Blog

Deal types and prices across South Florida

Let’s take a look at the different deal types (REO, Short Sales & Traditonal sales) across the South Florida residential market. Today’s charts show the number of transactions and median sales price by deal type. Here is a snapshot of the median sale prices in July for single-family homes:

- REO – $314,417, up from $300,523 in June

- Short sale – $289,000, down from $295,000 in June

- Traditional sale – $405,000, up from $387,000 in June

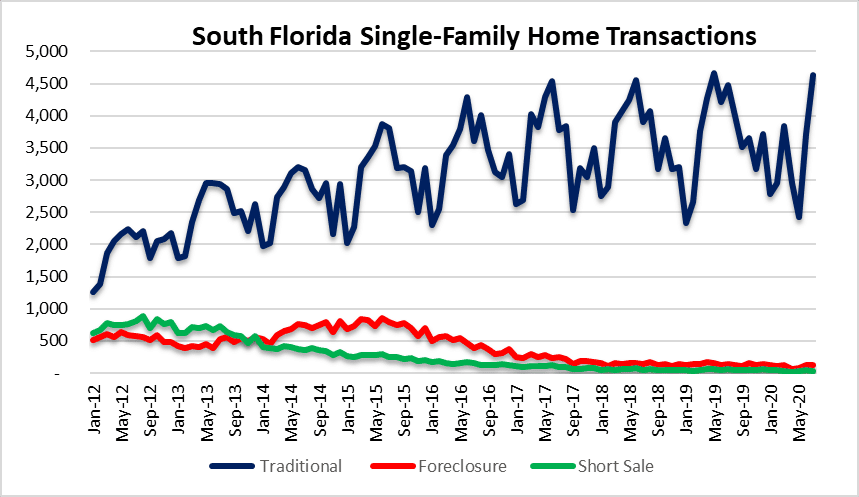

Deal types in the single-family home market

There were 4,781 houses sold in the tri-county area during the month of July. That represents a 23% increase over the 3,880 houses sold in June. Here is how they breakdown by type of sale:

- REO – 120, down from 126 in June.

- Short sale – 31, down from 41 in June

- Traditional sale – 4,630, up from 3,713 in June

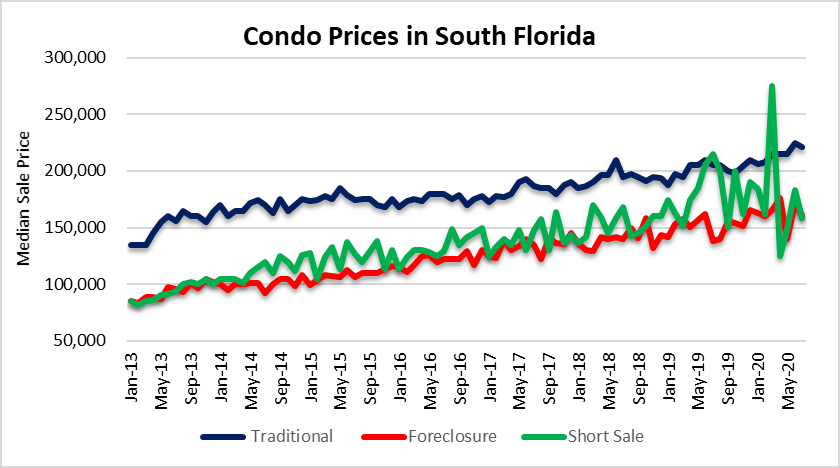

Condo prices

Here is a look at the median sale prices and you will notice the median traditional sale in the condo market has down in price last month:

- REO – $161,500, down from $171,500 in June

- Short sale – $158,000, down from $183,500 in June

- Traditional sale – $221,250, down from $225,000 in June

Deal types in the condo market

There were 3,571 condo properties sold in July. That is up a whopping 29% from 2,761 units sold in June. he is a look at the breakdown:

- REO – 96, up from 81 in June.

- Short sale – 10, down from 11 in June

- Traditional sale – 3,468, up from 2,669 in June

You will notice that the single-family home segment showed a strong rebound in July. If supply remains constrained, there is a good chance that prices will continue to firm until that trend reverses. Condo properties don’t appear to be as popular these days and that segment could see some further weakening, especially if there is a build in available inventory. Six months ago it was difficult to see how the pandemic would impact the market and we still don’t know if these changes will be part of a longer term trend for the real estate market.

Foreclosure activity in South Florida

There is currently a moratorium on foreclosure filings until September 1, but it appears that some lenders are getting a head start in filings their foreclosure actions. It is clear when the halt in filings began during the month of April due to COVID-19. Even with record amounts of borrowers currently in forbearance programs, this chart will certainly show a spike in activity during the fourth quarter of the year and into 2021.