Blog

Monitoring the developments in the South Florida real estate market and spotting trends

There is an interesting trend in South Florida real estate that may have started over the summer. As we have discussed previously, it appears the the latest market rally off the lows may have peaked in June. It’s time to look at a few charts that illustrate our point better. First, here is a chart of single-family home transactions in the tri-county area. Since the month of June, the number of traditional sales has dropped 35% . Foreclosure sales have dropped 32% and short sales have dropped 34%. Although the housing perma-bulls have attempted to blame new lending regulations implemented in October, this trend started several months ago and it is quite clear in the chart below.

How about the median sale prices? They seem to be holding up for now, with a slight uptick in foreclosure sale prices and a drop in short-sale median prices. The climb in median sale prices of foreclosures may be attributed to the fact that the owners of higher-end properties in foreclosure had the resources to stall the process, but finally may be running out of time after gaming the system for years.

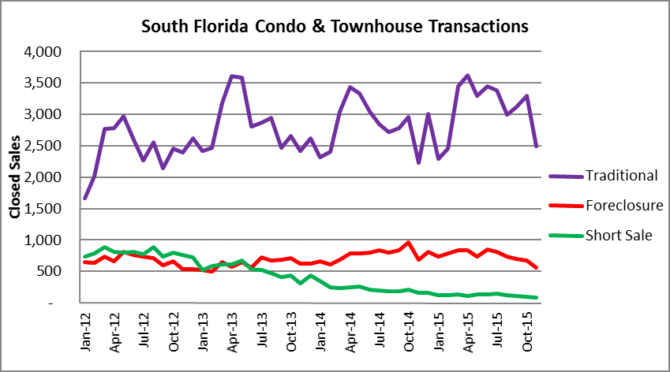

Now, let’s take a look at the condo market where traditional sales saw a decline of 28% since the month of June. Foreclosure sales in the condo/townhouse segment have dropped 35% and short-sale transactions have dropped 34% since June.

As for the median sale prices of condo and townhouse properties, the traditional and short-sale transactions have been declining, while the foreclosure prices have been rising slightly. With the mortgage debt forgiveness finally expiring this year, short sales have become less attractive for sellers because they may will now be taxed on the amount of debt forgiven by the bank.

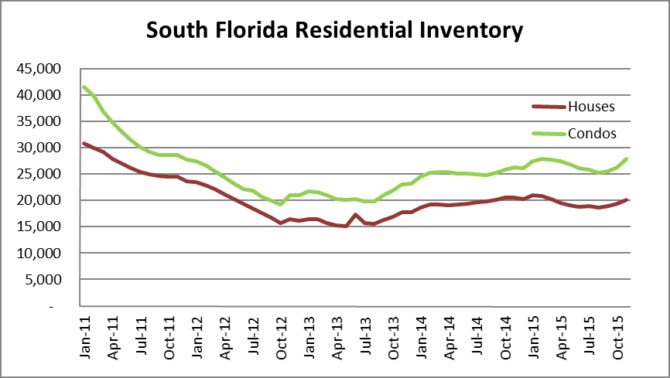

The available inventory of houses and condo properties for sale in Miami-Dade, Broward and Palm Beach County appears to be on the rise again. After foreclosures were halted for the robo-signing litigation back in 2010, inventory dropped for the next few years and reached a low of 35,123 units for sale in May of 2013. Since that point, South Florida residential inventory has made a slow grind back and is now up 37%, reaching 47,972 properties on the market in the month of November.

Please keep in mind that the slowdown in the South Florida residential real estate market started way before any hint of rising rates, or the recent implementation of “know before you owe”. As we have mentioned in many of our posts, the record low interest rate environment pulled consumption forward across all asset classes and at some point there needs to be price discovery. We will continue to monitor the markets and within the next day or two we will highlight the residential real estate data for the Broward County / Greater Fort Lauderdale market.

At Allied Realty Group, we understand that all asset classes experience market turbulence and fluctuations in value. Each segment of the real estate market will at some point be impacted by various economic conditions and cycles. We provide a full range of services designed to help our clients navigate today’s complex and dynamic real estate market and make well informed, intelligent decisions. Clients rely on our advisory services to make buy-sell decisions, understand debt /equity markets and their impact on financing products, shape long-term portfolio strategies, evaluate development or redevelopment options and optimize investment returns.