Blog

All is quiet on the foreclosure front

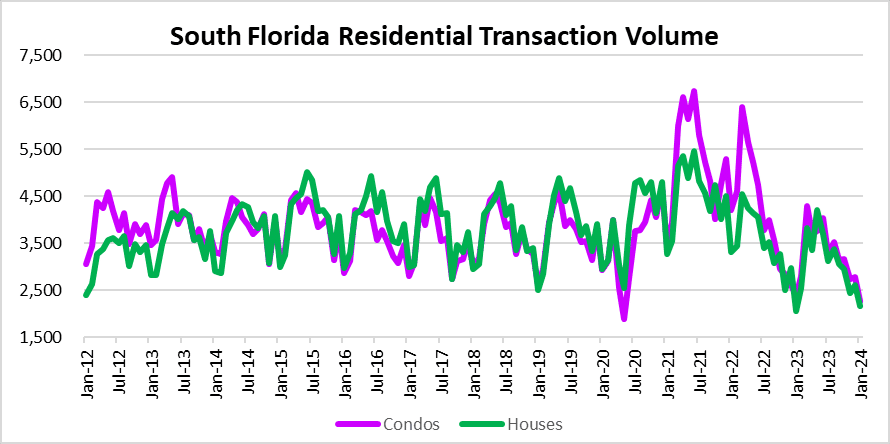

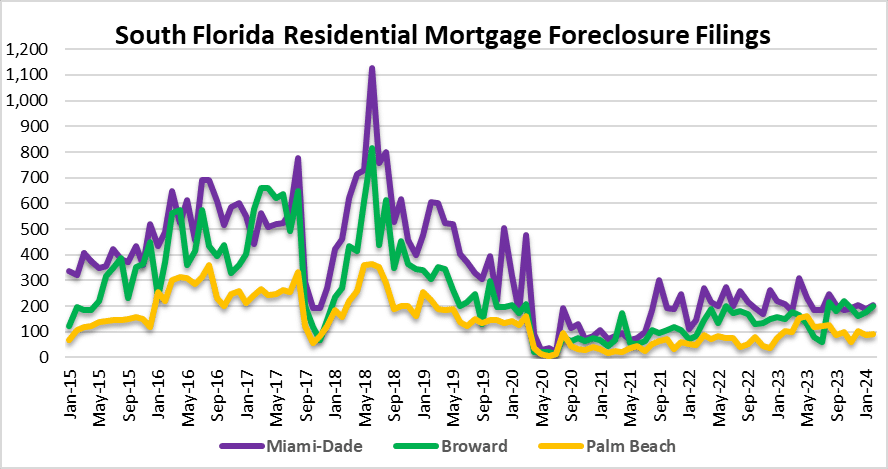

All is quiet on the foreclosure front across South Florida as we cruise through our monthly charts. It’s been awhile since new filings have been elevated, but this chart may be worth watching as we move through 2024. South Florida has been ground zero for speculative bubbles and there are reasons to believe that we may be prepping for a market change. During the last housing market crash, we wrote a brief post on submitting a successful REO offer which may be worth reading. Although we aren’t going to see a huge wave of foreclosures just yet, the market will be changing. First of all, deal volume is cratering. If things don’t pickup over the spring selling season, you will start to see the over-leveraged crowd panicking. This chart tracks the monthly residential closings for houses and condo properties back to 2012 when we were emerging from the last housing market crash. You will notice that deal volume is almost as low as during the COVID lockdowns.

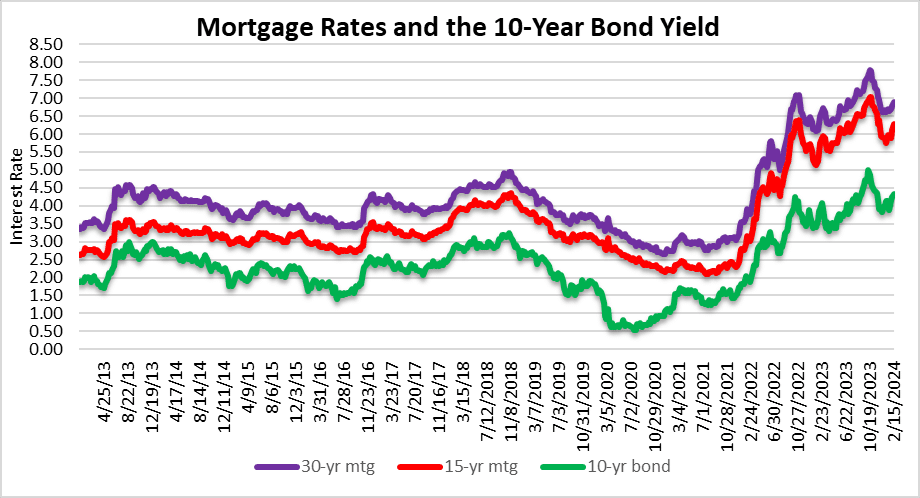

Next, mortgage rates may not be declining anytime soon. Everyone was hoping that rates would drop, but that hasn’t transpired yet.

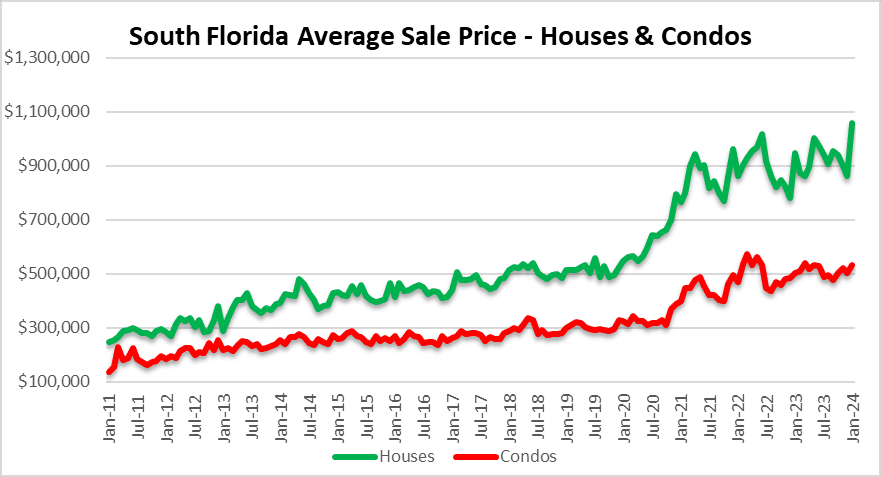

How about prices? Yes, for now they are stubbornly high as a kite! The luxury segment will continue to keep prices elevated for awhile, but eventually everything will normalize.

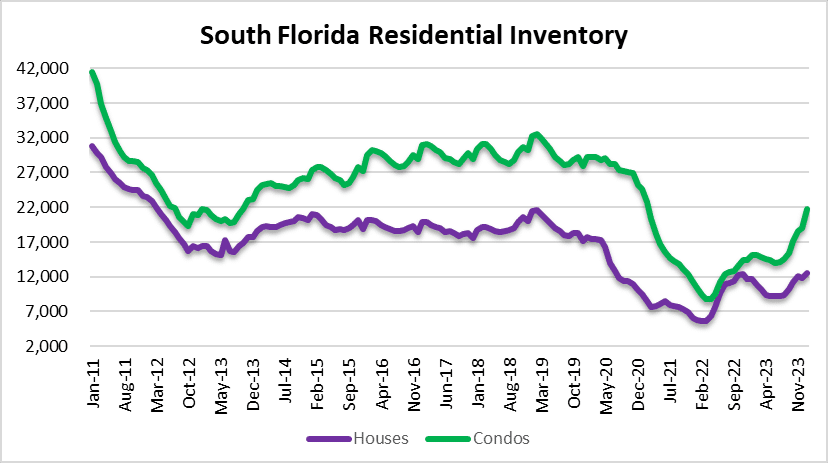

What’s the best way to get prices back to normal? Just add inventory. You will notice from the next chart that condo inventory is climbing at a steady pace and will continue as special assessments, repairs and insurance costs scare buyers away. During the month of January, there were 21,700 condos listed on the market across Miami, Fort Lauderdale and Palm Beach. That level hasn’t been breached since early 2021. Expect that number to continue moving higher. It’s one thing to read articles about insurance costs, but once it hits your monthly bills, it’s really a wakeup call. For property owners that have a monthly maximum budget, at some point they will have to decide which bills to pay or not pay each month.

This real estate market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. All is quiet on the foreclosure market in theses areas for now. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.