Blog

The hangover

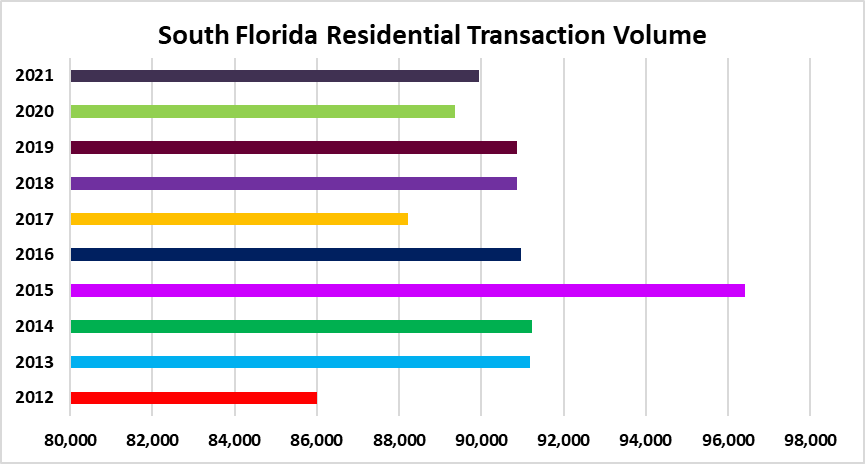

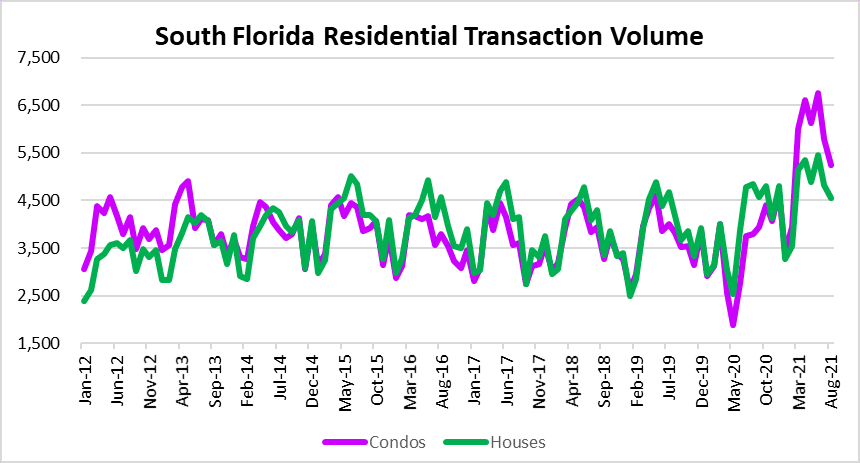

Just like after any great party, it looks like the hangover is getting ready to hit South Florida real estate. The housing market certainly has been having a party since the COVID-19 pandemic hit, but now things are settling down. Deal volume across the tri-county area continues to drop after reaching highs for the cycle around June. There were 4,817 single-family home sales in September, down 29% from 6,746 in June. Condo sales reached 5,462 in June and have dropped 23% since then to 4,180 in September.

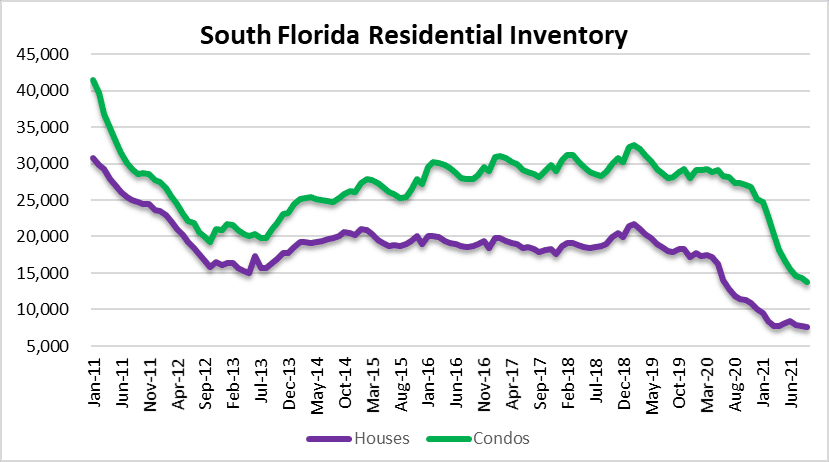

Aside from sale prices being ridiculous, inventory remains very low across South Florida. As of September there were only 7,650 houses and 13,793 condo properties available for sale.

The hangover hits real estate prices

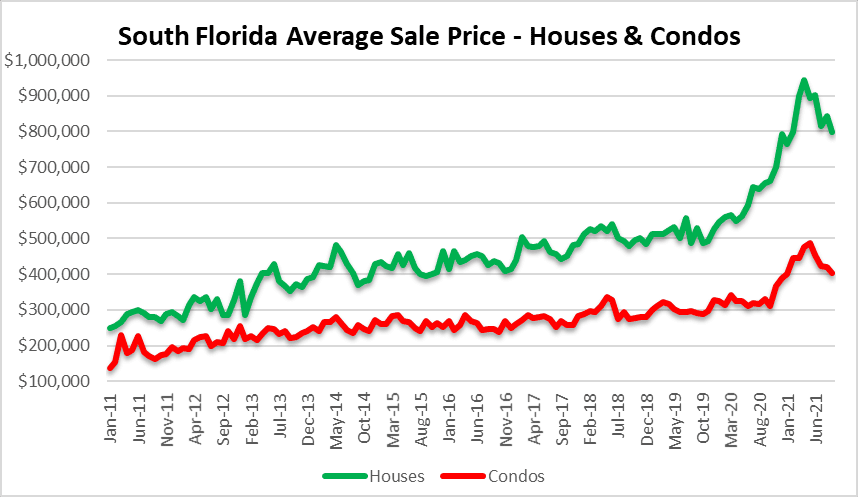

You can see from the chart of sale prices that prices have been dropping and there is going to be more of this, so buckle-up. The average sale price of a single-family home in South Florida has declined 15% from the high of $943,299 that was set in April, now sitting at $797,226. The average sale price of a condo peaked in May at $488,283, now down 18% from there at $402,403.

Here is a look at the annual transaction volume:

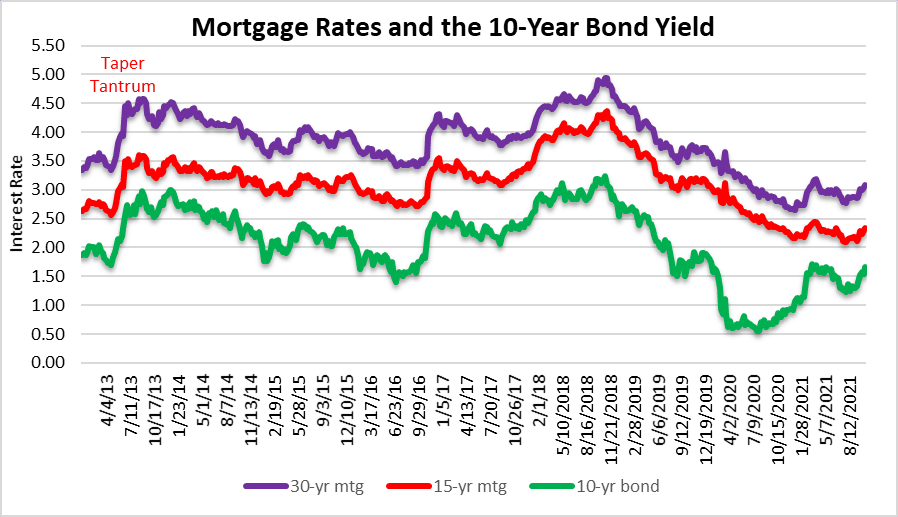

Mortgage rates are still low….for now at least

Mortgage rates have made a small move higher, but still remain very low. The line in the sand used to be 5% prior to the Great Financial Crisis, but now it’s probably around 4% on the 30-year mortgage where you will really see the hangover hit South Florida real estate purchases. The problem is that the real estate market has become addicted to low rates. Each incremental rise in mortgage rates will chop a little off prices. Speaking of which, it looks like even the savviest, well-funded house flippers are beginning to see signs that the red-hot housing market is cooling off.

This market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.