Blog

When did housing prices peak?

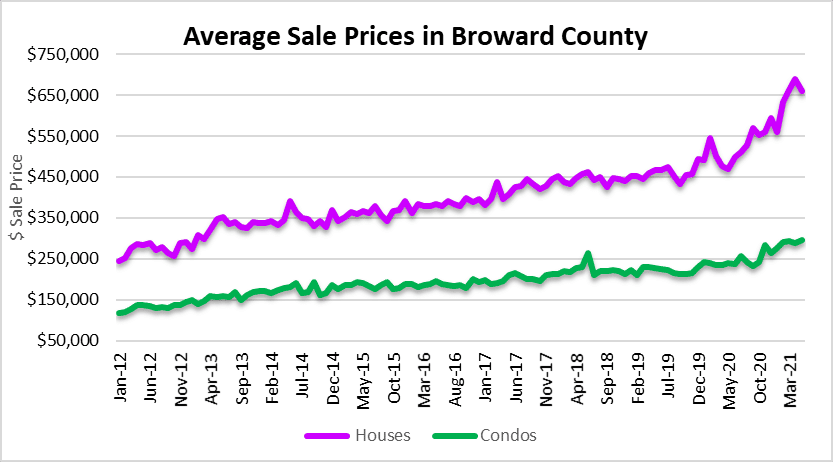

When did housing prices peak? By looking at our charts, it appears that housing prices may have peaked during the month of April in the Greater Fort Lauderdale area. Single-family home sales reached an average sale price high of $689,592 in April. After that, they declined 4% to $660,338 during the month of May. Condo prices actually climbed month over month from April to May. In April, the average sale price of a condo in the Fort Lauderdale area was $287,920. Prices climbed 3% from April to May reaching an average sale price of $296,156. Obviously, the lack of inventory of single-family homes in the area has led more buyers to the condo market.

Available inventory is still very low for single-family homes but appears to have stabilized during the month of May. There were two, 214 houses listed for sale across Broward County in May, that number is up slightly from 2,094 during the month of April. Condo inventory declined month over month from 5,001 units available during the month of April to 4,472 in May.

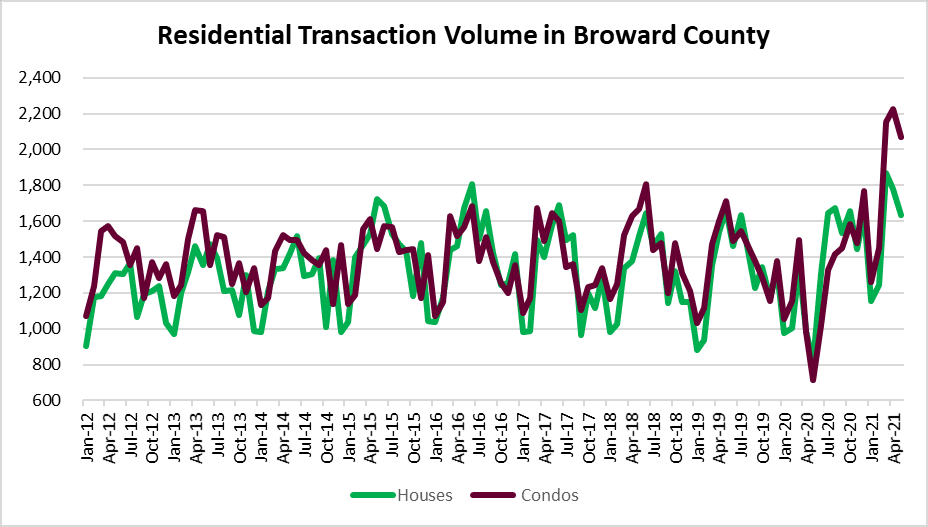

Transaction volume declined during the month of May as well. There were 1,634 houses sold during the month of may, down from 1,782 houses sold in the month of April. Condo sales volume declined in the greater Fort Lauderdale area from 2,224 during the month of April to 2,071 during the month of May.

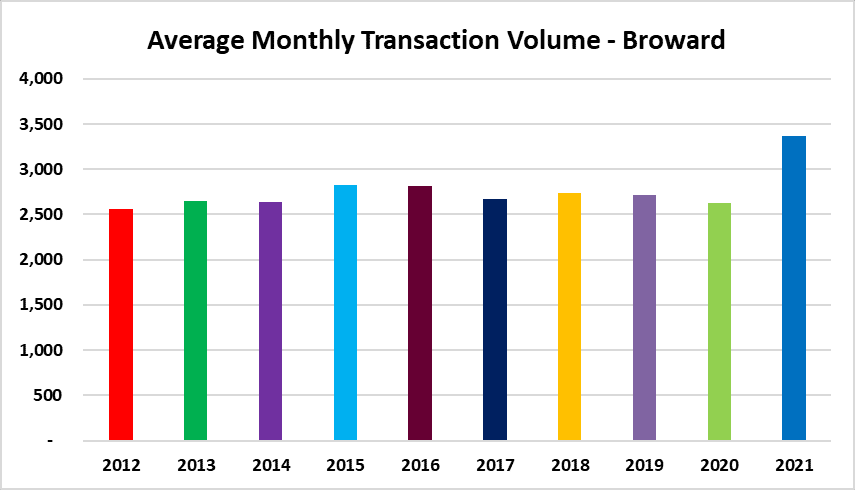

When you look at the number of transactions on an average monthly basis, 2021 still looks fairly strong through the first five month of the year. The second half of 2021 may bring the average sale numbers back in line with prior years. A few of the factors that may lead to lower sales volume are:

- Lower inventory still restricting transaction volume.

- Property insurance costs continue to climb.

- Possible reduction in mortgage backed securities purchased by the Federal Reserve. They currently own over $2.3 Trillion of mortgage backed securities and continue to buy $40 billion more every month! If you wonder how real estate prices have been in a steady climb since the last housing bubble burst, just take a look at the chart in the link. This has certainly been one of the continuing factors.

- Free money and bailouts may finally be ending. If you wonder how everyone is out buying houses, cars, boats and whatever else they want, check out this link to see how much money was thrown at the COVID-19 pandemic. yes, it’s a jaw dropping number!

- High prices often cure high prices. This simply means that buyers are finally realizing that we are in yet another housing bubble and they will no longer be engaging in ridiculous bidding wars. It’s funny how local real estate agents spent the last year telling prospective buyers “it’s a great time to buy” and they needed to hurry-up and get into the market, further stoking the FOMO flames. Now that inventory is at historical lows and agents have nothing to sell, they are all telling people “it’s a great time to sell”. Now is a great time to remind you of this quote:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.” – Upton Sinclair

Mortgage Rates

Last week mortgage rates dipped slightly, but it looks like housing affordability issues will dampen demand going through the summer.

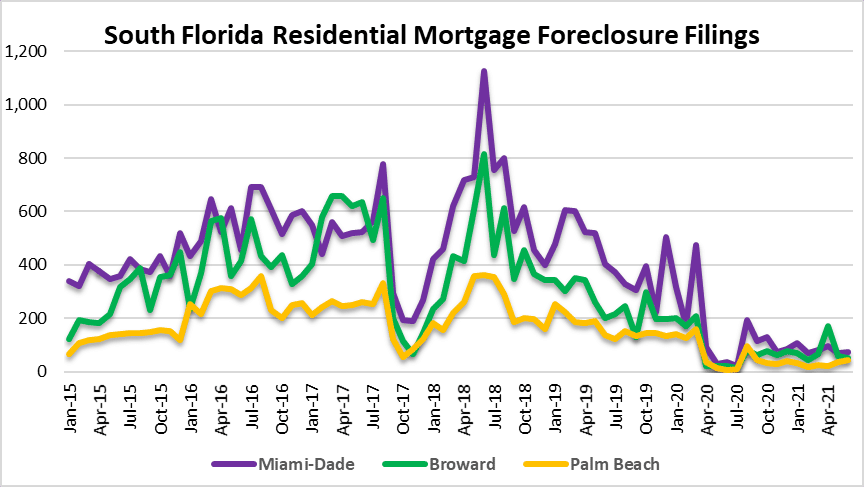

Foreclosure filings

A few weeks ago we provided an update on mortgage foreclosure activity across the Miami, Fort Lauderdale and Palm Beach markets. There has been a moratorium on new filings, but here is a snapshot of activity going back to 2015:

This foreclosure chart covers mortgage foreclosure filing activity in Miami-Dade, Broward and Palm Beach County, Florida. Here are just a few of the cities in each of these three markets:

- Miami-Dade – Aventura, Coral Gables, Miami Beach, Hialeah, Sunny Isles Beach, North Miami, Homestead, Doral, Miami Lakes, Downtown Miami, Brickell and Key Biscayne.

- Broward – Fort Lauderdale, Pompano Beach, Deerfield Beach, Hollywood, Hallandale, Weston, Parkland, Wilton Manors, Oakland Park, Plantation, Cooper City, Davie, Coral Springs, Sea Ranch Lakes, Lauderdale by the Sea and Lighthouse Point.

- Palm Beach – Delray Beach, Highland Beach, Jupiter, Palm Beach Island, Boynton Beach, Boca Raton, Highland Beach, Palm Beach Gardens, West Palm Beach, Wellington and Lake Worth.