Blog

Sector spotlight: Single-family homes in the Greater Fort Lauderdale area

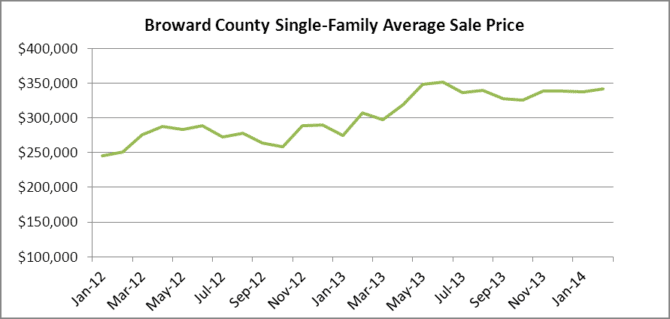

Over the past few months it sure looks like the average selling price of a house in the Greater Fort Lauderdale / Broward County area has met some resistance. After reaching $351,431 last June, the average selling price has dropped slightly and was $341,779 in February.

Another interesting chart is the available inventory for sale. After hitting a bottom with only 4,089 houses for sale back in April of 2013, the amount of houses listed for sale is finally on the rise again and reached 5,565 in February. The last time we saw that many houses on the market was March 2012.

So what types of deals are closing? You will see that the total number of transactions has been declining since peaking last spring. Out of 979 closings in February, here is the breakdown:

- 715 were traditional sales, or 73% of the total

- 110 were foreclosure sales, or 11% of the total

- 154 were short sales that accounted for the remaining 16% of all closings

Now we will take a look at the median sale prices for each type of transaction in the month of February:

- Traditional sales – $282,500, down from $300,000 in January

- Foreclosure sales – $158,500, up from $135,950 in January

- Short sales – $170,000, down from $185,000 in January

From the looks of the chart, here are just a few points worth mentioning:

- Median sale prices of traditional sales have been sliding because of tighter lending standards, slightly higher rates and increased supply of houses on the market as we noted in our second chart.

- Foreclosure sales are finally picking up steam after over 3-years worth of robo-signing delays and various stall tactics. There will now be a wider variety of foreclosures hitting the market and this may already be helping the median sale price drift higher.

- Short sales will most likely be in decline since the mortgage debt relief act expired at the end of 2013.

Finally, let’s see how the pace of new foreclosure filings is shaping-up in 2014:

There were 1,543 new filings in March, up from 1,378 in February. The pace of new filings has tapered slightly after hitting a near-term high in December. In order to decrease the massive shadow inventory of foreclosures, the pace of new filings will need to drop and the pace of distressed property sales increase significantly. The distressed properties in South Florida have been “hanging around” for quite some time, as the average loan in foreclosure in this area is over 1,200 days past due. Here is a quick summary of the monthly average of new filings for single-family homes in Broward County:

- In 2012, the monthly average was 953

- In 2013, the monthly average was 1,624

- So far in 2014, the monthly average is 1,599