Blog

Residential sale prices, inventory and transaction types in the Broward County / Fort Lauderdale area

The average selling prices of houses and condos appear to have stabilized over the past few months and appear to be encountering some upside resistance. In January, the average selling price of a single-family home was $337,534, down slightly from $338,712 in December. As for condo/townhouse prices, the average selling price was $170,508 in January, down from $172,077 in December.

As for transaction types, the next chart illustrates how traditional transactions have basically fallen off a cliff.

The 989 single-family home transactions closed in January were as follows:

- 693 traditional sales, down from 918 in December (25% drop in one month)

- 128 foreclosure/REO sales

- 168 short sale transactions

Now, let’s see how the condo/townhouse market looks.

The chart sure looks similar, and here is the breakdown of the 1,132 closed sales:

- 809 traditional sales, down from 1,000 in December (19% drop in this segment)

- 192 foreclosure/REO sales, up from 183 in December

- 323 short sales, down from 340 in December

Now we will take a look at the inventory available for sale.

It looks like inventory is finally in an upswing again after years of dwindling supply. In January, there were 5,338 houses listed for sale in Broward County, up from 5,042 in December. As for condo/townhouse properties, there were 7,674 units available for sale in January, up from 7,171 in December. Usually there is a “January effect” in the residential market when properties are relisted at the beginning of the year after being removed during the holidays. Aside from that, the gradual increase in residential inventory started in the summer and appears to be here to stay.

Over the past few years there was a strong appetite for residential property (mostly single-family homes) from institutional buyers. These large investors thought it would be easy money to buy foreclosed homes and rent them out through their REO to rental programs. In some markets this may have been true for awhile, but South Florida presents a laundry list of challenges that are unique to this market. Basically, the investors put a “floor” on prices because they have been borrowing for close to zero to acquire real estate thanks to the Federal Reserve keeping rates artificially low for so long. This next chart from Realtytrac is based on a national level, but shows that the institutional buyers are leaving the market. The fact of the matter is that prices climbed to a level where it is no longer a good investment. Right in line with the greater fool theory, they are rapidly heading for the exits in hopes that the retail buyers step up with offers for their inventory. The problem is that the retail buyers won’t have unlimited funds at zero cost and with the new Qualified Residential Mortgage rules, they will actually have to prove their ability to repay the loan!

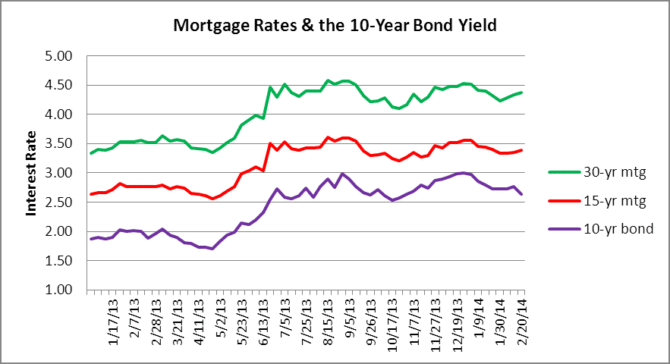

Finally, rates appear to have settled down for awhile and here is a look at the correlation of the 30-year and 15-year mortgage to the 10-year bond. Our chart of interest rates is updated every Thursday when the mortgage rates are released from Freddie Mac. The mortgage rates posted are net of any points or closing costs and those may vary by lender. We should have some new data for the distressed property market next week and will update our charts as soon as we have it.