Blog

South Florida residential sale prices, inventory & distressed market update

Today we will take a quick run through the residential market data for the tri-county area of Miami-Dade, Broward and Palm Beach County, Florida. It is usually easier to spot market trends once the data is dropped into charts. First, let’s look at some good news:

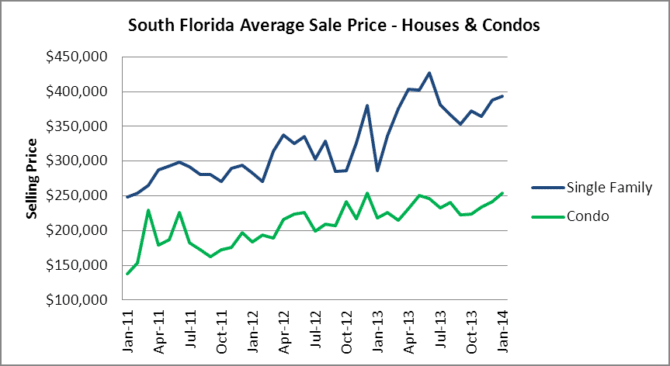

In January, the average selling price of a single-family home rose to $393,110 and the average selling price of a condo/townhouse property rose to $253,332. Both property types had dropped back in September, but appear to have rebounded slightly since then, even if it may be short-lived. It is also important to remember that it only takes a small number of sales on the higher end of the market to lift the average sale price for any given month.

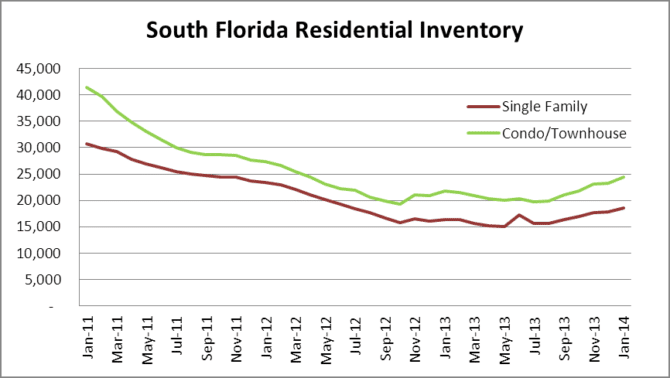

Now let’s take a look at the inventory of residential properties listed for sale, which has been in a gradual uptrend lately. In January, there was a 5% increase in available inventory. There is normally a slight increase in January, as sellers sometimes remove their properties from the market during the holidays and relist them in January. Just to add some perspective, take a look at the left side of the inventory chart to see how high the inventory was before foreclosures were halted in late 2010. In January 2011 there were 72,241 residential properties listed for sale and in January 2104 there were 43,069.

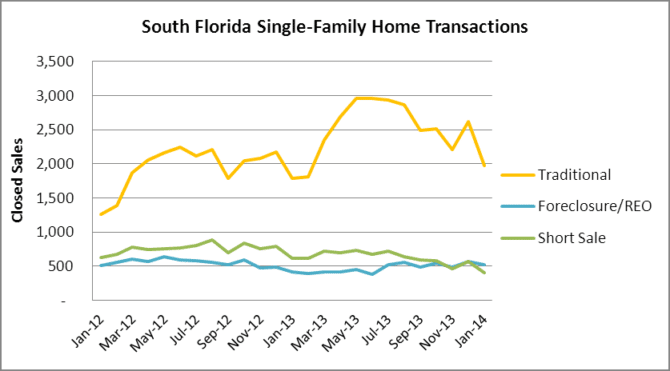

What types of transactions are closing?

You will see from this chart of single-family home transactions that the traditional sales have really fallen off a cliff in the past few months. Last month there were 2,907 single-family closings, and here is the breakdown.

- 1,975 traditional sales which accounted for 68% of all closings in South Florida

- 529 foreclosure / REO sales that accounted for 18% of all closings in South Florida

- 403 short sales that accounted for the remaining 14% of all closings in South Florida

It is important to note that short sales dropped 30% month over month from 575 in December to 403 in January. This may be attributed to the expiration of the Mortgage Debt Relief Act at the end of the year. Without debt forgiveness, distressed sellers will lose the incentive to short sell their property.

Now for the condo & townhouse transactions.

Out of 3,320 condo/townhouse closings, here is the summary:

- 2,312 traditional sales which accounted for 70% of all closings in South Florida

- 666 foreclosure / REO sales which accounted for 20% of all closings in South Florida

- 342 short sales which accounted for the remaining 10% of all closings in South Florida

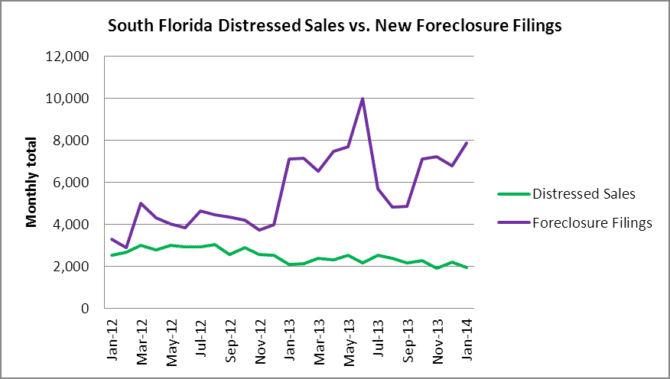

Now we will take a look at the wide divergence between new foreclosure filings and distressed sales. When we combine the short sale and REO transactions, there were 1,940 closings in January, but 7,870 new foreclosure actions filed for the same period. Basically, there were 4 times as many new foreclosures filed as distressed sales.

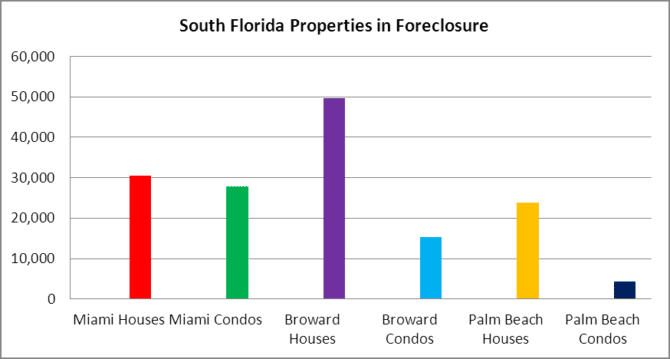

How will we ever see a drop in this massive shadow inventory of foreclosures when the new filings/distressed sales ratio is so lopsided? We counted roughly 151,000 residential properties in foreclosure throughout South Florida at our last tabulation in January. This number is actually conservative because several cities have maxed-out over the 5,000 property limit for each city and property type.

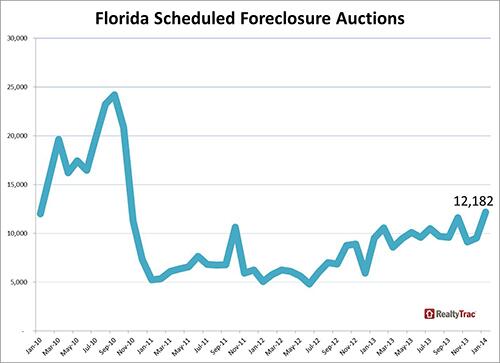

Finally, take a look at this last chart generated by RealtyTrac which shows the pipeline of foreclosures for the State of Florida. You will notice the huge decline of scheduled auctions in October 2010 when the robo-signing litigation caused banks to cancel the scheduled foreclosure auctions and halt their foreclosure pipeline to get their paperwork in order. Don’t think for a second that those foreclosures just disappeared. People always ask where all of the foreclosures have gone. The answer is simple: The foreclosures haven’t gone anywhere! They are still here almost 6-years later and getting scheduled for auction now that all of the litigation has been settled. Realtytrac estimates that roughly 65% of existing foreclosures in South Florida are still occupied by the previous owners (nicknamed Vampire Foreclosures). Since Florida is a judicial state, the average foreclosure takes 933 days to complete and many Florida residents have mastered the art of remaining in their properties for 4-5 years without making a mortgage payment. The remaining 35% of foreclosures have either been abandoned by the lenders (Zombie Foreclosures), or they are occupied by squatters or renters who may or not be aware that their landlord is collecting rents and not paying the mortgage. That’s why after 6 years, we really aren’t in any better shape than we were in 2008!