Blog

Another move higher in housing prices across South Florida

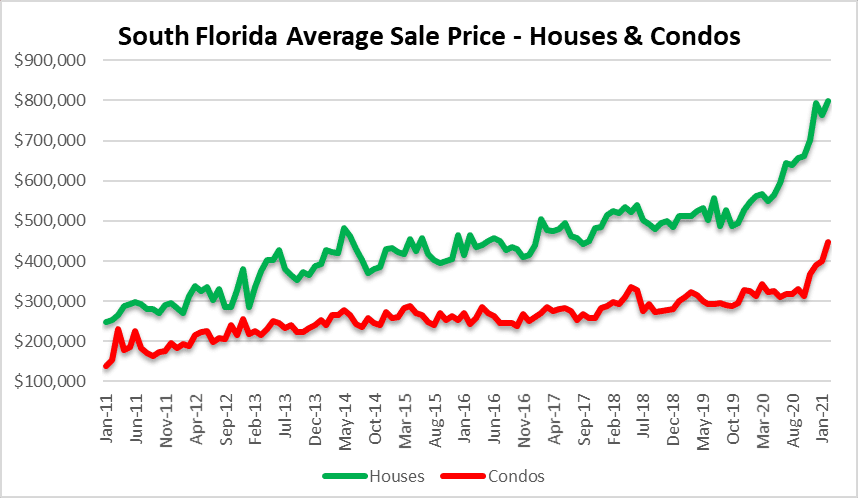

Average sale prices in South Florida

During the month of February, the average selling price of houses in condos resumed their ascent in the South Florida area. The average sale price of a single-family home reached a new high of $798,062. The average sale price of condo prices also climbed, reaching a new high of $446,450. After a booming second-half of 2020, we thought that real estate prices would begin to settle down . That doesn’t seem to be the case right now, as prices continue to climb. At some point we will run out of inventory, but in the interim that lack of inventory will continue to drive prices higher. There are quite simply too many people chasing too few properties. That’s the simple law of supply and demand, resulting in higher prices.

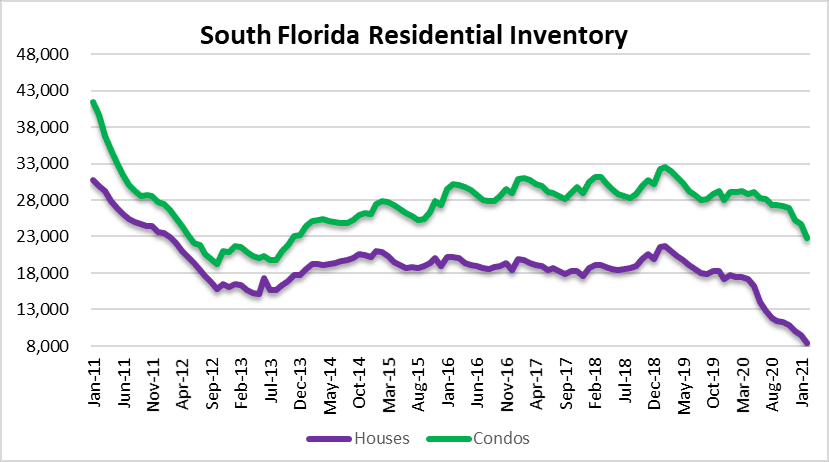

Residential Inventory In Miami, Fort Lauderdale and Palm Beach

The number of single-family homes on the market across Miami Dade, Broward, and Palm Beach counties had a new low during the month of February. There were only 8453 houses on the market in February, down from 9503 in January. Looking at the condo market, there were 22,801 condos on the market during the month of February, down from 24,674 in January. When we combine the number of houses and condos there were 31,000 254 properties on the market in February in South Florida.

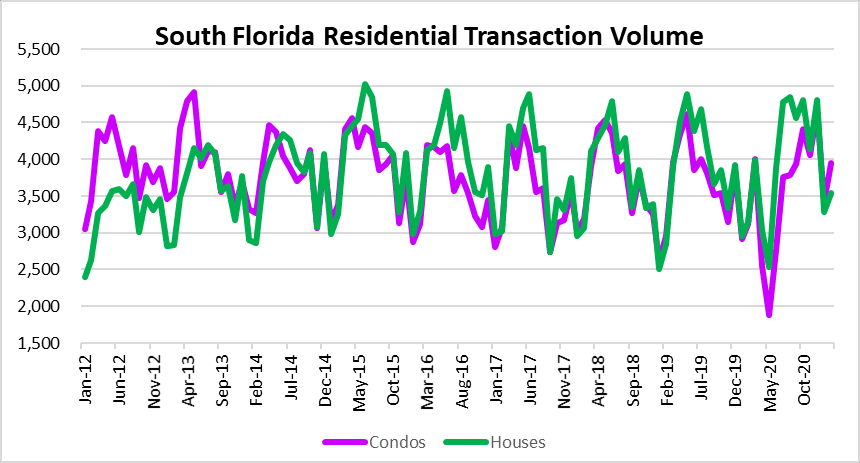

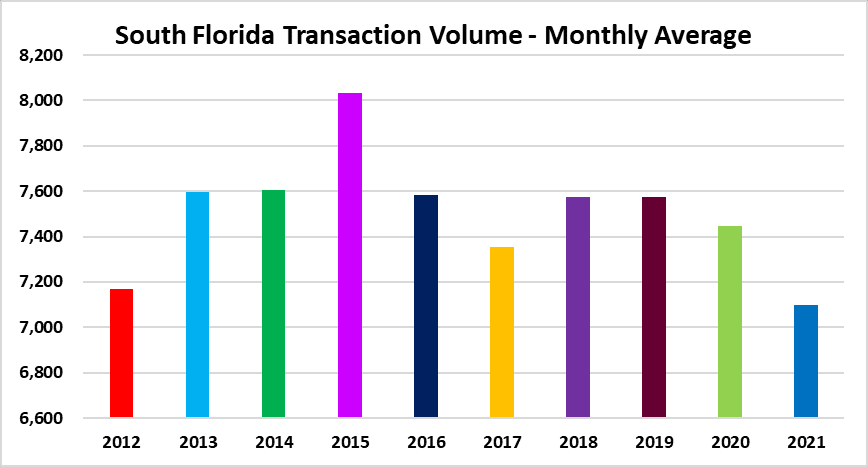

Transaction Volume across the tri-county area

There were a total of 7,497 residential transactions during the month of February across Miami Dade, Broward, and Palm Beach counties. In the single- family market, there were 3,950 Closings and there were 3,547 condo sales during the month of February. Once again, the main factor limiting sales as we move through 2021, will be the lack of inventory.

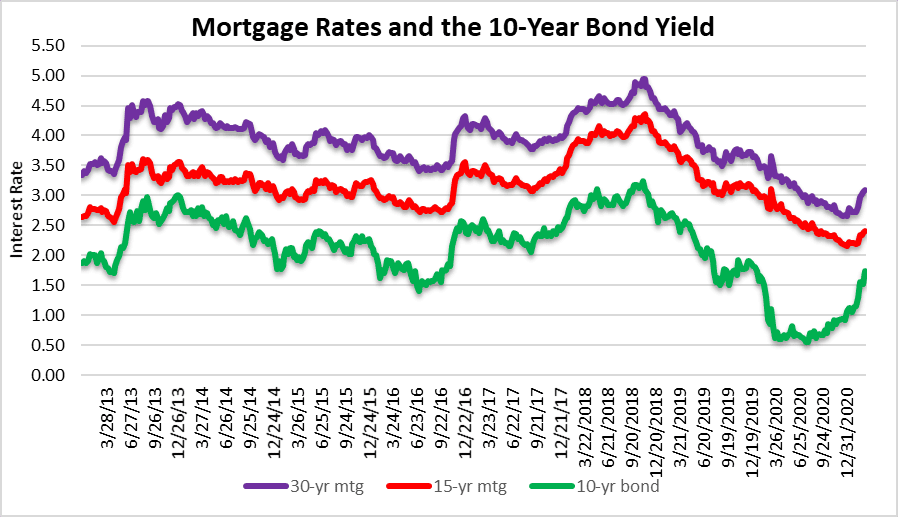

Mortgage rates

Mortgage rates are finally starting to climb higher on hopes of an improving economy. The move thus far may not hinder real estate transaction volume, but a significant move higher could further restrict affordability of real estate. South Florida is currently experiencing the highest prices seen since the last housing bubble burst over one decade ago. Rates have been so low for so long and haven’t even been close to 5% since 2018! That used to be the pain point where real estate activity would slow. Maybe the new pain point is closer to 4% since everyone is hooked on low rates. Another issue that will continue to limit affordability will be rising insurance costs.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.