Blog

Taking a look at the Miami-Dade, Broward & Palm Beach distressed property market

In the month of September, it looks like the pace of new residential foreclosures filings dropped month over month in two out of three South Florida Counties. Obviously a chart is helpful in illustrating the data, so let’s take a look at the pace of new foreclosure filings in the tri-County area:

From the chart it is obvious that new foreclosure filings in Miami-Dade and Palm Beach appear to be headed in the right direction, but the Broward numbers seem to be bucking the trend. There were 48,633 new foreclosure filings in South Florida in 2012, for an average of 4,053 per month. So far in 2013, there have been 61,084 new foreclosure actions filed, which averages 6,787 per month. That represents a 67% increase in the monthly average of new filings when you compare 2012 and 2013.

In September, Miami-Dade County had a total of 1,888 new foreclosure filings when you combine the single-family home and condo/townhouse filings. Here is a chart that separates the two property types.

At least the pace of new foreclosure filings has retreated from elevated pace in the first half of this year. In September, there were 1,183 single-family home foreclosure filings and 705 condo/townhouse filings, down from 1,794 houses and 1,105 condo/townhouse filings in August.

Let’s cruise up I-95 to Palm Beach County where the pace of new foreclosure filings slowed to only 393 single-family homes and 87 condo/townhouse filings in September. After a big jump in June and July, the pace of new foreclosure filings appears to be slowing in Palm Beach as well. We always say that one month doesn’t make a trend, so we will see what happens when we get the October foreclosure data. For now, here is the Palm Beach chart.

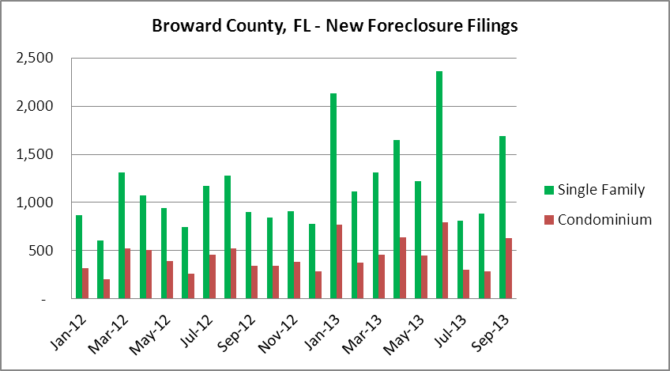

Now, let’s stop back down in Broward County, where new foreclosure filings almost doubled in September over the August figures. In September, there were 1,694 single-family home foreclosure filings, up from 886 in August. Also, there were 626 condo/townhouse foreclosure filings, up from 288 in August.

Finally, there is still a massive inventory of distressed property in South Florida that will eventually need to be sold. There are currently over 105,000 single-family homes and 50,000 condo/townhouse properties in some stage of foreclosure throughout Miami-Dade, Broward and Palm Beach County. The pace of new foreclosure filings will need to slow down and distressed sales will need to pick-up if we ever want to establish a foundation for a true recovery in the South Florida residential real estate market. Here is a chart of the shadow inventory and we will break it down by County in one of our upcoming posts.