Blog

Updated single-family housing & condo inventory, sales & foreclosure starts for Miami, Ft. Lauderdale & Palm Beach

The month of August showed another drop in single-family and condominium properties in the tri-county area of South Florida.

In August of 2010 prior to the halt on foreclosures due to the robo-signer litigation, the total available property inventory in the multiple listing service (mls) was 51,905 properties. That number has dwindled to a mere 27,428 as of August 2012, basically cut in half. The next few charts will break out the data, first the single-family properties listed for sale in the Miami, Fort Lauderdale and Palm Beach:

In August 2010, the mls listed single family inventory was at 20,379 and has gradually dropped to only 13,003 units listed for sale. Next, take a look at the South Florida condo and townhome inventory:

This property segment has seen a 55% decrease in available properties for sale since August 2010. Keep in mind that is about a month before foreclosures were halted. Inventory in this segment hit a high of 31,526 units for sale in August 2010 and has now reached a new low of only 14,425 units. When you continue to remove inventory, the short term effect is a brief uptick in prices:

And for the single-family homes in Miami, Fort Lauderdale and West Palm Beach Florida:

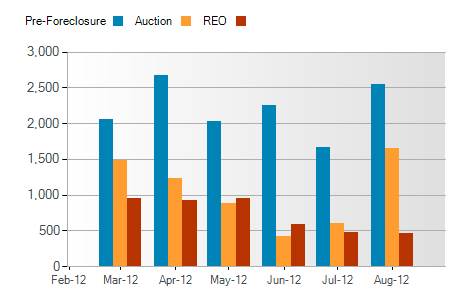

Sometimes the national media and even the headlines in the local newspaper may paint an incorrect picture of the real estate market, so the next few chats from Realtytrac will show the Miami Dade, Broward and Palm Beach County foreclosure starts and will help people see where the inventory will be coming from. In brief, the housing market may have stabilized in other parts of the country, but not South Florida. The blue bar shows the level of properties in pre-foreclosure and please note the spike in August of 2012 in all three South Florida counties.

Next, take a look at the blue line in the chart for Broward County, Florida (Fort Lauderdale area):

Finally, we have the same chart for Palm Beach County Florida:

These three charts from Realtytrac don’t exactly paint a pretty picture of the future for South Florida. What they do illustrate is that the foreclosure train is just getting fired-up again. The robo-signer litigation was settled in the first quarter of 2012 and signed in March. The largest lenders and loan servicers are now working diligently to negotiate short sales and then foreclose on properties when a short sale cannot be completed. Keep in mind that the state of Florida is a judicial state and a foreclosure takes 1,000 days on average to complete. I know this sounds insane, but it is true. Therefore, the “recovery” that people though they saw in South Florida was artificially created by halting foreclosures for over two years. If you remove supply of any product for a few years, you will create artificial demand and a short-term spike in prices. One or two months don’t make a trend, but we will continue to monitor the data releases and see how it impacts the single-family and condominium markets in South Florida.

Based on the recent data, my assessment of the South Florida housing market is as follows:

- Banks will continue to negotiate short sales in accordance with the $25 billion robo-signer settlement and will attempt to modify loans whenever possible

- Most attempts at loan modifications will fail because the borrower does not meet the lending criteria, regardless of how long the Fed artificially suppresses interest rates

- When a short sale cannot be completed on a property, banks will have to foreclose

- Short sales and foreclosures will continue to increase as a larger percentage of overall sales in the Miami, Fort Lauderdale and Palm Beach housing markets and remain elevated for at least a few more years. Single-family and condo inventories will gradually increase in the tri-county area.

- Distressed properties will continue to put downward pressure on prices in South Florida

- The percentage of “underwater” borrowers will once again increase as new distressed property supply hits the market. The properties with negative equity will enter the cycle of attempted modification, short sale or REO and most likely be added to the distressed property inventory.

- A true “recovery” in the South Florida real estate market is still a few years away

Allied Realty Group is located in Fort Lauderdale, Florida . Our residential brokerage team serves as the exclusive broker for a variety of financial institutions in the management and sale of distressed single family and multi-family properties. Our team will inspect, repair, market and dispose of REO properties in a manner that mitigates bank losses.

Allied Realty Group’s REO assignment territory is Broward County, Florida and we complete broker price opinions (BPO’s) for banks on a daily basis in the cities of Fort Lauderdale, Pompano Beach, Deerfield Beach, Oakland Park, Wilton Manors and the surrounding areas. All of our residential brokerage clients appreciate our extensive market insight since we are actively visiting properties and preparing comprehensive valuations for asset managers.