Blog

Housing price inflation across South Florida

Just when people though that housing affordability couldn’t get much worse in South Florida, it does. The month of April showed another move higher in average selling prices of houses and condos. After the last housing market crash, we had a new institutional buyer in the market to compete with. The fact is that they never really went away and continue to help crush affordability for families trying to buy a home. Add this to the list of other issues that continue to put pressure on consumers in the area.

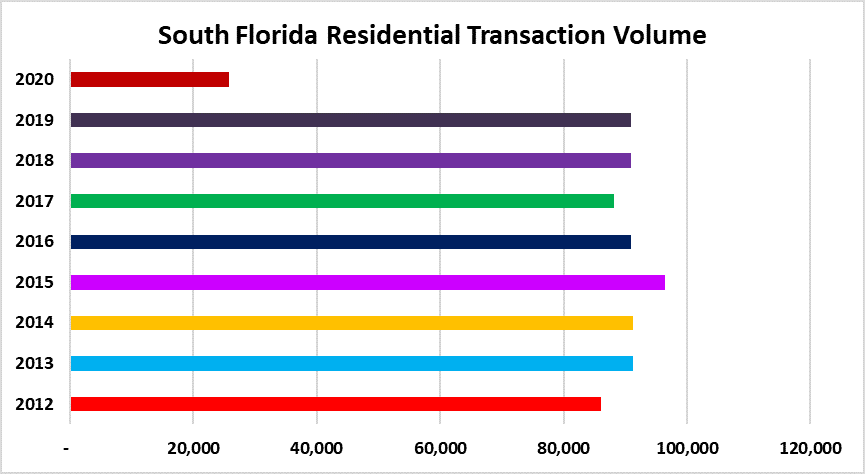

Housing inventory

How quickly everyone forgets about the last housing bubble, when house price inflation peaked in 2005-2006. Look at this first chart and how all of the lenders and institutional buyers made out like bandits after the last crash. The government intervened in the foreclosure process and distressed inventory declined until it finally bottomed in 2012-2013. You will notice that the inventory of houses never really spiked higher after that, as large institutional buyers were able to buy single-family homes in bulk, directly from lenders. Don’t think that this is the first time you’ve had to compete with them when buying a house, they have kept a bid in this market for over a decade. Wealth inequality continues to worsen and it looks like people are finally starting to notice.

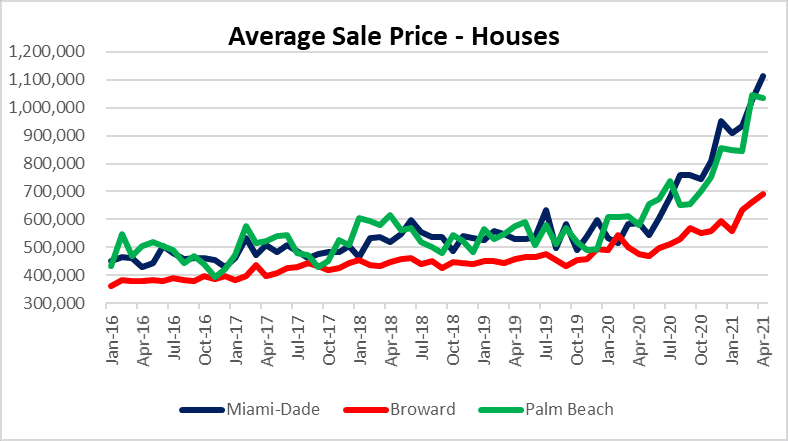

House price inflation

Take a look at this chart of single-family home prices in South Florida. This is a chart of average sale prices, so obviously the ultra-luxury market is helping to drag the average higher in Miami and and Palm Beach in particular. The last time that real estate dominated the news cycle like this, it sure didn’t end well. Here is a breakdown for the month of April in single-family homes:

- Miami-Dade – $1,112,95, almost double the $587,921 of April 2020

- Broward – $689,592, up from $475,849 in April 2020

- Palm Beach – $1,035,392, almost double the $579,898 in April 2020

Condo prices climb higher in Miami

The biggest move in prices occurred in Miami during the month of April. Once again, this is a result in a surge in the ultra-luxury segment dragging the average higher. I wonder if any of these real estate agents have warned their buyers that we are in a massive bubble and prices could collapse again. Cash buyers are probably skipping the appraisal process and that’s not a good idea. There has been a lot of talk from agents that lenders are starting to get cautious again and appraisals are coming up short. That should be a good indicator that this market is ready to turn down. In the meantime, here is a look at the tri-county area condo market for April:

- Miami-Dade – $697,114, up from $417,602 of April 2020

- Broward – $287,920, up from $235,911 in April 2020

- Palm Beach – $425,069, up from $345,789 in April 2020

This market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.