Blog

South Florida residential transaction volume disappeared in the month of November

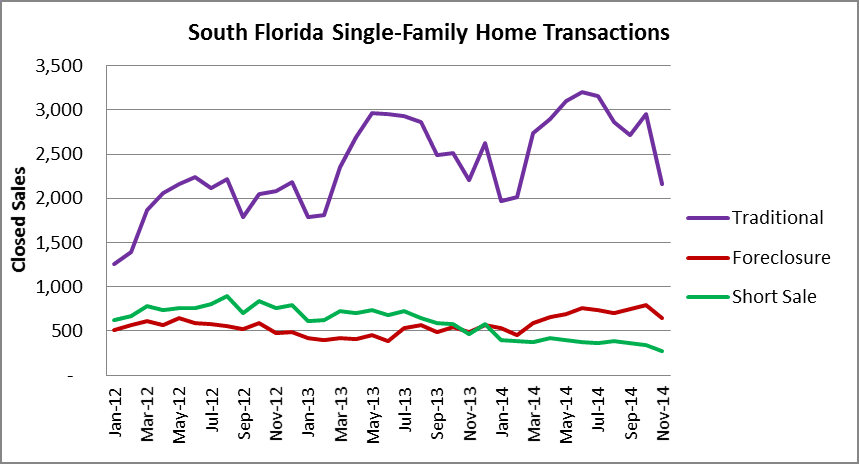

The volume of residential transactions disappeared during the month of November as the housing bubble 2.0 continues to deflate. Today we will show a few charts of single-family home sales and condo/townhouse transactions and the noticeable drop is difficult to hide. People often get misled by bogus headlines and puppets in the media, so we like to drop the raw data into charts to illustrate an accurate snapshot of the South Florida real estate market. First, let’s look at the single-family home transactions through the month of November.

Here is the breakdown of sales by transaction type:

- Traditional sales dropped 27% month over month

- Foreclosure sales dropped 19% month over month

- Short sales dropped 19% month over month

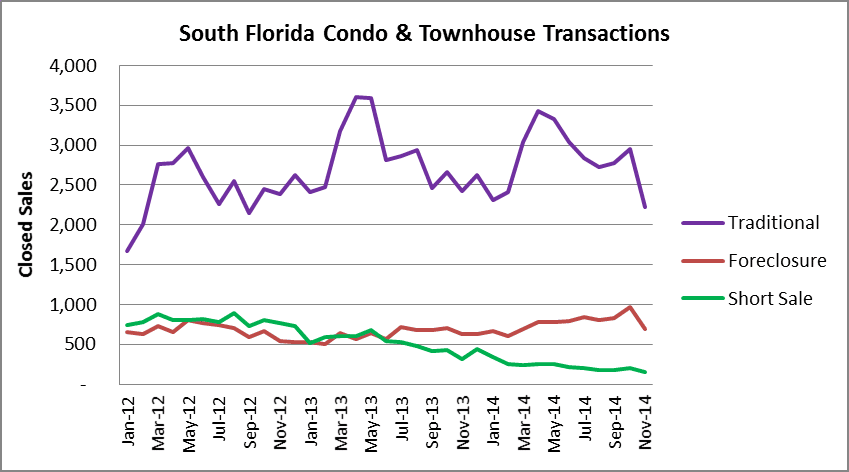

How about condo/townhouse transactions during the month of November?

Here is a breakdown:

- Traditional sales dropped 25% month over month

- Foreclosure sales dropped 29% month over month

- Short sales dropped 25% month over month

As for the inventory of residential properties listed for sale throughout the tri-county area, it continues to grow and has risen 33% from the recent lows set in May 2013. As of November, there were 46,675 properties listed on the market, which is still a far cry from the 72,241 properties listed in January 2011 (2 months after foreclosures were halted for the robo-signing litigation).

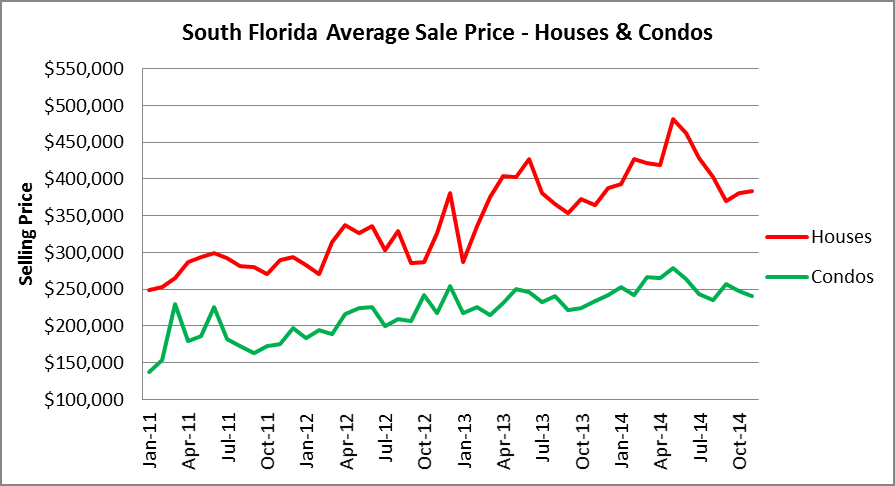

How about prices? We stand by our previous comments that the South Florida residential prices hit their peak back in May and the housing bubble 2.0 continues to deflate. Since that time, the average sale price of a single-family home in South Florida has dropped 20% to $384,101 and the average sale price of a condo/townhouse property has declined 13% to $241,197.

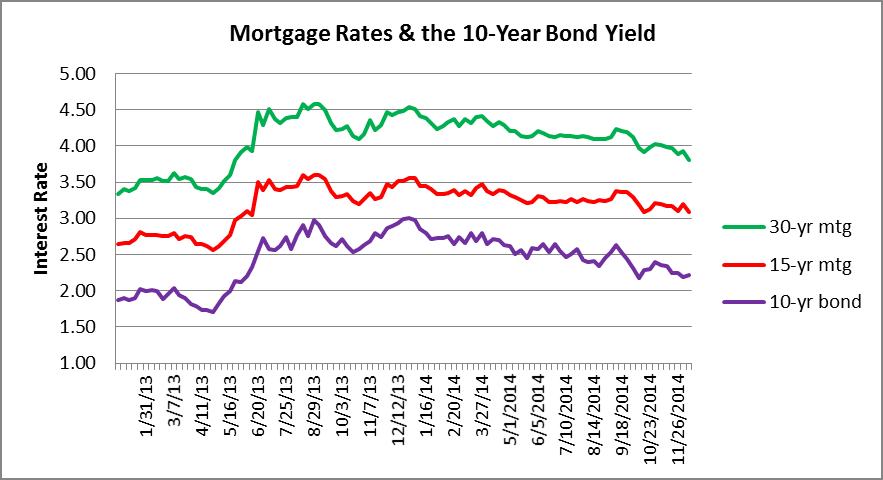

Finally, you cannot blame interest rates, as we are still resting on the lows:

So why are the residential real estate prices in South Florida dropping?

- Prices climbed too far, too fast

- After years of being tied-up in frivolous litigation, foreclosures are being processed through the courts

- Institutional investors that rushed into the market for REO to rental ventures are now heading for the exits

- Underwater borrowers are reaching break-even or positive equity positions and now able to sell

- The pace of new foreclosure filings remains elevated

- The rest of the world (Europe, Russia, South America) all have their own economic challenges and that may be limiting buyers

- The easy money supplied by the Fed created a bubble across all asset classes …. and all bubbles eventually pop!