Blog

Thumb on the scale

It appears that someone still has their thumb on the scale as we begin 2018. With housing, stocks and bonds still at elevated levels, maybe we should give credit where credit is do: Central banks! By keeping rates at record lows and buying every asset class regardless of price, the invisible “thumb” is what keeps all of this stuff in the air. If you look at the U.S. Federal Reserve (The Fed), European Central Bank (ECB), and Bank of Japan (BOJ), they hold approximately $14 Trillion in various securities. Clink on the link below from FRED, the Federal Reserve Economic Data website labeled “Chart of Fed Assets” to take a look at the nearly $4.5 trillion balance sheet of our own Federal Reserve and you will see who is helping keep prices in the air. (The FRED website is an amazing resource for all types or economic data) You will notice a spike in the 4th quarter of 2008 when the Fed launched QE1 with an initial purchase of mortgage backed securities in response to the financial crisis. They continued the party with QE2 and QE3 lasting through the middle of 2014. Look at the chart below and you will see a noticeable decline in prices around May of 2014. Now does it all make sense?

Finally, after nine years of the “recovery” they are gradually reducing their holdings (treasuries, mortgage backed securities) to mature and run off the balance sheet to the tune of $10 billion per month, with plans to increase the amount over time. As of December 27th, the Fed was holding nearly $1.8 Trillion dollars in mortgage backed securities, which is a pretty big “thumb”! If you remove the Central Banks and their impact on asset prices, would you still consider this a recovery? Where do you think residential real estate prices would be?

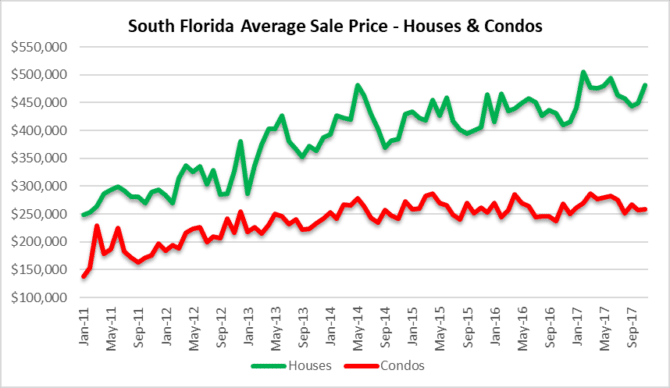

Thumb on the scale impacting prices

Average sale prices of single family homes continue to show strength through the month of November. Condo prices look like they will continue to move sideways until there is a decline in inventory. Average sale prices for November 2017 for the tri-county area were as follows:

Average sale prices of single family homes continue to show strength through the month of November. Condo prices look like they will continue to move sideways until there is a decline in inventory. Average sale prices for November 2017 for the tri-county area were as follows:

- Single-family homes – $481,274 which is a 18% jump from $409,216 in November 2016

- Condo properties – $258,206 which is a 4% decline from $268,753 in November 2016

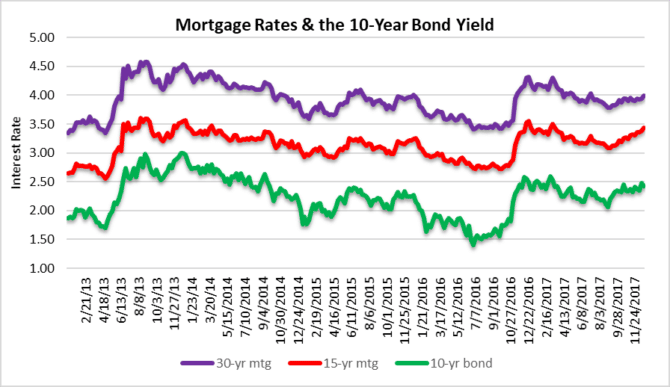

The thumb keeps rates down

This is pretty simple: As long as Central Banks aren’t dumping their bond holdings, rates will stay low. Also, the bond market doesn’t seem to buy into the MAGA growth projections. If there was a strong growth outlook, the ten year bond would be well over 3.00% by now. It just cannot seem to get any traction. Low rates will continue to support real estate prices.

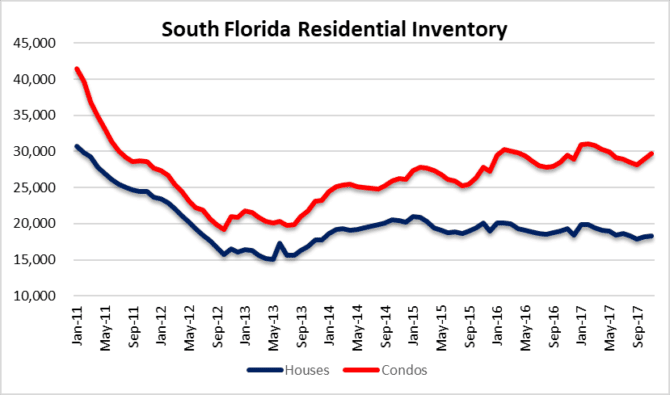

South Florida Residential Inventory

As of the end of November, there were 48,061 houses and condos available for sale in the tri-county area, up slightly from 47,146 in October. Some of that increase may be attributed to properties returning to the market after the storm. The chart clearly illustrates the divergence between the single-family home and the condo property inventory. As me move through 2108 the South Florida condo inventory should continue to climb.

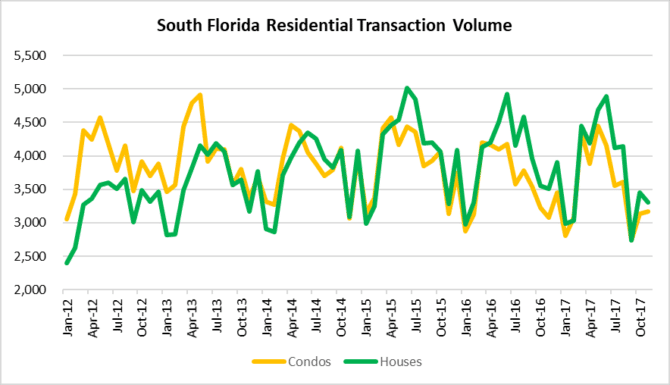

Residential transaction volume was lower by 2% year over year in November, which really isn’t much. As for the average number of monthly closings, here is a summary of the past 5 years with 2015 having the highest volume:

- 2012 – 7,167

- 2013 – 7,598

- 2014 – 7,603

- 2015 – 8,034

- 2016 – 7,581

- 2017 – 7,356 (through November)

Were foreclosures halted again?

Of course they were! Take a look at this chart. Just as new foreclosure filings were gaining momentum and reaching a multi-year high in August, they were put on hold by FEMA in September after Hurricane Irma. The average number of monthly foreclosure filings in Miami-Dade, Broward and Palm Beach was 1,400 from January to August of 2017. After the hold,they declined sharply to only 362. Expect them to resume filings in the first quarter of 2018.

There are still plenty of safeguards in place since the financial crisis. Whether they are periodic foreclosure halts, keeping rates at crisis lows or Central Bank intervention and asset purchases, they are all akin to a thumb on the scale. Until the training wheels are removed and markets are permitted to function on their own, we will not have true price discovery. Until then, party on!