Blog

Sector Spotlight – Condo market prices, transactions & foreclosure activity in Fort Lauderdale area

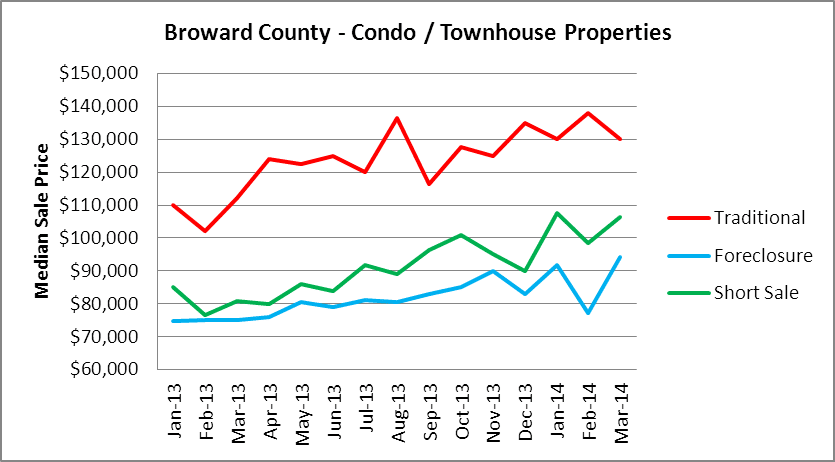

There have been some significant changes in the condo/townhouse market in the Fort Lauderdale area over the past year: Condo inventory has grown at a faster rate than single-family homes, distressed sale prices are dropping and foreclosure activity appears to be gaining momentum as we move through 2014. Our first chart today shows the median sale prices for each type of transaction.

Here is a chart summary by the numbers:

- In April, the median price if a traditional condo sale was $129,000, down from $130,000 in March.

- The median price of a condo foreclosure sale was $87,000, down from $94,300 in March.

- The median short sale price for a condo was $95,000, down from $106,500 in March.

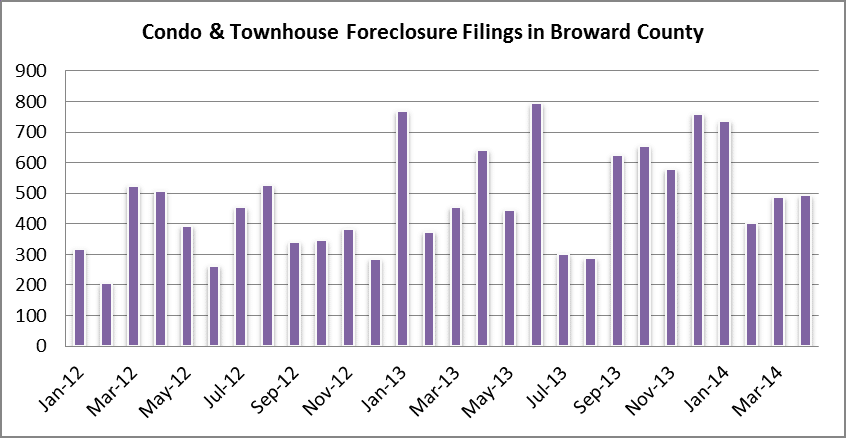

Foreclosure activity has remained strong throughout Broward County, where there were 493 new filings in April. That number is up from 488 in March and 402 in February. So far in 2014, the monthly average of condo foreclosure filings in Broward County is 530, down slightly from a monthly average of 558 in 2013. In the next month or two we should surpass the 2013 monthly average. Does that sound like a recovery?

As for the existing condo/townhouse properties that are lingering in some stage of foreclosure, take a look at this next chart to see where over 14,000 condo/townhouse properties in foreclosure are located (the actual count was 14,320 on May 20, 2014). Just click on the chart to enlarge and see how your city compares to other cities in Broward. Keep in mind that this chart doesn’t include the over 45,000 single-family homes in some stage of foreclosure throughout Broward.

In order for the South Florida real estate market to even begin to improve, the pace of foreclosure filings will need to decrease and distressed sales need to increase. In April, there were were 493 new condo foreclosure actions filed and only 314 distressed sales (short sales and foreclosures combined). If we didn’t have this massive shadow inventory of condo properties in foreclosure, that wouldn’t be such an issue. With only 314 monthly distressed sales, it would take nearly four years to sell all of the distressed properties in Broward, even if we assumed there were no new foreclosure filings. That assumption is unrealistic, as the pace of new foreclosure filings looks to be picking up steam as me move through 2014. We took a sneak peek at the may data and it doesn’t look too promising.

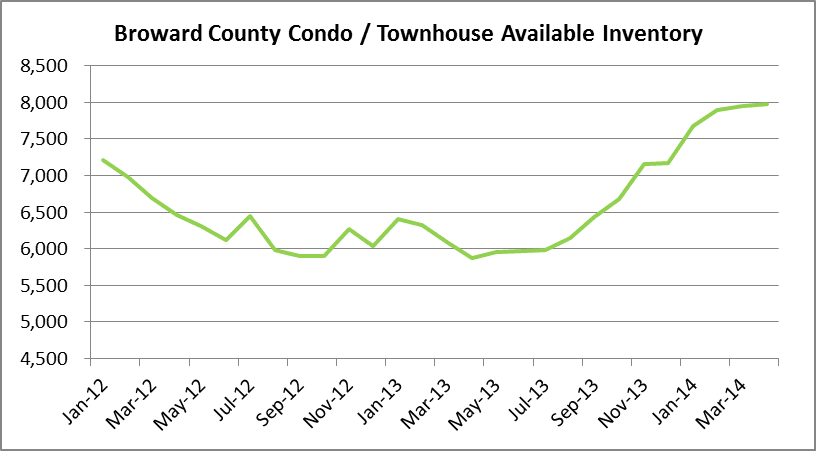

Finally, here is a quick look at the existing condo/townhouse inventory in Broward County. In April, the available supply reached 7,969 units. That is a 136% increase off the low of 5,877 units listed last April. As inventory grows, prices should start to come under pressure. We haven’t seen this level of inventory in several years. One final stat: There are twice as many condo/townhouse properties in some stage of foreclosure in Broward than there are listed for sale. Can you imaging if banks start to liquidate their holdings at a faster pace? Luckily the foreclosure timeline in Florida is one of the longest in the country!