Blog

Buying a condo in South Florida?

Are you looking at real estate and thinking about buying a condo in South Florida? Well, there are some things that you need to be aware of because the market has changed since the collapse of the condo building in Surfside. There are now mandatory condo inspections and will have to check with each county individually is there a different requirements depending on the proximity of the condo building to the coastline.

Buildings that are within 3 miles of the ocean will have to be inspected at least every 25 years and every 10 years thereafter. Buildings located further inland may not have as stringent of requirements. These mandatory inspections will be accompanied by detailed reports with recommended repairs along with a timeframe for these repairs to be completed.

Who is going to bear the cost of these condo building improvements? This is why you need to pay attention: Of course it’s going to fall on the individual owners of the condo units in the building. In addition to the required repairs, new state laws require that HOA reserves be fully funded for required repairs. This means that even if the repairs are not required to be completed immediately, you will have to budget for these costly repairs to be fully-funded for prior to the date of needing the repairs. For example, if the inspector says that you will need a new roof on the building in ten years, the HOA needs to start collecting fees for that now so you have the money in reserves when the time comes. Now do that exercise for all of the different areas of the building that need repairs and/or replacement. It’s just important to know that condo fees will not be going down anytime soon.

There are so many older buildings with underfunded reserves that the state needed to get involved to mandate funding of these reserves for safety reason. This is important to keep in mind when you’re looking at a condo building is that you’re basically going to be partners with all these other people and there’s going to be disagreement on how and when to fund improvements. Escalating maintenance costs are inevitable so make sure that you obtain a copy of the most recent condo meeting minutes, as well as a declaration of any upcoming assessments and/or proposed increases in HOA fees.

One big reason for rising condo fees is that insurance costs are out of control. If you can even get insurance on an older building, it’s going to be an expense that trickles down right into your HOA fees. Cancellations of insurance for older buildings will become more prevalent. Condo fees that might’ve been $800 to $1,000 per month could very easily double year over a year. Guess what else? Each year when the insurance renewal date approaches you have a risk of losing your insurance again so it’s not going to be just this year or next. Just plan on it being something you will be dealing with on an annual basis.

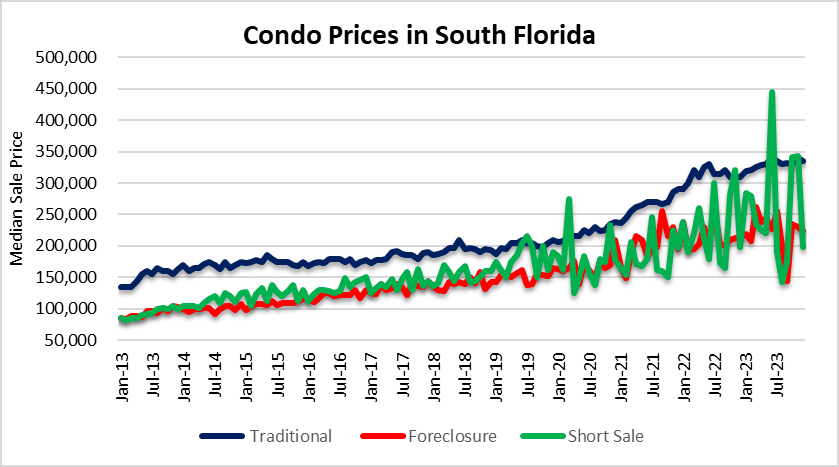

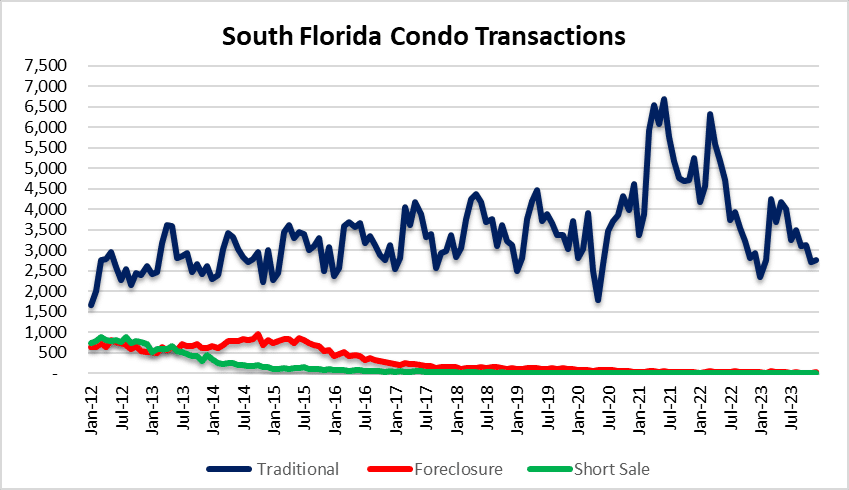

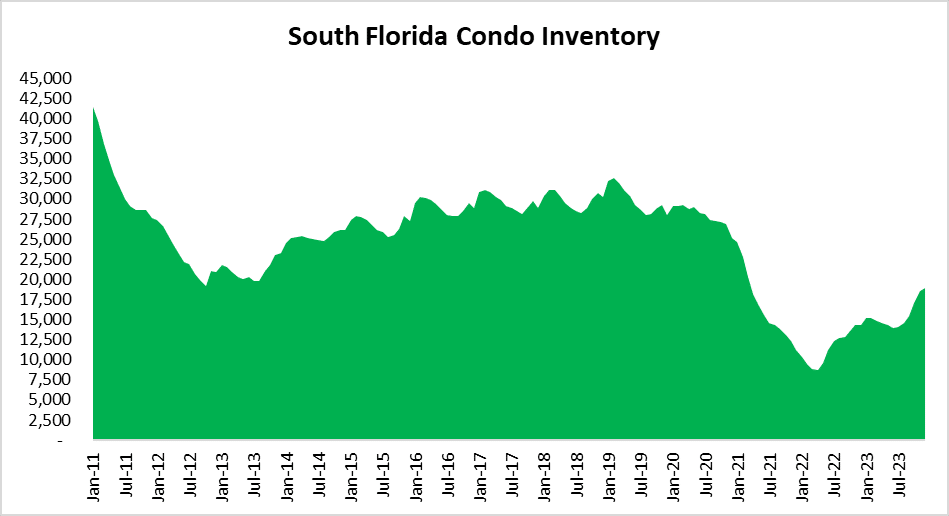

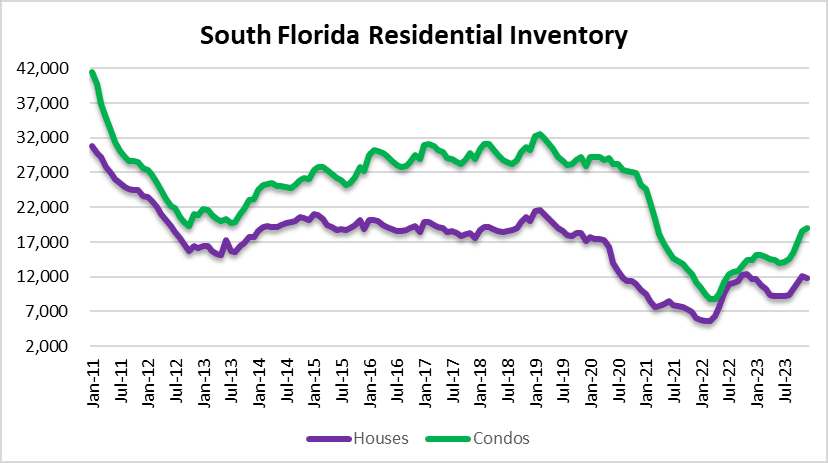

We have some charts that show the average sale, price, transaction volume inventory, and the pace of sales throughout the Miami, Fort Lauderdale and Palm Beach market. The mania that began during during COVID is now in the rearview mirror and reality will now set in.

Take a quick look at the inventory chart you’ll notice that the number of condos on the market is starting to climb. If you take into account all of the related costs of ownership, it is no longer “cheap” to own anything down here. keep your head on a swivel and make sure you do your homework before you buy a condo unit in South Florida, By mid 2024, the market dynamics could easily change as inventory continues to climb.

You just don’t want to be the one bearing all the cost of years of neglect because people didn’t want to pay for repairs and are now being forced to do so.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.