Blog

Fort Lauderdale area condo market update with transaction types, prices and distressed sales

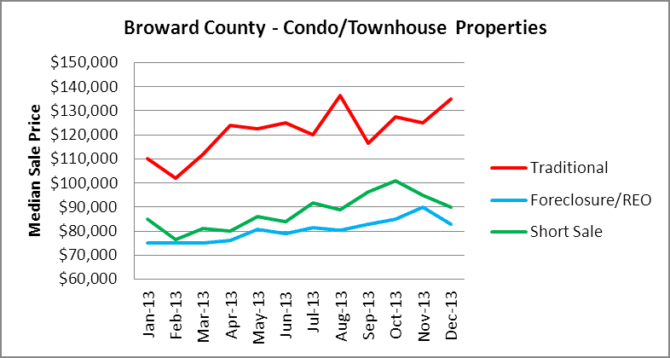

Today we are going to run through some of the recent data on the Greater Fort Lauderdale are condo and townhouse market. Our first chart shows the median sale prices of traditional, short sale and REO transactions.

You will notice from the chart that the median sale price of short sale and REO transactions are significantly lower than traditional sales. Here are the median sale prices for Broward condo and townhouse properties in December:

- The median sale price of traditional transactions was $135,000

- The median sale price of a foreclosure/REO was $82,901 (39% discount to a traditional sale)

- The median short sale price was $90,000 (33% discount to a traditional sale)

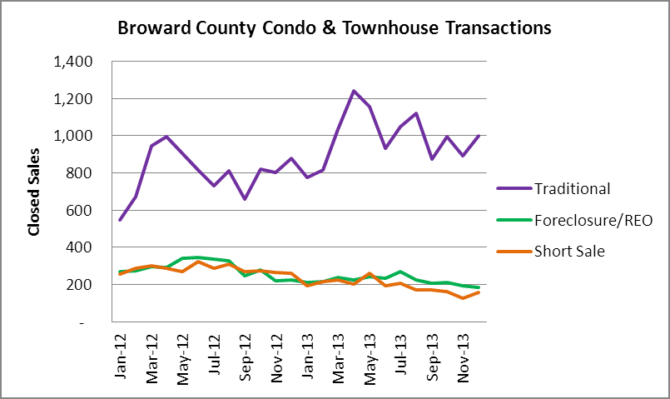

As for the breakdown of transaction types, out of 1,340 transactions in December, here are the numbers and percentages:

- 1,000 condo/townhouse sales were traditional transactions, (75% of all closings)

- 183 condo/townhouse sales were foreclosure/REO transactions, (14% of all closings)

- 157 condo/townhouse sales were short sale transactions, (11% of all closings)

It is actually surprising that the short sale figures were that low in December since the mortgage debt relief act expires at the end of the year and in the single-family home segment there was a wave of short-sellers rushing to close their sales.

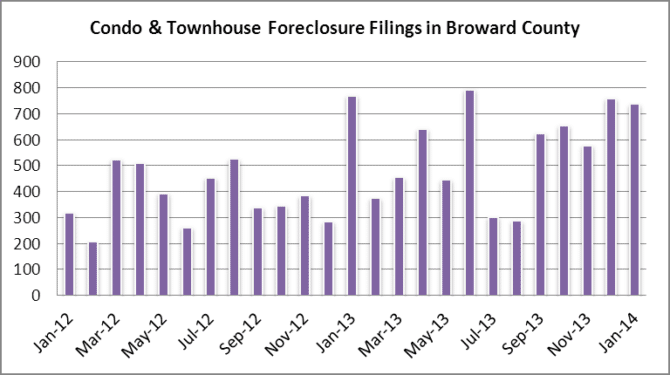

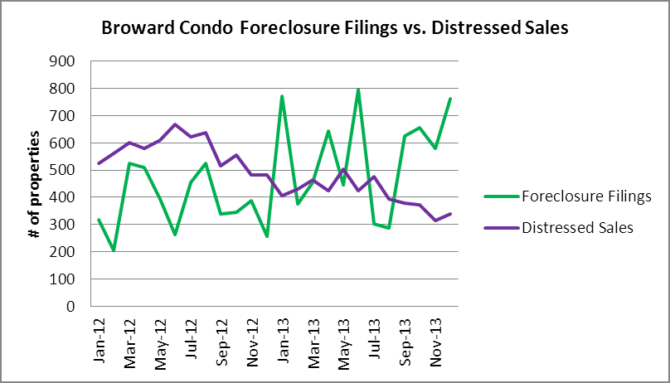

Now for the foreclosure filings, which settle back a bit in January to 737 new filings, down from 760 in December.

- In 2012, the monthly average of new foreclosure filings in the Broward condo/townhouse market was 379.

- In 2013, the monthly average of new foreclosure filings in the Broward condo/townhouse market was 558, representing a 47% increase over 2012.

- In January 2104, there were 737 new filings, which represents a 32% increase over the 2013 monthly average.

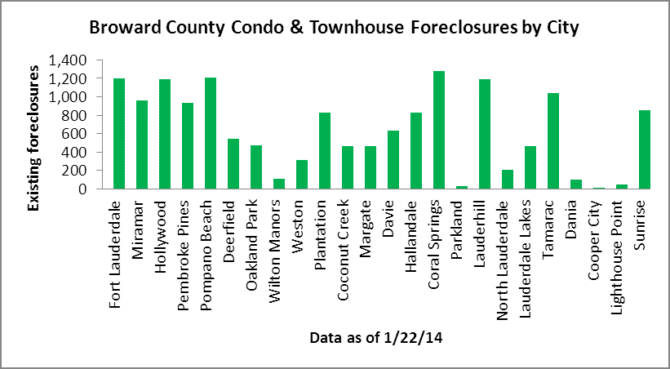

Now take a look at the shadow inventory of existing foreclosures throughout Broward County. As of January 22, 2014, the total was at 15,384 condo/townhouse properties in the foreclosure process throughout Broward. This does not include the roughly 50,000 houses in foreclosure throughout the county. Unless the pace of distressed sales increases dramatically, this overhang will be in place for quite some time. Feel free to click on the chart to see how your city measures up.

Now we will show why this massive shadow inventory continues to grow. In December, there were 760 new foreclosure filings and only 340 distressed sales which includes short sale and foreclosure/REO sales.

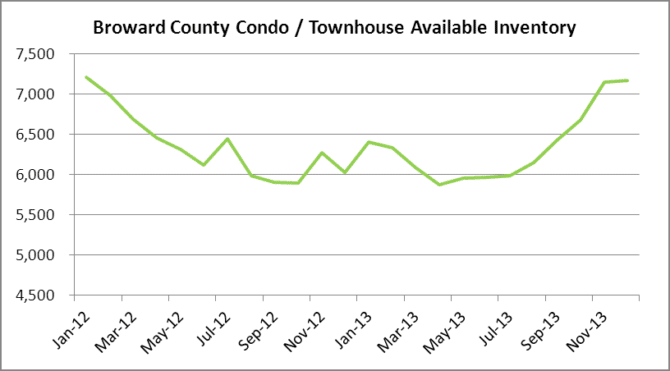

As for inventory, there are finally some properties getting listed again. After hitting a recent low back in April 2103 with only 5,877 condo/townhouse properties listed, inventory has bounced back to 7,171 units listed as of December. That represents a 22% increase from the April low and is an indicator that sellers are more comfortable with recent prices to list their properties for sale. However, the rising inventory, coupled with higher borrowing costs and a significant amount of foreclosures in the shadow inventory waiting to hit the market, this could be a triple-whammy for condo prices going forward!