Blog

When will housing prices drop?

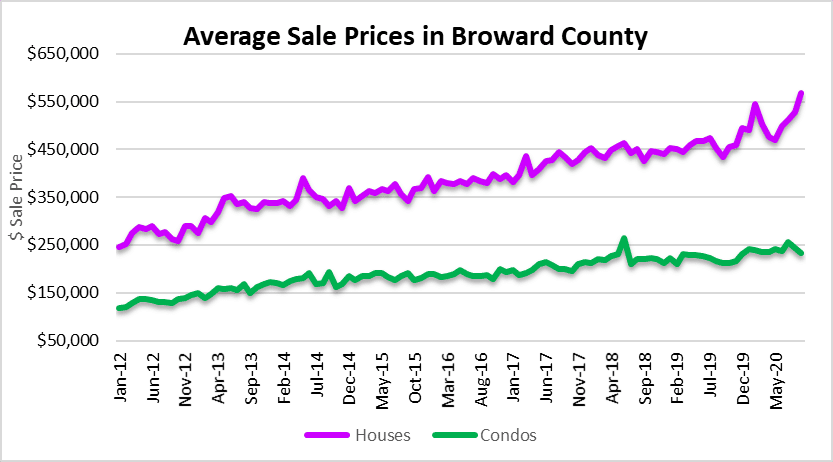

The charts are showing strong trends in prices for single-family homes in South Florida. Today we will take a look at the average selling prices of houses and condos, along with transaction volume and available inventory. The lack of homes available for sale in the area has helped propel the selling prices to new highs. Although property owners may enjoy looking up prices of recent sales in the area, this has also put housing out of reach for many people. By looking at our first chart above you sill see that the average selling price of a house in the Greater Fort Lauderdale / Broward County market reached $568,978 during the month of September. That represents a whopping 8% increase over the August average selling price of $528,622. Condo prices haven’t been behaving the same way. The average selling price of a condo in the Fort Lauderdale area was $233,110 in September, down 4% from $243,083 in August.

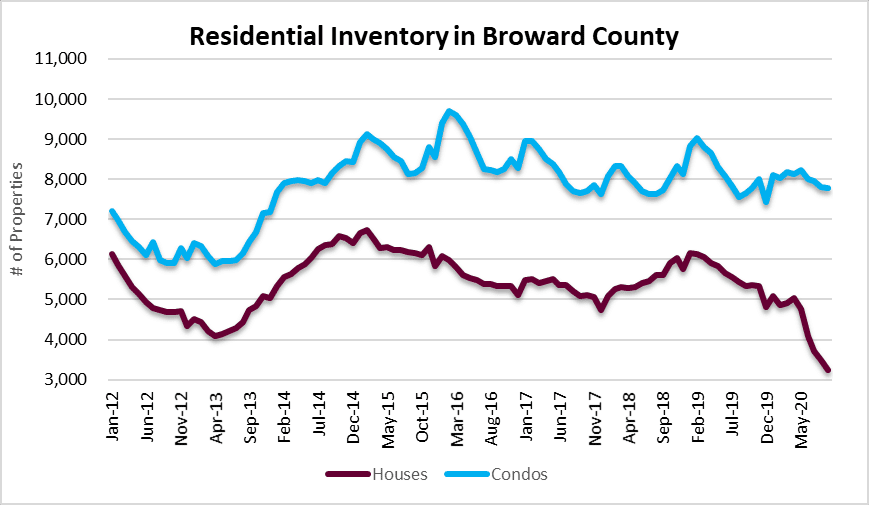

Inventory of houses and condos

Look no further than lack of supply in available houses for sale for the recent price spikes. It seems like everyone wanted a house once COVID-19 hit and people that already had one didn’t want to sell it. This goes back to the basic economics of supply and demand that caused a massive price swing. Condos are another story. During the month of September there were 7,784 condos available for sale in the area, but only 3,234 houses available for sale. Hopefully this inventory chart helps explain the spike in house prices. It dates back to 2012 when we here starting to recover from the last housing market crash.

Transaction volume

When we see a noticeable trend in deal volume slowing down, we should be able to determine where prices are heading. With housing inventory so low, it may not take much demand to keep them elevated for awhile. However, once transaction volume peaks for the cycle, lower prices will follow. It takes several months for the trend to change direction. This next chart shows that demand may have peaked in August, with closings on houses declining to 1,535 (down 8% month over month) in September. Condo sales were actually up 2% from 1,417 in August to 1,449 in September. The one thing different this year is that the spring selling season was delayed until summer. The chart also shows how transaction volume usually declines for several months after it peaks each year.

Transaction volume in the area is significantly below prior years if you look at this next chart. We haven’t seen such low deal volume since the last recovery started. The average number of monthly transactions since 2012 follows the next chart.

|

Average Monthly Transaction Volume |

||

| 2012 | 2,555 | |

| 2013 | 2,647 | |

| 2014 | 2,636 | |

| 2015 | 2,829 | |

| 2016 | 2,815 | |

| 2017 | 2,668 | |

| 2018 | 2,733 | |

| 2019 | 2,717 | |

| 2020 | 2,433 | |

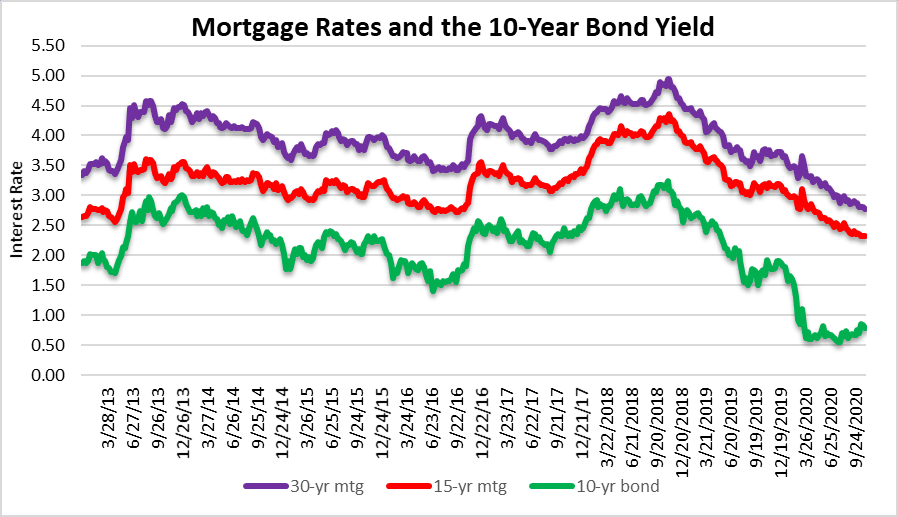

Mortgage Rates

We cannot provide a market update without looking at mortgage rates. Yes, they are still very low. This continues to be a contributing factor to higher real estate prices. Think of low rates as an invisible hand supporting the market. Next, sprinkle some demand and low inventory of properties for sale. That’s a recipe for an elevated market for the time being.

Foreclosure Activity

The pace of mortgage foreclosure filings ground to a halt during the pandemic. Don’t expect them to resume until early 2021.