Blog

How will the foreclosure moratorium expiration impact the housing market?

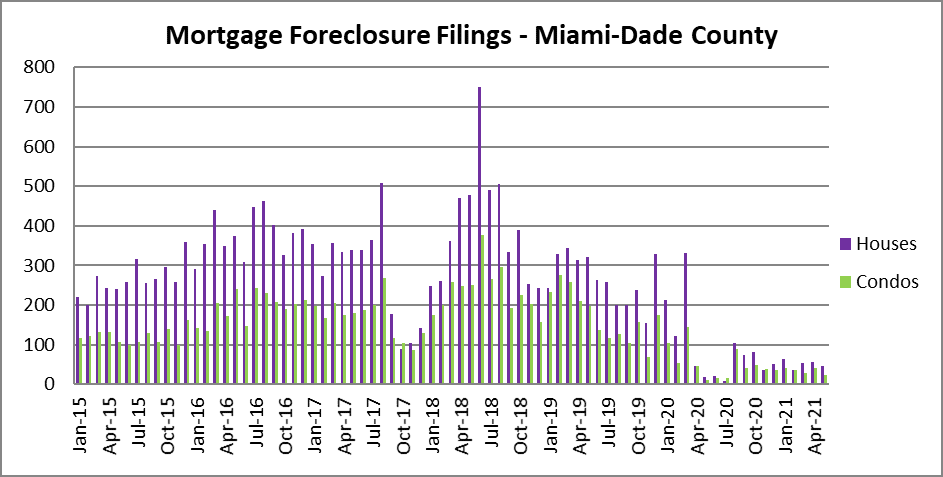

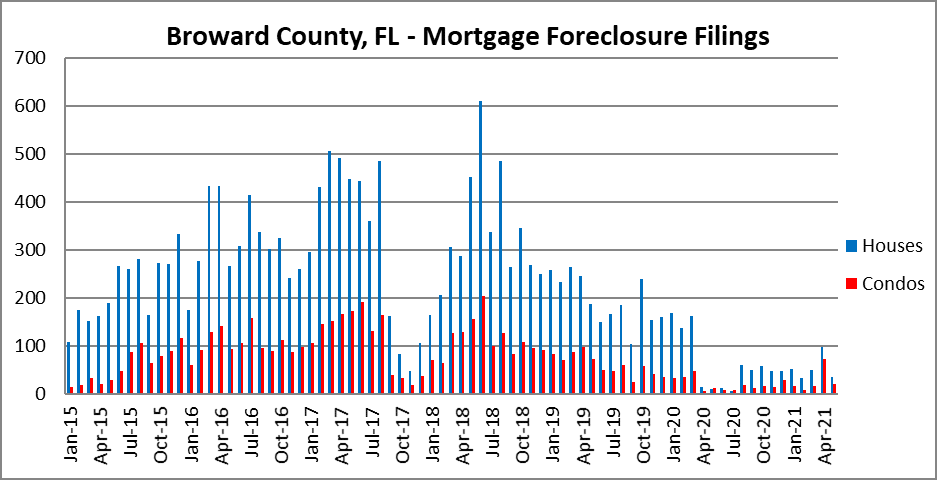

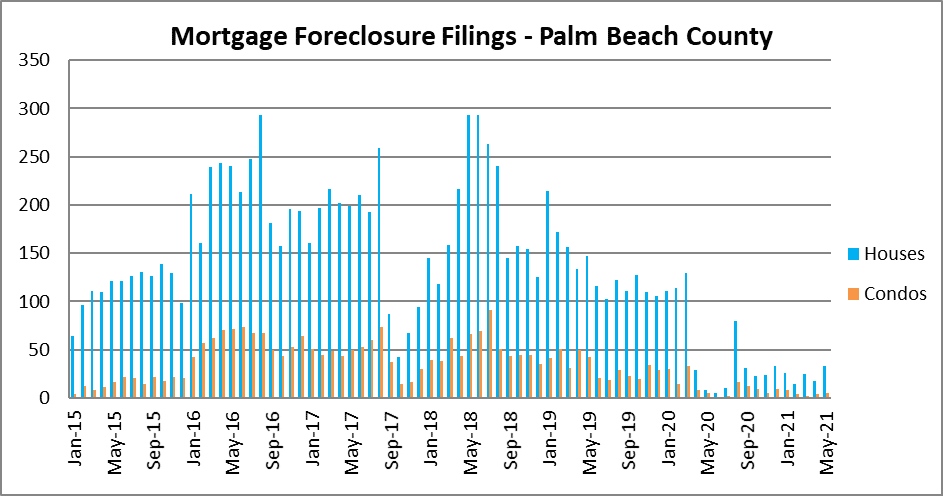

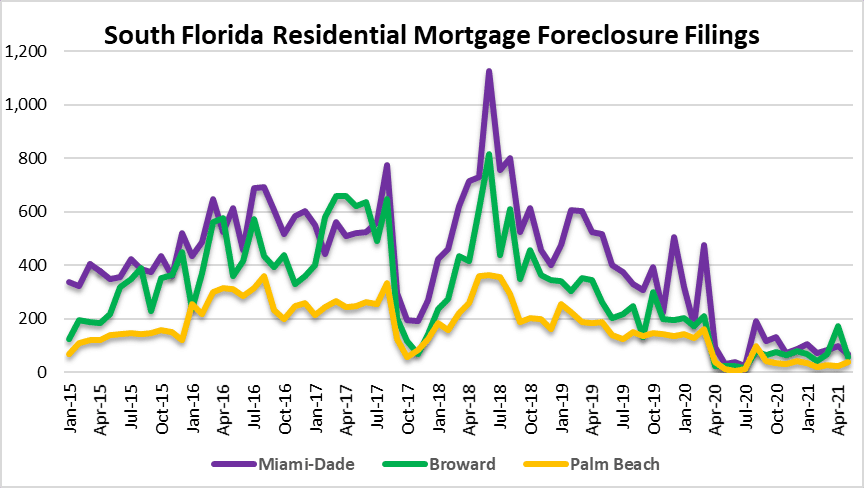

How will the foreclosure moratorium expiration impact the housing market? The moratorium on evictions and foreclosures is set to expire (again) on June 30th. There hasn’t been any indication of extending it again, but we do live in an era of perpetual bailouts, so who knows! Here is a quick look of the annual filings for the tri-county area since 2015 and displayed in the chart above. We include the total number of residential foreclosure filings, the monthly average and the year over year change in the monthly average. Needless to say 2020 and 2021 have been very quiet, but activity may pick up over the remainder of this year and into 2022.

| Annual | Monthly | Change | |

| 2015 | 9,557 | 796 | |

| 2016 | 15,194 | 1,266 | 59% |

| 2017 | 13,071 | 1,089 | -14% |

| 2018 | 15,905 | 1,325 | 22% |

| 2019 | 10,355 | 863 | -35% |

| 2020 | 3,513 | 293 | -66% |

| 2021 | 975 | 195 | -33% |

Will foreclosure filings slow housing price gains?

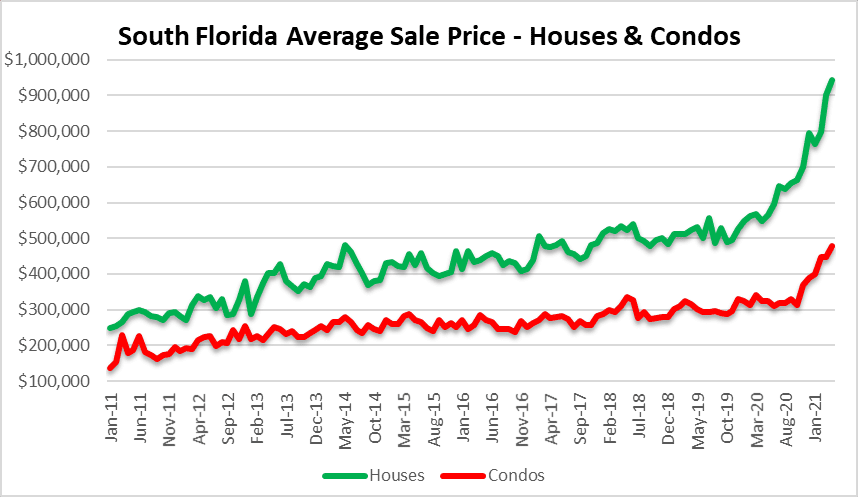

In brief, probably not! Other things may have an impact on prices, such as lack of affordability, rising mortgage rates, or the massive increase in insurance costs that show no signs of slowing down. Here is a snapshot of the average sale prices across South Florida. They have been on a slow grind higher since the last housing market crash, then they went parabolic during the COVID-19 pandemic. At some point there will be mean reversion and that will prove painful for those who allowed FOMO to control their buying decisions. Here is one of recent market updates and you will notice that a common theme is that these price gains will not last.

The foreclosure moratorium across South Florida markets

Here is a quick chart fest showing the impact of the foreclosure moratorium across the Miami, Fort Lauderdale and Palm Beach residential real estate markets. The first chart covers Miami-Dade County:

Now we take a quick ride up I-95 to Broward County and the Greater Fort Lauderdale residential real estate market:

Finally, here is a snapshot of foreclosure activity across Palm Beach County:

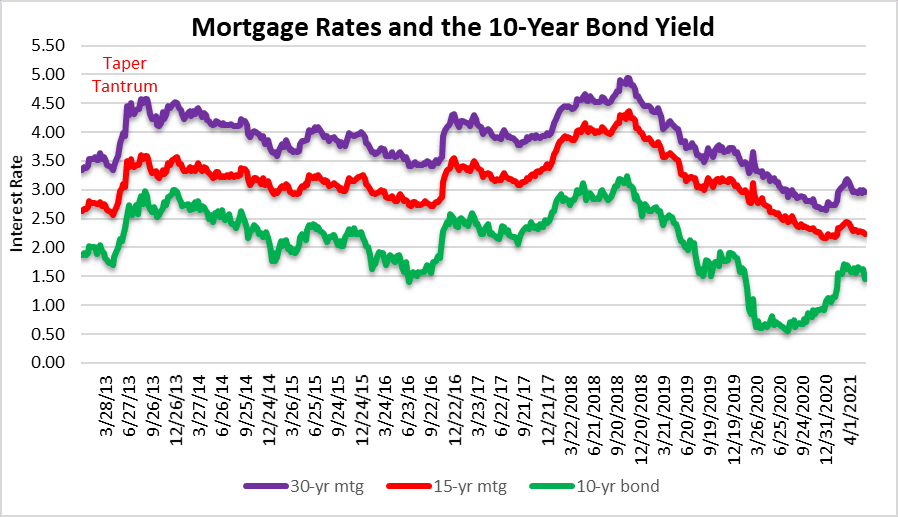

Mortgage rates

Once the foreclosure moratorium is lifted, it will be helpful if mortgage rates remain low. There have also been a variety of mortgage forbearance programs available during the pandemic. It seems like there has been a tug of war in the mortgage rate market. Every time rates try to move higher, they end up slumping again. The problem with rates being so low for so long is that they encourage people to stretch their budget and sometimes overpay for their property.

This market outlook covers real estate activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.