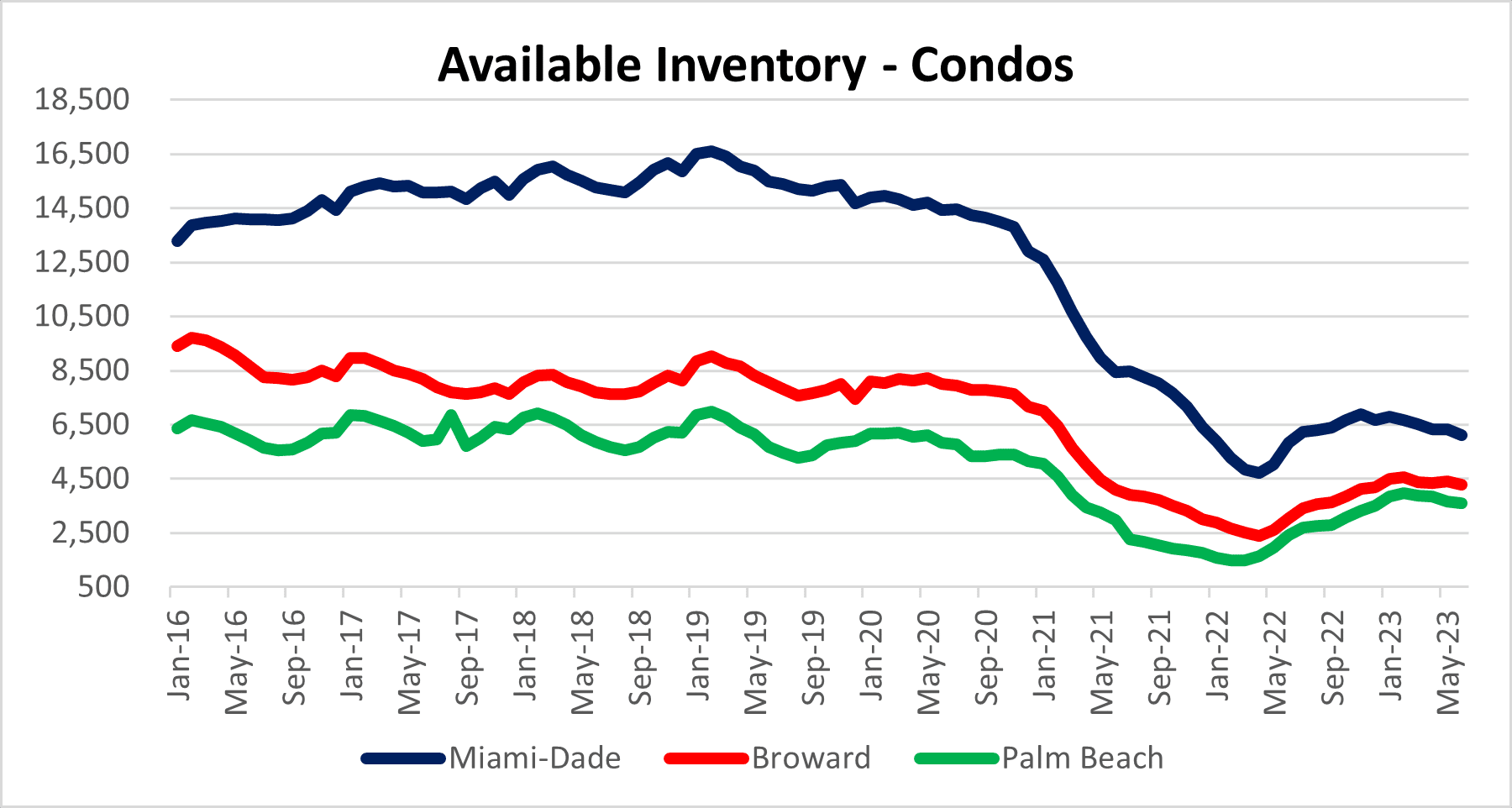

Inventory of Condo Properties

- Miami-Dade – 6,116

- Broward – 4,291

- Palm Beach – 3,592

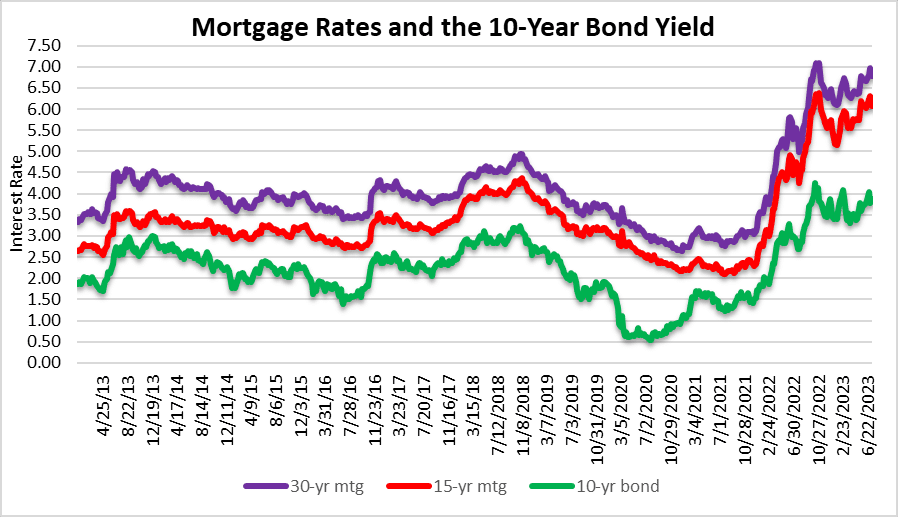

How about a look at mortgage rates? With rates holding steady around 7% this week, it sure isn’t helping to stimulate activity in the market. If you read our most market outlook, we talked about how rates will most likely remain in the 6-7% range for several months. The only way that rates will drop significantly is if the economy dips into a prolonged recession. There are consequences for leaving interest rates so low for so long. We will now see if the residential real estate can tolerate these rates for an extended period of time.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.