Blog

Putting the residential shadow inventory into perspective with a Broward area spotlight

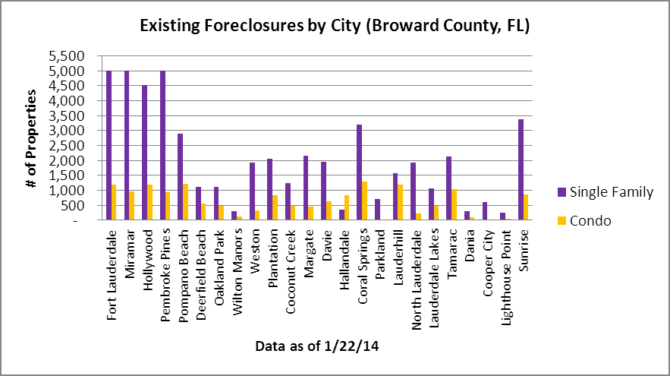

In most of our monthly residential market updates we add a few charts with the pace of new foreclosure filings and a snapshot of the existing shadow inventory of residential properties in foreclosure throughout Broward County. Here is a glance of the shadow inventory which stood at 65,089 as of 1/22/14.

Feel free to click on the chart to see where the highest level of foreclosures are located, but here are a few of the chart leaders:

- Fort Lauderdale has over 5,000 houses and 1,197 condo/townhouse properties in some stage of foreclosure

- Miramar has over 5,000 houses and 964 condo/townhouse properties in some stage of foreclosure

- Pembroke Pines has over 5,000 houses and 933 condo/townhouse properties in some stage of foreclosure

- Hollywood has 4,527 houses and 1,191 condo/townhouse properties in some stage of foreclosure

- Coral Springs has 3,194 houses and 1,279 condo/townhouse properties in some stage of foreclosure

- Sunrise has 3,386 houses and 856 condo/townhouse properties in some stage of foreclosure

Keep in mind that our search results are limited to 5,000 for each property type (house or condo), for each city. Therefore, our recent count of 49,705 houses and 15,384 condo/townhouse properties in foreclosure throughout the county is actually a conservative number.

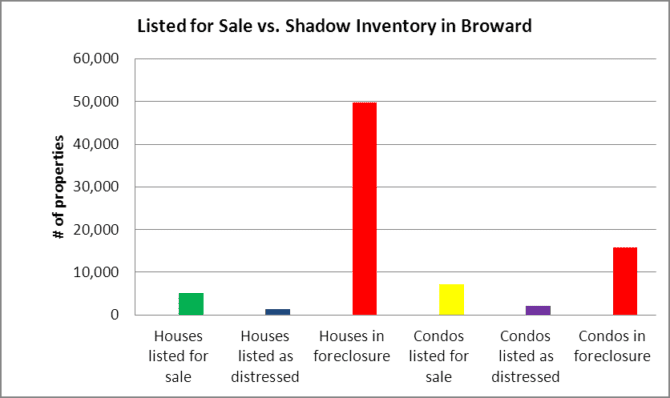

Now, to explain why this presents a serious problem for anyone who is hoping to purchase a house or condo in this market, here is a look at how such a small percentage of these properties in foreclosure are even listed for sale.

Maybe this chart will help explain this “recovery” that people have been talking about. The shadow inventory of foreclosures from the housing bust of 2008 still hasn’t reached the market. It will take years to sell all of the distressed inventory and it will be done at the expense of house and condo prices going forward.

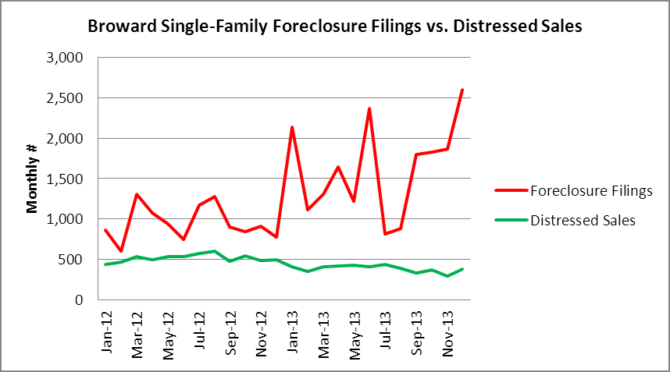

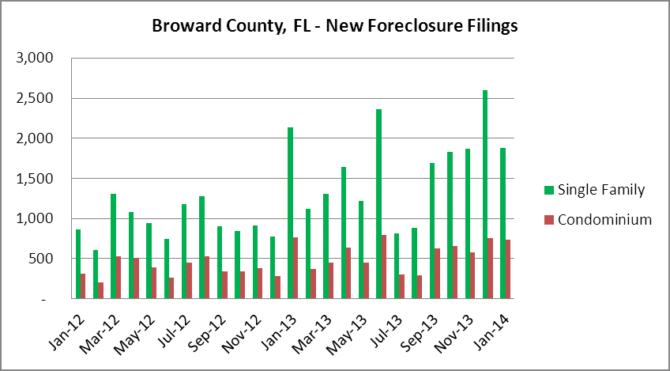

Let’s take a look at the pace of new foreclosure filings vs. the distressed property sales in the single-family home segment. We don’t have all of the January data, but in December there were 2,602 new foreclosure filings in the single-family home segment and only 382 distressed sales (REO and short sales combined). That equates to about seven times as many foreclosure filings as distressed sales.

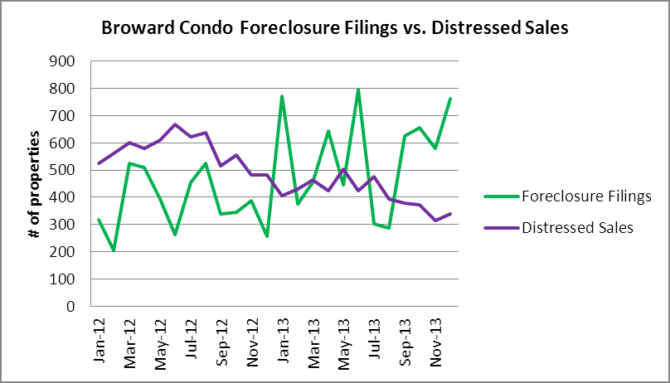

As for the condo/townhouse segment, there were 760 new foreclosure filings and only 340 distressed sales in December. That amounts to just over twice as many new filings as distressed sales. There is a very disturbing divergence in these trends and it certainly doesn’t point to any “recovery” in either the house or condo/townhouse market.

Here is a snapshot of the monthly foreclosure filings for Broward County and this chart is by no means indicative of a recovery either. In January, there was a total of 2,614 new filings which included 1,877 houses and 737 condo/townhouse properties receiving a foreclosure notice. The pace of new foreclosure filings will likely remain elevated throughout 2014 and into 2015. When you couple the new filings with the existing shadow inventory, it will take several years to work through this distressed real estate issue in South Florida. The government intervention and foreclosure delays due to the robo-signing litigation merely kicked the can down the road and delayed the recovery.