Blog

Rising inventory and falling prices appear to be the new trend in the Fort Lauderdale area condo market

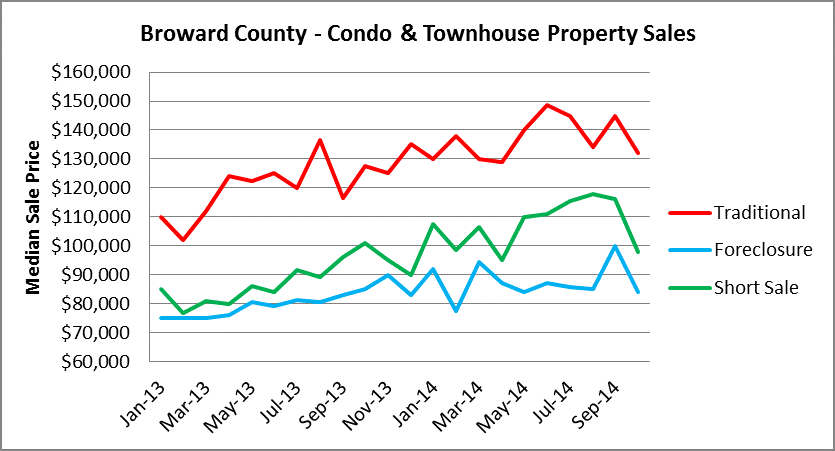

For the past several months we have witnessed the selling prices of Fort Lauderdale area condo and townhouse properties taking a hit, as the available inventory of units for sale increases. Below is a chart of the median sale price for condo/townhouse properties for the area and as we have discussed previously, the market appears to have peaked in June.

For the month of October, 2014, here are the numbers::

- The median sale price for traditional transactions was $132,000, down 11% from June

- The median sale price for foreclosure transactions was $84,000, down 3% from June

- The median sale price for short sale transactions was $97,900, down 12% from June

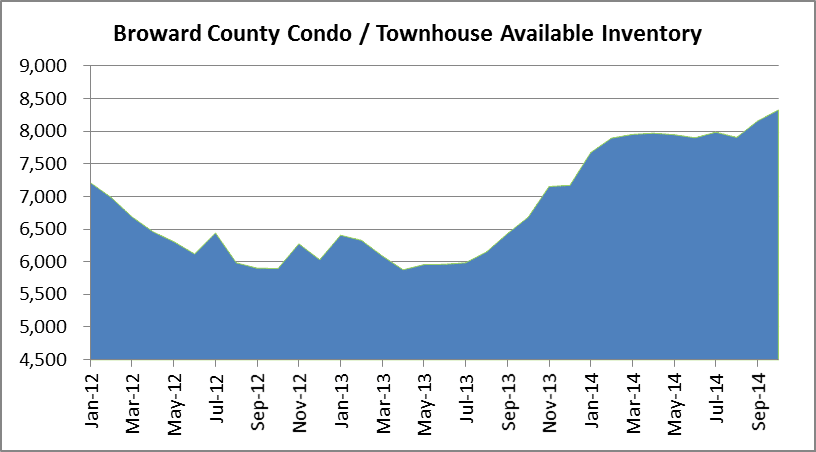

How about the inventory of condo units available for sale? It has bounced 42% off the lows set back in April 2013 and reached 8,325 units listed for sale in Broward County in the month of October.

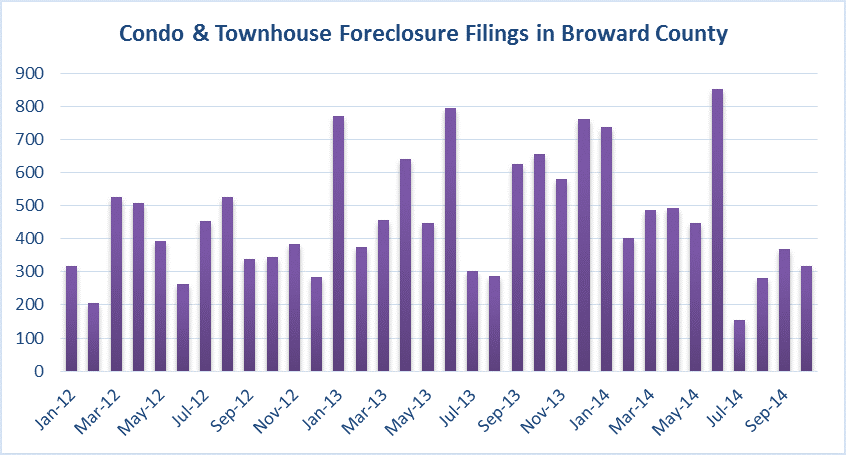

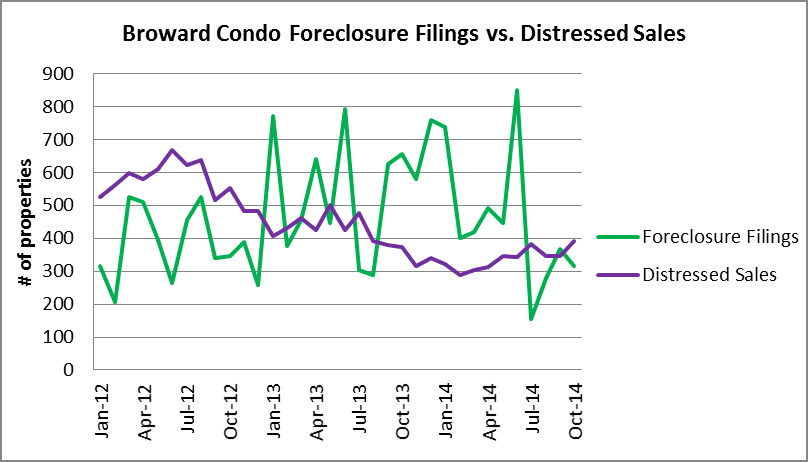

As for the pace of foreclosure filings, it has dropped slightly from last year, but will not be going away anytime soon.

As for the monthly average of filings for this housing segment, here they are:

- In 2012, the monthly average of foreclosure actions being filed was 379

- In 2013, the monthly average of foreclosure actions being filed was 558

- So far in 2014, the monthly average of foreclosure actions being filed is 454

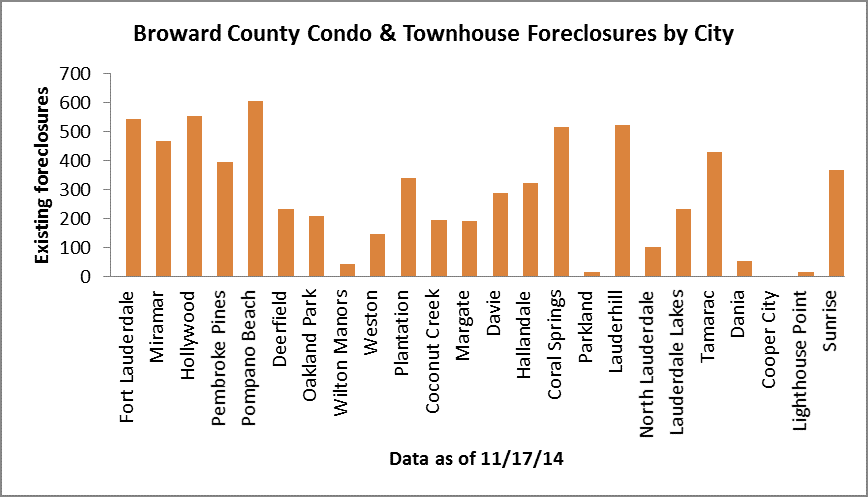

The good news on the foreclosure front is that the shadow inventory of condo properties in some stage of foreclosure has been declining. As of November 17, we only counted 6,798 and here is a look at the list of cities:

Finally, we like to monitor the pace of foreclosure filings compared to the total number of distressed sales (short sales and foreclosure sales). For a long time the pace of filings greatly outnumbered the distressed sales and that certainly didn’t help to reduce the number of condo properties lingering in and out of foreclosure over the past several years. Here is a glance at how those two numbers are shaping-up. Although plenty of distressed properties are being purchased by cash “investors” in the courthouse auctions, we will not see a true recovery in the South Florida market until these properties get in the hands of owner/users.