Blog

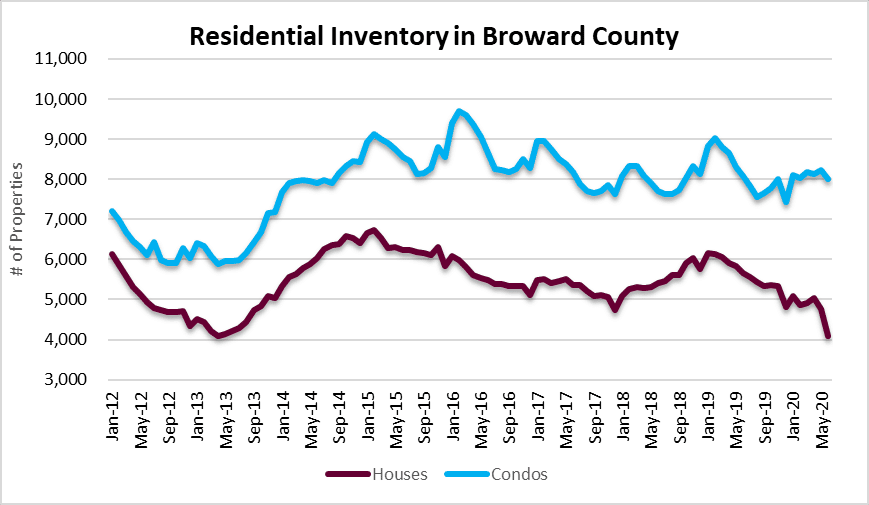

Supply & Demand

There was a nice bounce in real estate activity after lock-downs were lifted, clearly showing the challenges with supply across the South Florida single-family home market. Between May and June, there was a 14% decline in the number of single-family residences available in the Broward County / Greater Fort Lauderdale area. In May there were 4,762 houses on the market and the number dropped to 4,089 in June. The highest point of inventory for houses in the area was reached in February 2015, with 6,731 houses available for sale on the market. Condo inventory only declined 3% from 8,234 in May, to 8,002 in June. Obviously the pandemic has created demand for houses, as people work, school and vacation in their homes.

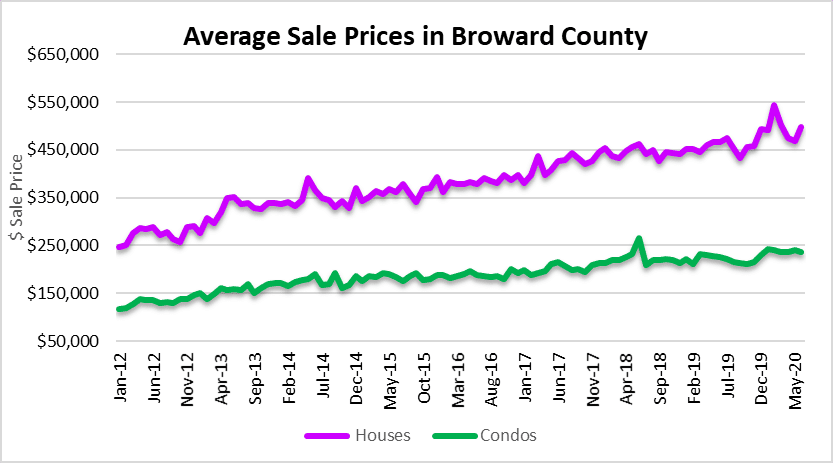

Supply issues impact prices

There was a rebound in the average sale price of houses in the Fort Lauderdale area, mainly created by lack of supply. Even after lockdowns were lifted, it doesn’t look like many people are interested in moving around. The average sale price of a house was up 6% month over month in the area. In May, the average sale price was $468,646 and it climbed to $498,158. keep in mind that it only takes a few mega-mansion sales to drag the average higher and that could be the case. Condo prices actually declined 2% from $240,808 in May to $236,573 in June.

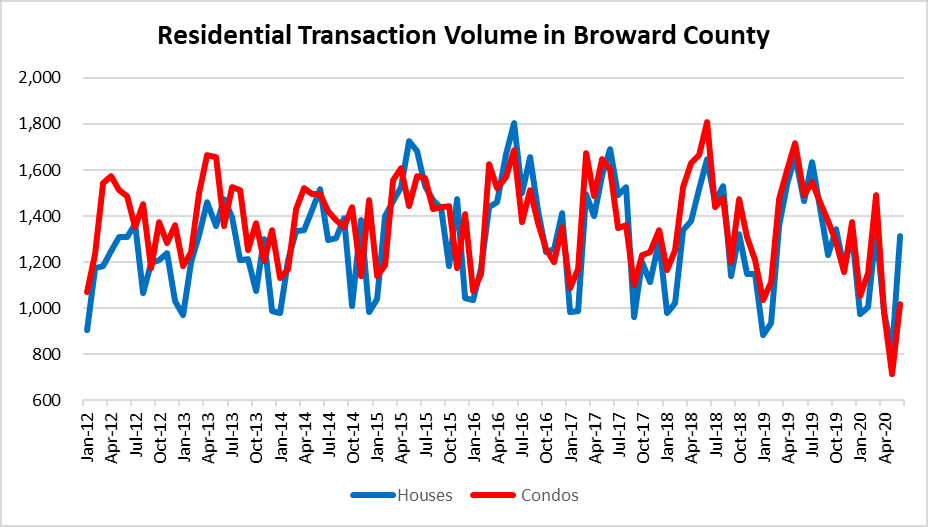

Transaction volume

This chart showing the volume of closed sales and the spike in single-family home deals compared to condos. There were 1,313 closed sales in the single-family home market in June. That number was up a whopping 61% since May. Condo volume had a 43% climb from May, which is still pretty impressive. There were 2,333 closed condo deals in June, up from 1,529 in May. Nobody knows how long this rebound in activity will last, but whenever low supply meets a higher level of demand, you will see an increase in prices. Obviously it just seemed focused on the single-family home market for the time being. One thing is for certain, it sure looks like this “recovery” will be uneven.

Foreclosures and distressed sales

This last chart today is worth watching as we move through the second half of 2020 and into 2021. Foreclosures and evictions are currently halted in Florida at least until August 1st, possibly for longer. After that point, there will most likely be an uptick in new foreclosure actions being filed and the number of distressed sales (short sales and REO transactions) could increase as we move into next year.