Blog

Will rising mortgage rates bend or break the housing market?

Last year was an unexpectedly amazing year for real estate prices in South Florida. The COVID-19 pandemic kept people in their homes and brought plenty of people escaping lockdowns in other states to the area. No bell goes off at the the top or bottom in a market, but remember that real estate is cyclical. The average sale price of a single-family home in South Florida dipped slightly in January to $764,570, down from $793,828 in December. If you look at the early days in the price chart, the average sale price was $248,627 in January 2011 during the last housing crash. That’s just amazing to see how prices have moved over the last decade. Most of the price appreciation can be attributed to mortgage rates never getting past the crisis lows. Could that party be ending after all this time? We will see soon. As far as condo prices, the average sale price was $400,733 in January, up from $389,160 in December.

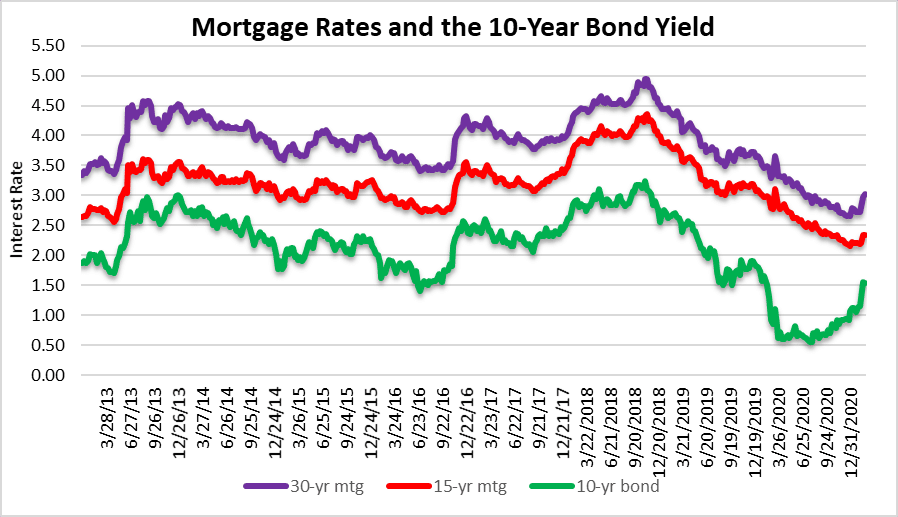

Mortgage Rates

This recent spike upward in the 10-year bond could spell T-R-O-U-B-L-E for mortgage rates and eventually real estate prices. We haven’t seen rates at this level since last February before the pandemic. Low rates fuel speculation and tends to encourage real estate buyers to take on more debt than they should. If this trend in rates continues, you can expect some type of correction in housing prices. If you rushed into the real estate market in 2020 you may be regretting your impulsive behavior. It’s taken a decade for the speculators from the last peak to breakeven and it could take another decade to recapture the losses if this monster bubble pops.

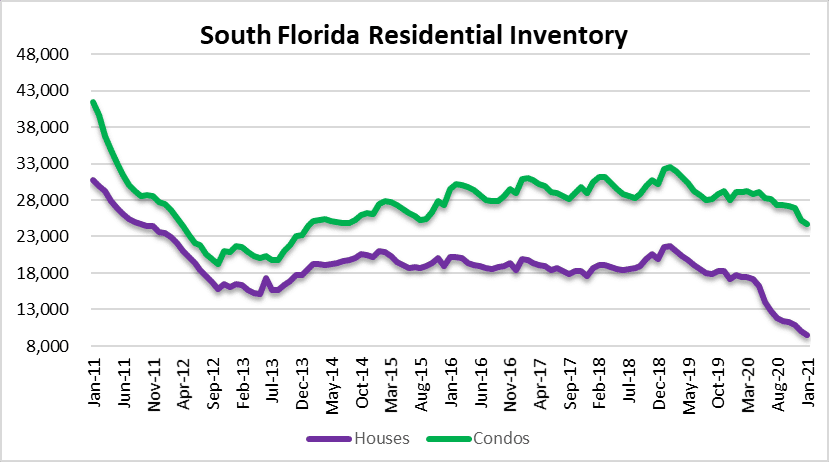

Housing inventory issues

The number of single-family homes listed for sale continued to reach new lows last month. There were only 9,503 houses available for sale in the tri-county area in January. Condo inventory is better, with 24,674 properties on the market last month. As the lockdowns are lifted and mobility returns, we should start to see inventory climb in 2021. Also, people may be getting insurance sticker shock fairly soon. People may flock to Florida some tax savings, but we will see if they stay when they realize the annual carry costs. If you bought a property on impulse without understanding the property taxes, windstorm and flood costs in South Florida, it will be a big shock!

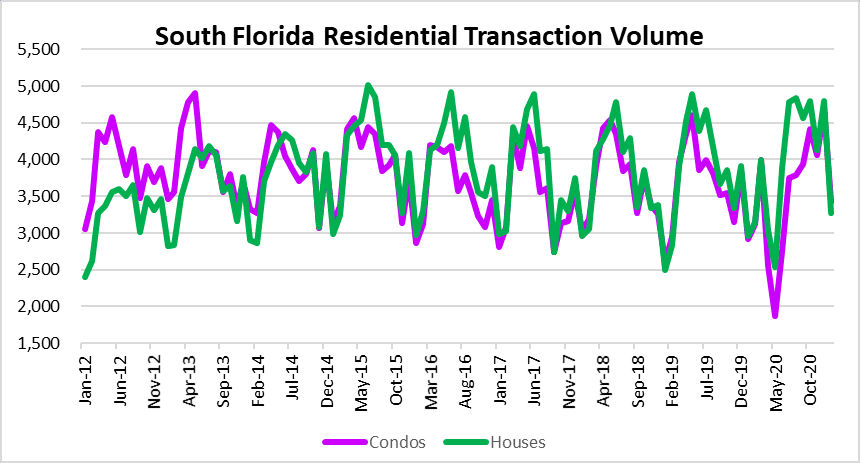

Real Estate transaction volume across South Florida

This chart shows the deal volume of houses and condos in Miami, Fort Lauderdale and Palm Beach area. There were only 3,424 houses sold in January, down from 4,681 in December. There were 3,276 condo sales in January, down from 4,801 in December. Until inventory levels rise, there may be a cap on how many residential real estate deals close in the first half of 2021.

Here is a breakdown of the single-family home sales in South Florida during the month of January:

- Traditional sales – 3,215

- Foreclosure sales – 33

- Short sales – 28

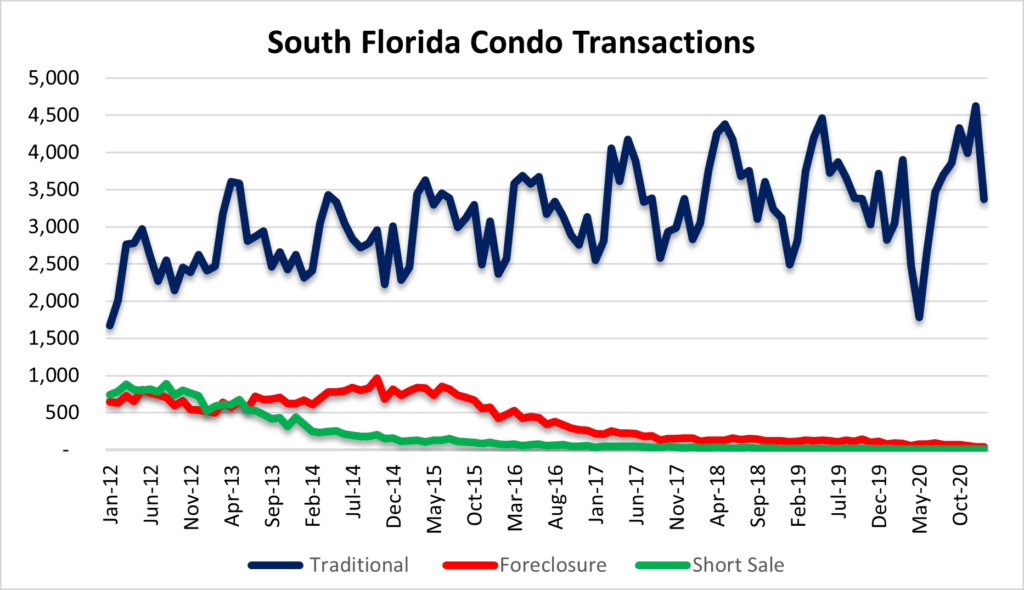

And a look at the condo sales by transaction type in January:

- Traditional sales – 3,372

- Foreclosure sales – 39

- Short sales – 13

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.